“All the breaks you need in life wait within your imagination. Imagination is the workshop of your mind, capable of turning mind energy into accomplishment and wealth.” —Napoleon Hill

The market rise stalled before the Fed announcement of no tapering until January. Until that point, the decline in early December was minor with the SPDR S&P 500 ETF Trust (SPY) decline contained after making a high of 181.75 on November 29. In the last newsletter I thought we could break support because of the negative divergences in place in the small cap area. Momentum oscillators were weakening, and market breadth was getting worse in the broad market. As you can see by the charts below there was no substantial selling pressure even though the short term trend has been broken in different sectors.

Volatility (VIX), commonly called the fear index, increased to a peak of 16.75 on Dec. 18 before the Fed’s announcement, making highs as the market fell. However, VIX stayed below levels that I would consider bearish. There are still too many bulls based on market sentiment indicators and not as many stocks made highs to confirm market averages’ highs. Negative divergences in MACD loom on some charts such as the iShares Russell 2000 Index ETF (IWM) which fell as low as 110.36 from its peak price at 114. However, IWM held the key support of 107.50. Market declines historically take place in the first two weeks of December which we had until the Fed announcement on Wednesday (12/18/13) when the market reversed to the upside.

What Are the Daily Charts Saying Now?

The short term trend is questionable because market indices are no longer in an uptrend.

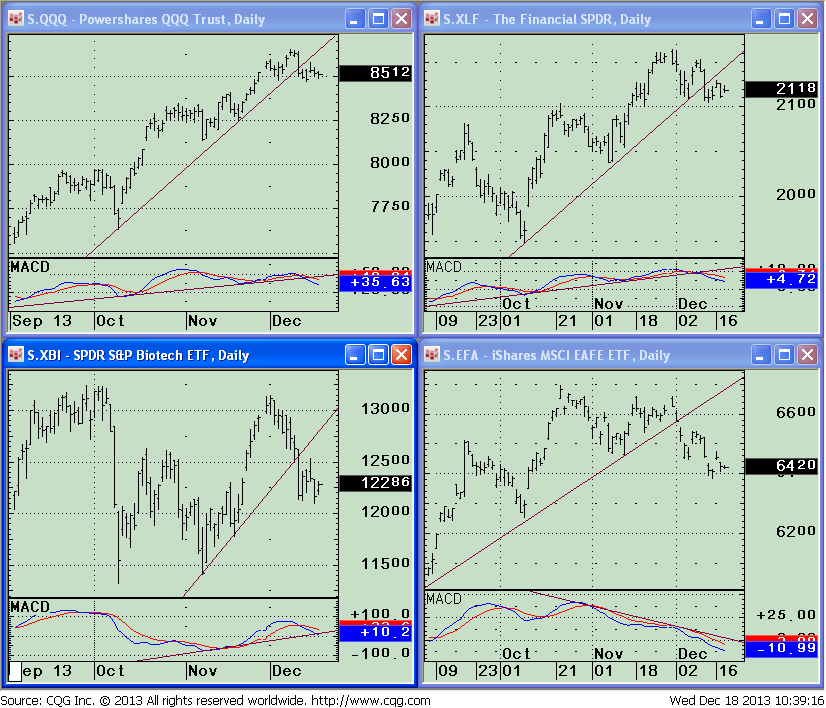

Top Left Chart—QQQ Daily: The PowerShares QQQ (ETF) is an exchange-traded fund based on the Nasdaq-100 Index. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. On December 12 the short term up trend line was broken to the downside. A reflex rally followed for a few days but so far has failed to take out the previous high. MACD has confirmed the breakdown in price.

Bottom Left Chart—XBI daily: The SPDR S&P Biotech ETF (XBI) is one of the leaders of the market that broke their uptrend from November on December 11th. A reflex rally occurred after the trend line break to rally to 125 but so far has failed to take out this level. MACD, the lower portion of this chart is falling and has generated a sell but, unlike the case with QQQ, is hanging on to hold the uptrend line from November bottom.

