For the first time this year, the Nasdaq hit a bump in the road. Investors took profits and rotated out of big cap tech stocks. No major damage occurred during the sell-off, but the enthusiasm quieted. Investors used the sell-off as a short term buying opportunity. The trend remains up. Short term support levels are intact. Our models remain overall neutral-positive for the intermediate term (weeks-months). The bulls remain in control for now.

Technology has higher projections. Top Holdings in QQQ remain in an uptrend.

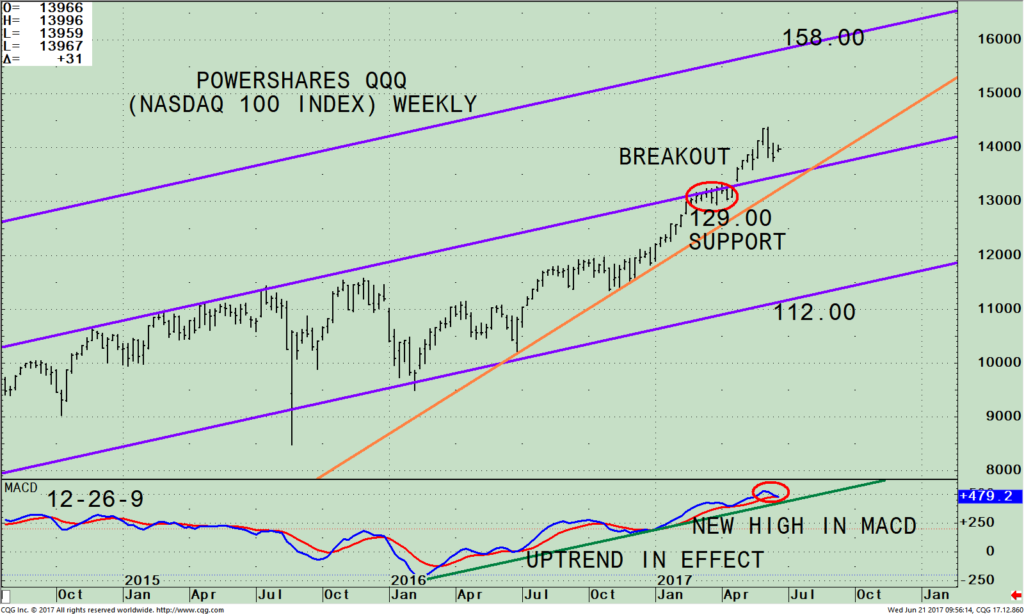

PowerShares QQQ ETF (Nasdaq 100 Index) Weekly Price and

Trend Channels (Top), and MACD 12-26-9 (Bottom)

The top part of the chart shows the weekly Power Shares 100 (QQQ), an exchange-traded fund based on the Nasdaq 100 Index and its operative trend channel. The QQQ includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq stock market based on market capitalization. As of 06/20/17, Apple, (AAPL) is the largest holding comprising 11.49%, Microsoft Corp (MSFT) 8.20%, Amazon.com, Inc. (AMZN) 7.20%, Facebook, Inc. Class A (FB) 5.47%, Alphabet Inc. Class C (GOOG) 5.01%, and Alphabet Inc. Class A (GOOGL), 4.38% totaling 41.75%.

The QQQ penetrated the middle channel after a 9-week consolidation trading between 129.38 and 134.00 (the red circle) on 04/24/17. The upside target is 158.00, an 11.2% gain from present levels, now trading at 140.33 as of 06/21/17 intraday. The intermediate trend remains up as long as the QQQ remains above the trendline (see the orange line). Notice how the middle channel and the trend line are very near one another, increasing the significance of key support at 129.00. If the QQQ falls below 129.00, on a weekly close, this would change the trend from up to down and more caution would be warranted.

The bottom half of the chart is MACD (12, 26, 9), a measure of momentum. MACD has confirmed the price high in the QQQ. The uptrend remains in effect (green line). Over the next several weeks watch to see if MACD breaks the uptrend, giving a warning of a trend change and potentially more selling could occur in the QQQ, or if MACD turns up again making another new high which would be bullish.

