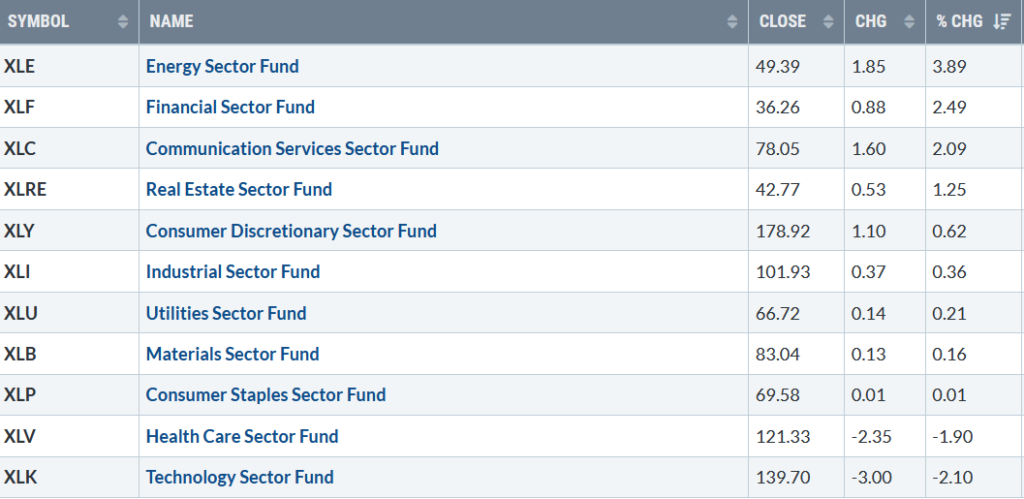

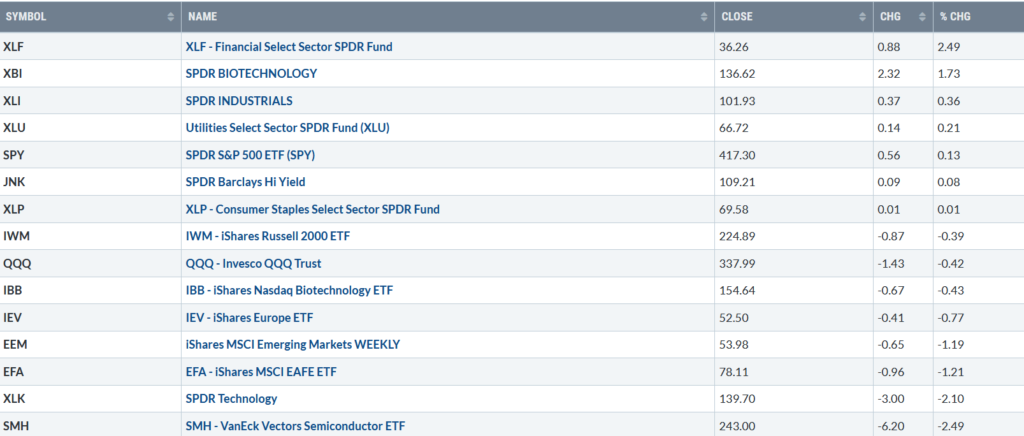

Strong earnings results drove the major averages to record highs. However, all closed lower on Friday. Nine of the eleven S&P sectors finished higher for the week ending 04/23/21. Energy (XLE) and Financials were the best sectors, gaining +3.89% and +2.49%, respectively. Healthcare (XLV), down -1.90%, and Technology (XLK) -2.10% were the weakest sectors. The SPDR S&P 500 ETF Trust (SPY), in comparison, was up +0.13%.

