“Wealth is the ability to fully experience life.” – Henry David Thoreau

The stock market has just completed eight weeks of gain since the October 7 low, leaving the market extended, and due for a decline. New highs were made in the SPDR S&P 500 ETF Trust (SPY) of 181.75 on November 29. The 5 day decline has been minor, and price is holding above its 50 and 200 day moving averages, which are at174.82 and 165.54 respectively at the time of this writing. There has not been a 10% correction since October of 2011. It would not surprise me to see wider swings in the market as we move into 2014. Volatility is increasing, as measured by the VIX.(Fear Index) On December 3 it penetrated its 200 day moving average, the first time since 9/27/13. Many stock market averages on daily charts are trading at near their highs but momentum is weakening and in some instances MACD has clearly formed negative divergences.

Extreme Levels of Optimism Are Worrisome

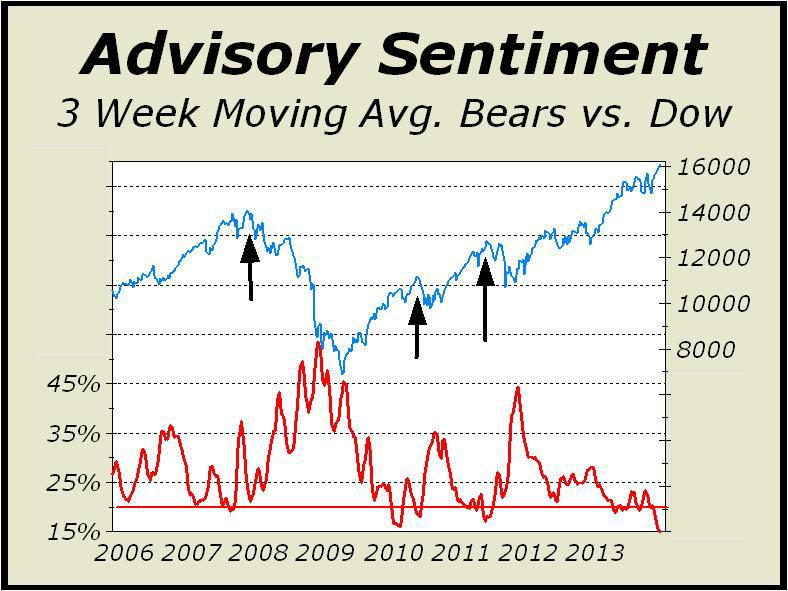

An interesting chart showing the high optimism, which as a contrary indicator is a potentially bearish phenomenon, appeared in Alan M. Newman’s Stock Market CROSSCURRENTS newsletter on December 2 (WWW.CROSS-CURRENTS.NET). Alan wrote:

“Sentiment measures show virtually no resistance to the belief that prices will continue to ramp. The Investor’s Intelligence poll of Investment advisors shows bears contracting to only 15.5%, the lowest since April 3, 1987, only six months before a historic stock market a historic stock market crash. The Investor’s Intelligence poll ofinvestment advisorsis at an extreme not seen in 26 years, the years stocks suffered the second worst crash in history. “The chart to the right is the three week average of bears, now down to 15.1%. The horizontal line at 20% signal. (This is a contrarian indicator, meaning that very low levels of pessimism are potentially bearish.)”

Time will tell if this low reading brings out the bears and the market moves lower. So far the market has held firm.

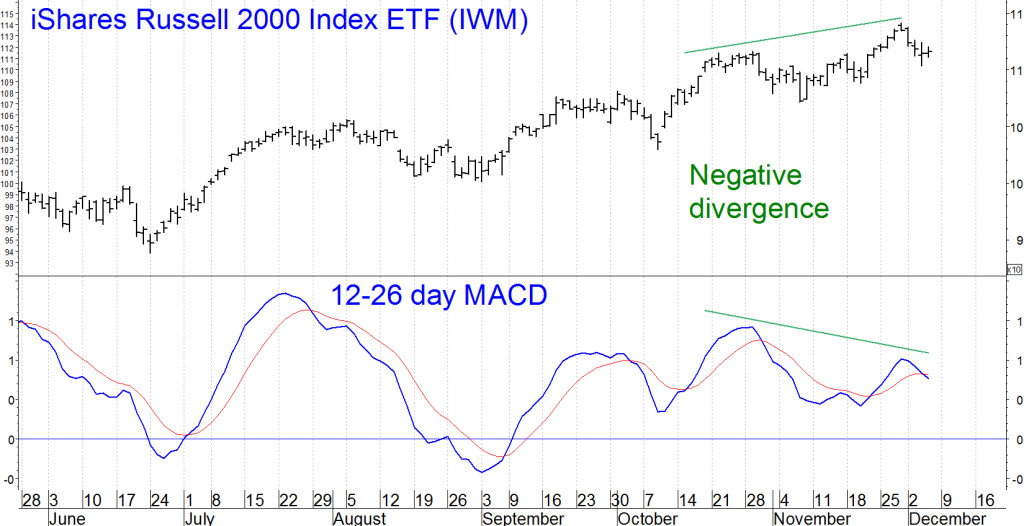

Small-caps have pulled back a bit, and formed a bearish MACD pattern.

The iShares Russell 2000 Index ETF (IWM) made its upside objective of $114 and now has started to decline to 111.46, down 2.4%. The daily short term channel support is 107.50, which I do not think will hold with MACD clearly giving a negative divergence. (Price making a high but momentum did not.)