Top Right Chart—XLF daily: The index is made of companies from diversified financial services; insurance; commercial banks; capital markets; REITs; consumer finance; thrifts & mortgage finance; and real estate management & development. The stock market does well when financials are leaders. Since printing out this chart, XLF has rallied to retest its Nov. 29 highs but has not broken them yet. However, MACD confirmed the earlier trendline break shown on the price chart, so I remain cautious about the financial sector.

Bottom Right Chart—EFA daily: The iShares MSCI EAFE Index is an International equity benchmark which includes stocks from developed countries in Europe, Australia and the Far East. The EFA is getting weaker failing to get through its previous high and continuing to make lower lows at this time. Foreign equity ETFs (especially emerging markets) remain under pressure, so I continue to prefer U.S. equities.

Just to Sum Up

The short term trend is in jeopardy. The decline appears to be broadening across more market indices which are a little disturbing, but so far it’s nothing more than a short term sell off. The good news is history is on the bull’s side. The second half of December is a very bullish time of the year for equities historically.

According to the December 16 issue of By The Numbers Research (MFS BTN Research), “since 1990, the 4th quarter (October-November-December) has produced an average total return (a gain of+5.0%) for the S&P 500 that is greater than the average total return (a gain of +3.4%) of the other 3 quarters combined” (11/25/13 issue,

bullet 1).

Even with the trend line breaks in price to the downside in many market indices I will give the benefit of the doubt to looking at the bright side, believing that the Christmas rally during the last two weeks of the year has begun after weakness early in the month. Our models remain on buys, with favorable seasonality in effect. I believe the bull is very much alive even though the short term trend suggests it could be harder to make money over the next few weeks. You should review your portfolio going into the new year to make sure the balance between potential risks and rewards is suitable for you. Aggressive traders could buy with tight protective stops underneath if there is further weakness. I will continue to give the benefit of the doubt to the bulls unless iShares Russell 2000 Index ETF (IWM) declines to below support of 107.50 and the S&P 500 (SPY) falls below 170 where I will then turn more cautious.

Feel free to contact me at bgortler@signalert.com with your comments or questions. Thank you for your reading my articles and for all of your comments this year. I wish you and your family health, wealth and happiness in 2014.

Here is a special offer to receive a

FULL YEAR OF SYSTEMS & FORECASTS NEWSLETTER

at a SPECIAL DISCOUNT – $99

This is a hypothetical result and is not meant to represent the actual performance of any particular investment. Future results cannot be guaranteed.

Although the information is made with a sincere effort for accuracy, it is not guaranteed either in any form that the above information is a statement of fact, of opinion, or the result of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments discussed above for their own particular situations and for determination of their own risk levels.

To discover how to achieve your financial dreams click here

Visit www.BGJourneyToWealth.com for more insights to growing your wealth!

Bonnie Gortler (@optiongirl) is a successful stock market guru who is passionate about teaching others about social media, weight loss and wealth. Over her 30-year corporate career, she has been instrumental in managing multi-million dollar client portfolios within a top rated investment firm. Bonnie is a uniquely multi-talented woman who believes that honesty, loyalty and perseverance are the keys to success. You will constantly find her displaying these beliefs due to her winning spirit and ‘You Can Do It’ attitude. Bonnie is a huge sports fan that has successfully lost over 70 pounds by applying the many lessons learned through her ongoing commitment toward personal growth and development while continually encouraging others to reach their goals & dreams. It is within her latest book project, “Journey to Wealth”, where Bonnie has made it her mission to help everyone learn the steps needed to gain sustainable wealth and personal prosperity. Order your copy of ”Journey to Wealth” today!

- Subscribe to BonnieGortler.com

- Connect with Bonnie via LinkedIn, Twitter & Facebook

- Put a smile on someone’s face and Send a card on Bonnie!

- Choose your very own FREE down-loadable gift by visiting bit.ly/bgoffers

Like this post? Feel free to use it in your blog or ezine as long as you use the above signature in its entirety.