S&P SPDR Sector ETFs Performance Summary

Week of 4/30/21

Source: Stockcharts.com

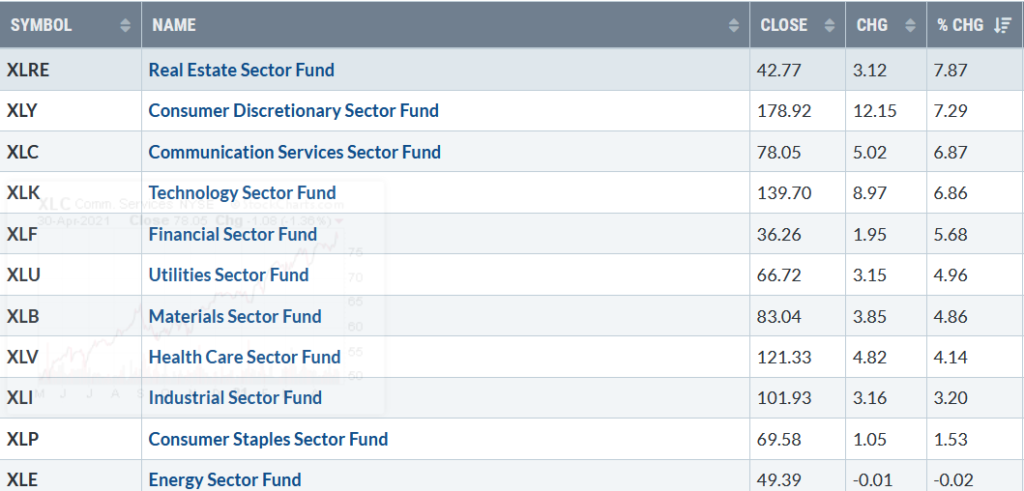

S&P SPDR Sector ETFs Performance Summary 4/1/21 – 4/30/21

Source: Stockcharts.com

10 of the 11 S&P SPDR sectors were profitable in April. The best performing sectors were Real Estate (XLRE), Consumer Discretionary (XLY), Communication Services (XLC), and Technology (XLK). Consumer Staples (XLP) and Energy (XLE) were the laggards for the month. The major averages were all higher in April, with the Dow up +2.7%, S&P 500 up + 5.2%, its best monthly gain since November, and Nasdaq rising +5.4%, it’s sixth straight monthly gain.

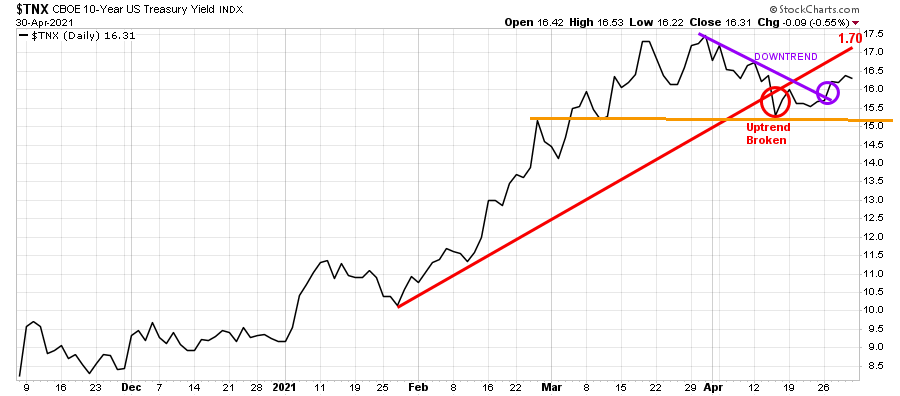

After breaking the uptrend from January (red line) the previous week, 10-Year Treasury yields rose last week, breaking the downtrend (in purple), closing at 1.631%, the highest level since 4/13.

It would be positive if rates could fall below 1.5% (orange line). On the other hand, a close above 1.7% would imply higher rates and likely increase selling of growth stocks but help financial stocks.

Source: Stockcharts.com

The Dow was down -0.50% its second week in a row, the S&P 500 was up +0.02%, and the Nasdaq lost -0.39.%. The Russell 2000 (IWM) finished lower, down -0.24%.

Weekly market breadth was neutral. The New York Stock Exchange Index had 1761 advances and 1672 declines. Nasdaq had 2168 advances and 2198 declines.

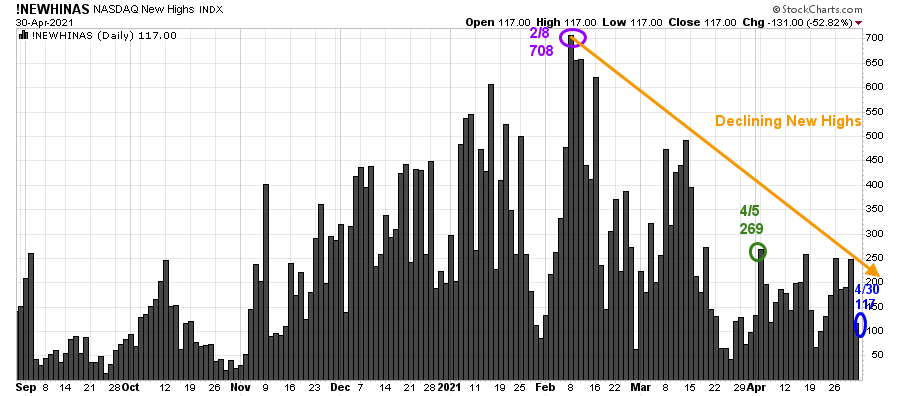

It remains concerning with the Nasdaq near record highs that daily New Highs are not expanding (orange line), closing at 117 (blue circle), not surpassing 269 new highs on 4/5/21, and well below the peak reading of 708 set on 2/8/21. Watch if this trend continues higher or if New Highs begins to broaden, or if they continue to lag. If New highs continue to weaken, expect short-term weakness in Nasdaq.