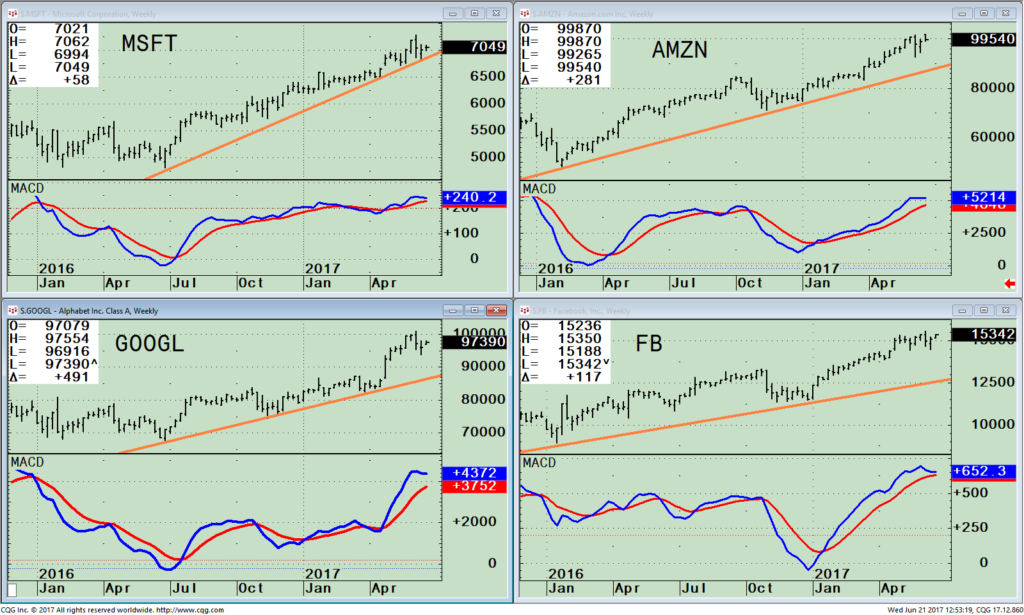

Weekly Price of Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL) and Facebook, (FB) and MACD 12-26-9

Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL) and Facebook, (FB) are top holdings of the QQQ and are in weekly uptrends (orange line). MACD in all four stocks has made highs, confirming their price high which is bullish. As long as these stocks remain in uptrends the QQQ should continue higher towards the upside objective of 158.00.

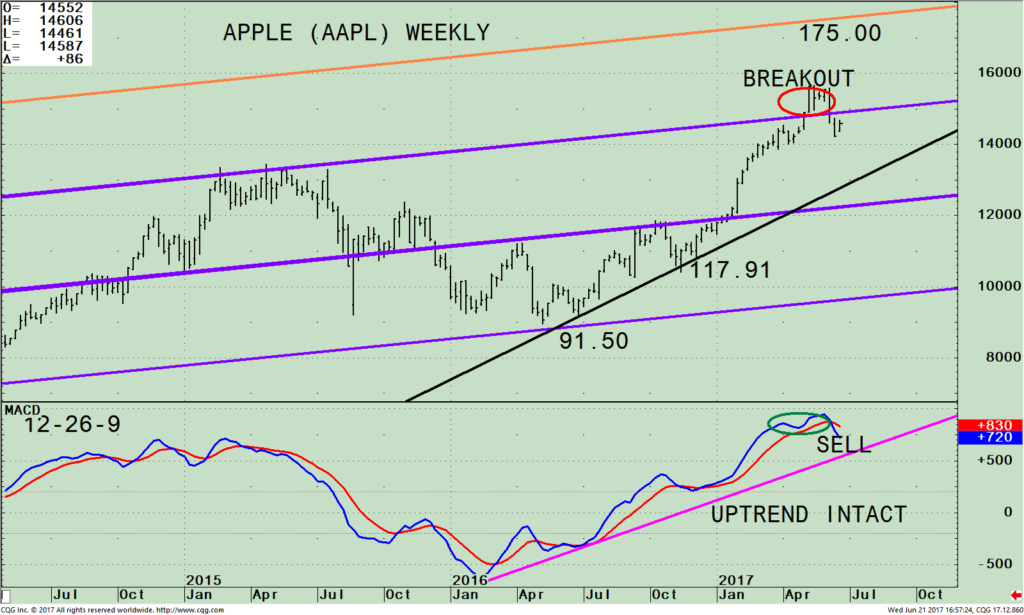

Apple (APPL) Weekly Price and Trend Channels (Top),

and MACD 12-26-9 (Bottom)

The top part of the chart shows the weekly price of Apple’s active trading channel (purple lines), projecting the upside objective at 175.00. Apple had a false breakout peaking on 05/08/17 (red circle), then retreated from 156.42 to 142.20, a pullback of 9.1%, more than the 2-3% I expected. Even with the recent decline, the intermediate uptrend (black line) remains in effect. Another test of the high is possible.

The bottom half of the chart is MACD (12-26-9), a technical indicator that measures momentum. MACD did go on a sell after Apple’s (APPL) large rise. Even with the MACD sell, I remain optimistic another test of the highs is likely because MACD confirmed Apple’s price high (green circle) and MACD uptrend remains intact. These confirmations are positive signs another rally attempt is likely. If either trend is broken to the downside, my bullish outlook would be negated.

In Sum:

Our models remain overall neutral-positive for the intermediate term which means upside potential remains greater than downside risk. Technology stocks continue to lead the market higher despite last week’s weakness. The intermediate uptrend in Nasdaq 100 (QQQ) price, MACD, Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL) and Facebook, (FB) are all intact which is bullish. Apple is the only stock to have generated an MACD sell. If the QQQ falls below 129.00, on a weekly close, this would change the trend from up to down. If the uptrend is broken on either price or MACD on the QQQ more caution will be necessary. For now give the bulls the benefit of the doubt.

I would love to hear from you. Please call me at 516-829-6444 or email at bgortler@signalert.com to share your thoughts or ask me any questions you might have.

If you like this article, then you will love this!

Free Instant Access to Grow Your Wealth and Well-Being E-Book HERE

*******Article published by Bonnie Gortler in Systems and Forecasts June 22, 2017

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.