Original source: Investor’s Business Daily: http://news.investors.com/business/110613-678173-investors-intelligence-shows-too-many-market-bulls.htm#ixzz2mWd5kVzQ

Stock Market Momentum is Diminishing; Short-Term Pullback on the Horizon

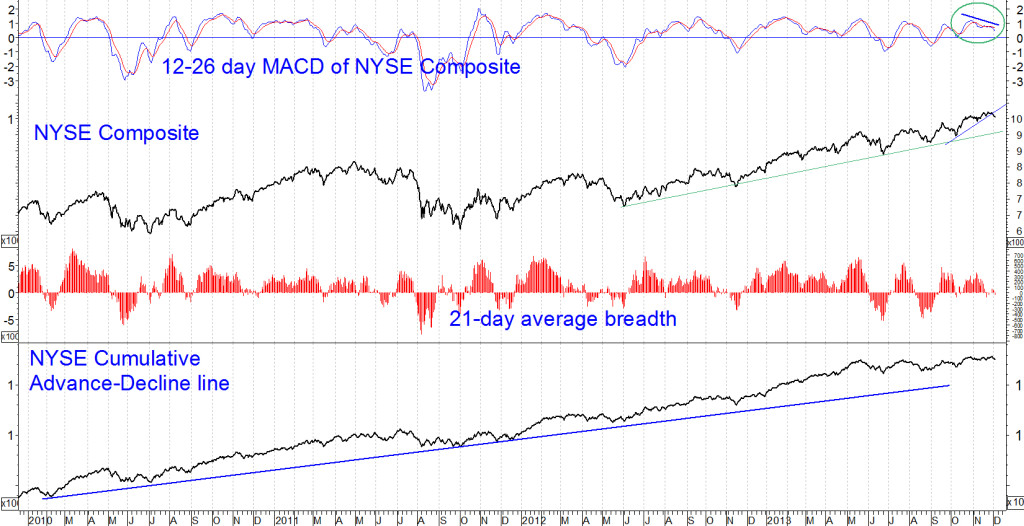

The New York Stock Exchange index is an example of another major index that has made new highs but clearly is showing momentum weakening. The good news is the uptrend from June remains in effect but the short term trend from October has been violated to the downside confirmed by MACD sell signals. In fact, as with IWM, MACD has formed a negative divergence (circled in green) with the level of the NYSE Composite. The chart (below) also contains studies that are based on the advance decline line, one of my favorite indicators to monitor because it measures stock market breadth, which I find very important when analyzing the internal strength of a market advance or decline. On October 4 I wrote about market breadth and said I would be watching. Market breadth is clearly getting weaker.

The middle clip (red) in the chart

shows the 21-day average NYSE

advances minus declines. It is

showing a negative reading, even

with the market near its high. That

is bearish.

The bottom clip in the chart is the NYSE Cumulative Advance Decline line. Each day that you have net advances the line rises and is added to the previous total.

Conversely, it falls when you have net declines for the day and is subtracted from the total. The long term trend is up, with a clear up trend in place from 12/31/2010. Until this line is broken, declines will likely be contained and no major sell off will take place.

To Sum Up.

There is a mixed message being given at the present time. The good news is our models are positive into next year and we are in a favorable seasonality period. The monthly charts which represent the long term trend are also suggesting higher prices. We have had a few days of decline that has been minor with short term support levels holding, which has kept the bulls in control.

We are now at a critical juncture with warnings signs being given that the stock market could be near a top or it has been seen last week. The short term trend has not broken down yet, but I do not think the market will hold, and a further pullback will occur. Market breadth is getting weaker, more and more charts are showing momentum weakening. Keep an eye on iShares Russell 2000 ETF (IWM). If it breaks below 107.50, the odds increase that a further decline will take place. If the IWM goes above 116 I am wrong and a further advance is ahead. If you have not done so already, take a good look at your investments, and your risk. Don’t be the one to get caught up in the euphoria of the market rise and give back the gains that you have made this year.

Feel free to contact me with your thoughts or comments at Bgortler@Signalert.com.

Sign up now to receive FREE REPORTS about investing including

“Market Outlook 2013” at Signalert.com

This is a hypothetical result and is not meant to represent the actual performance of any particular investment. Future results cannot be guaranteed.

Although the information is made with a sincere effort for accuracy, it is not guaranteed either in any form that the above information is a statement of fact, of opinion, or the result of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments discussed above for their own particular situations and for determination of their own risk levels.

To discover how to achieve your financial dreams click here

Visit www.BGJourneyToWealth.com for more insights to growing your wealth!

Bonnie Gortler (@optiongirl) is a successful stock market guru who is passionate about teaching others about social media, weight loss and wealth. Over her 30-year corporate career, she has been instrumental in managing multi-million dollar client portfolios within a top rated investment firm. Bonnie is a uniquely multi-talented woman who believes that honesty, loyalty and perseverance are the keys to success. You will constantly find her displaying these beliefs due to her winning spirit and ‘You Can Do It’ attitude. Bonnie is a huge sports fan that has successfully lost over 70 pounds by applying the many lessons learned through her ongoing commitment toward personal growth and development while continually encouraging others to reach their goals & dreams. It is within her latest book project, “Journey to Wealth”, where Bonnie has made it her mission to help everyone learn the steps needed to gain sustainable wealth and personal prosperity. Order your copy of ”Journey to Wealth” today!

- Subscribe to BonnieGortler.com

- Connect with Bonnie via LinkedIn, Twitter & Facebook

- Put a smile on someone’s face and Send a card on Bonnie!

- Choose your very own FREE down-loadable gift by visiting bit.ly/bgoffers

Like this post? Feel free to use it in your blog or ezine as long as you use the above signature in its entirety