Figure 2: Daily Nasdaq New Highs

Source: Stockcharts.com

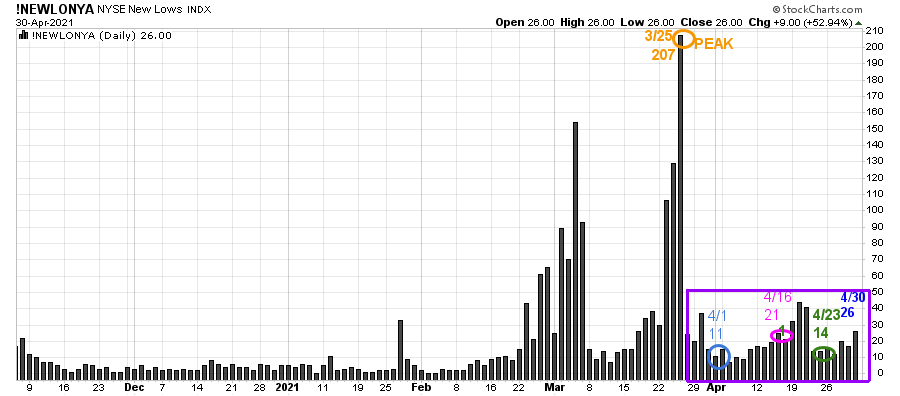

Figure 3: Daily New York Stock Exchange New Lows

Watching the New lows on the New York Stock exchange is a simple technical tool that helps awareness about the immediate trend’s direction. In my book Journey to Wealth, when the New Lows are below 25, the market is very strong (Very Low Risk, and prices tend to rise).

Source: Stockcharts.com

On 3/25, the NYSE New Lows peaked at 207 (orange circle) and then immediately contracted to 11 on 4/1 (blue). On 4/30, New Lows closed at 26, their highest reading in the past five weeks slightly above the most bullish zone (purple rectangle), but not yet in a high-risk area continuing to show healthy underlying internal strength.

Continue to monitor the New Lows on the New York Stock Exchange if they start to expand. As long as they remain between 25 and 50, risk is low, and the odds of a further rally are likely. On the other hand, if new lows begin to expand, it would suggest a higher risk environment, and more caution is needed.

“Financial freedom is available to those who learn about it and work for it” Robert Kiyosaki

Key ETFs to Monitor

Figure 4: Performance week of 4/26 – 4/30

Source: Stockcharts.com

Positives

- The NYSE A/D line made a new high. Historically rarely does the market make a final peak when the cumulative advance-decline line makes a new high.

- Hi-Yield (JNK) and Open-end high yield corporate bond funds remain at or near their highs.

- Market sentiment (contrary indicators) showed more caution. The CNN Fear and Greed Index fell from 66 last week to close at 56. American Association of Individual Investors (AAII) number of bulls dropped to 42.6% from 52.7%

- The Dow Jones Transportation Average continues to show strength making new highs, confirming the Dow high.

- The major averages consolidated last week. Momentum oscillators of short-term hourly charts have worked off their overbought condition.

Negatives

- 10-year yields declining were short-lived as they began to rise again.

- SMH (Semiconductor) down -2.49% last week continues to be weaker than XLK and QQQ. In strong markets, SMH leads.

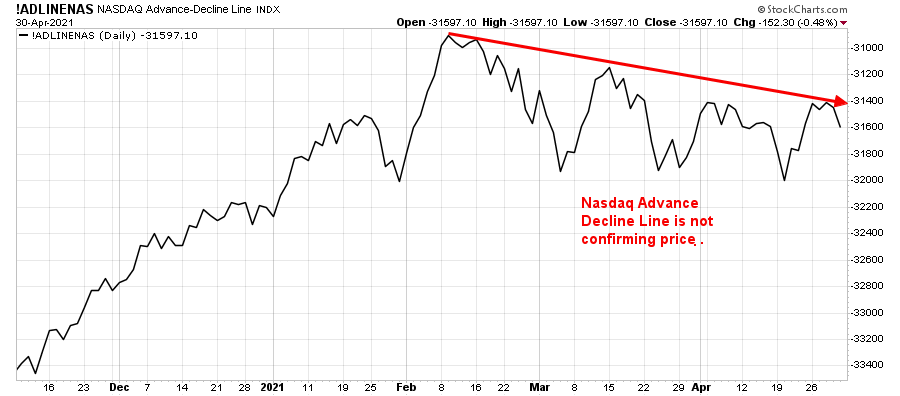

- The Nasdaq Advance-Decline Line is not confirming highs in Nasdaq (Figure 5).

- Emerging Markets (EEM) closed near its lows on Friday, slightly under its 50-Day Moving Average.

- IWM (Russell 2000) failed to get through resistance and reversed to close just under 225.00, its old support level.

Figure 5: The Nasdaq Advance-Decline Line

Source: Stockcharts.com

What ETFs to observe this week for direction?

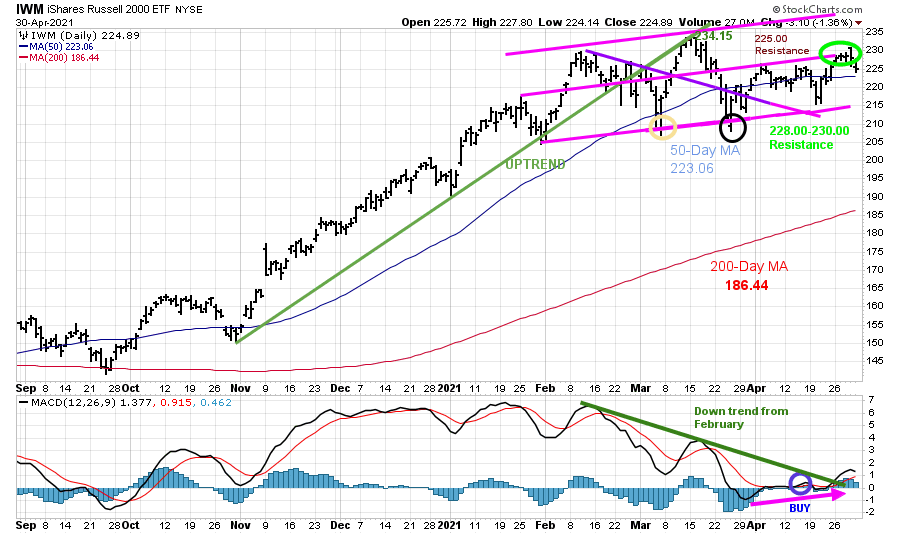

Figure 6: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The top portion of the chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (blue line) and 200-Day Moving Average (red line) that traders watch and use to define trends.

After slightly penetrating the bottom of the channel and the 50-Day MA (yellow circle), on 3/5, at 207.21, IWM stalled at 234.15, the upper channel that coincided with the old uptrend line from November (in dark green). Then IWM fell below the 50-Day MA to the lower channel (black circle), where the buyers stepped in, successfully testing the March 4 low.

Last week, IWM failed to close above resistance at 230.00 (mentioned in Market Wealth update 4/23), closing at 224.89. However, it’s positive IWM closed above its 50 Day Moving Average which stands at 223.06.

Support is at 222.00, followed by 215.00. Resistance remains between 228 and 230.00 (green circle). A close above 230.00 for two days would imply another rally towards the 3/15 high at 234.53 and potentially 252.00.

On the other hand, a close below 215.00 would be a short-term negative. A close below 207.21, the 3/5 low, is likely to trip the sell stops and be a clue a more severe decline will occur.

The bottom half of the chart is MACD (12, 26, 9), a measure of momentum. MACD is on a buy (blue circle), turning up from below 0. MACD this past week broke the downtrend from February (green line), implying downside momentum is complete, and IWM is likely to go higher. For those of you who are day trading, note the hourly MACD is now below 0, in an oversold condition. An hourly close above 227.00 would imply a rally is likely sooner rather than later. Time will tell.

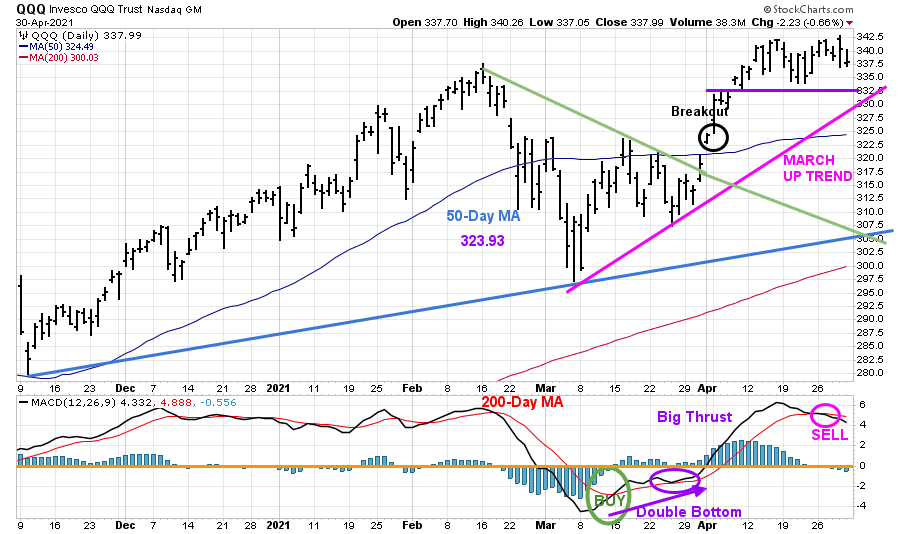

Figure 7: Daily Invesco QQQ Trust Nasdaq (QQQ) Price (Top) and 12-26-9 MACD Bottom)

Source: Stockcharts.com

The top part of the chart shows the daily Invesco QQQ, an exchange-traded fund based on the Nasdaq 100 Index with its 50-Day Moving Average and 200-Day Moving Average. On 3/31, QQQ broke the downtrend from February (green line) and then gapped higher (black circle), breaking out to the upside.

QQQ remains in an uptrend since March. The upside objective is 358.00.

QQQ is in a three-week trading range, closing at 337.99 with first support at 331.00 (purple line). A close below the 50-Day MA 324.49 would negate the upside objective.

A close below 320.00 would break the March uptrend (pink line) and increase the odds of immediate short-term weakness towards 305.00.

A close below 305.00 would break the November uptrend (blue line) and imply the start of a more significant correction.

The bottom half of the chart is MACD (12, 26, 9, a measure of momentum. After the MACD March buy (green circle) and big thrust to the upside, MACD has turned down, now on a sell. The sell is likely not to be as significant, with QQQ holding above 320.00 support. With the hourly chart oversold, it would be positive if QQQ can turn up early in the week.

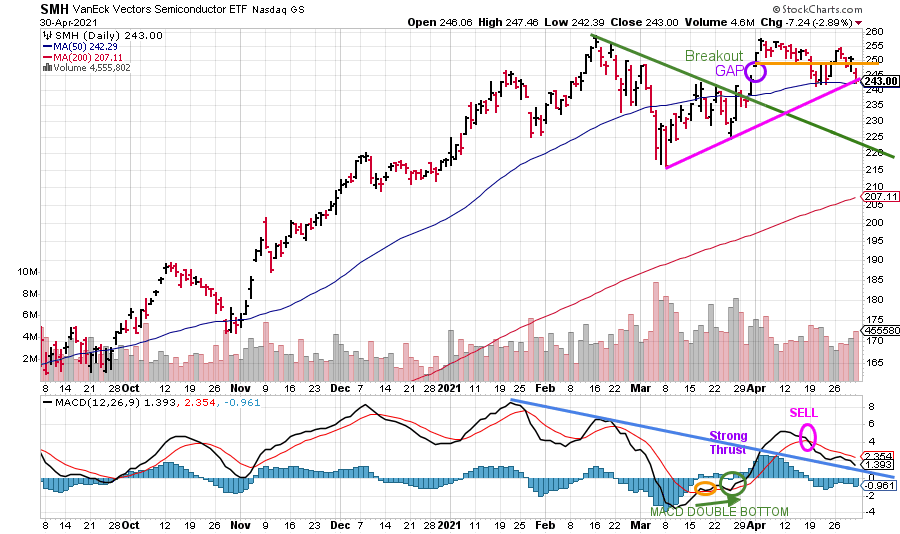

Figure 8: Daily Vaneck Vectors Semiconductor (SMH) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The top chart shows Semiconductors (SMH) broke its downtrend on 3/26 (green line). SMH then gapped up (purple circle), breaking out to a high of 256.68 on 4/8. SMH reversed lower and filled the gap on 4/19. It concerns me that SMH is unable to sustain any upside momentum.

Last week SMH fell -2.49% to close at 243.00, holding short-term support at 242.00. SMH remains in an uptrend from the 3/3 low (pink line). If SMH does not firm now, and weakness continues, the next support is 225.00. Resistance is 255.00.

The lower chart is MACD, a measure of momentum. After rising from a favorable double bottom formation (green arrow), MACD generated a sell quickly. MACD remains above the downtrend (blue line) after the strong thrust in momentum but is not yet below 0 for a safe entry. Similar to QQQ and IWM, the hourly chart is an oversold position. However, SMH money flow has turned up, which is implying traders are stepping in to buy.

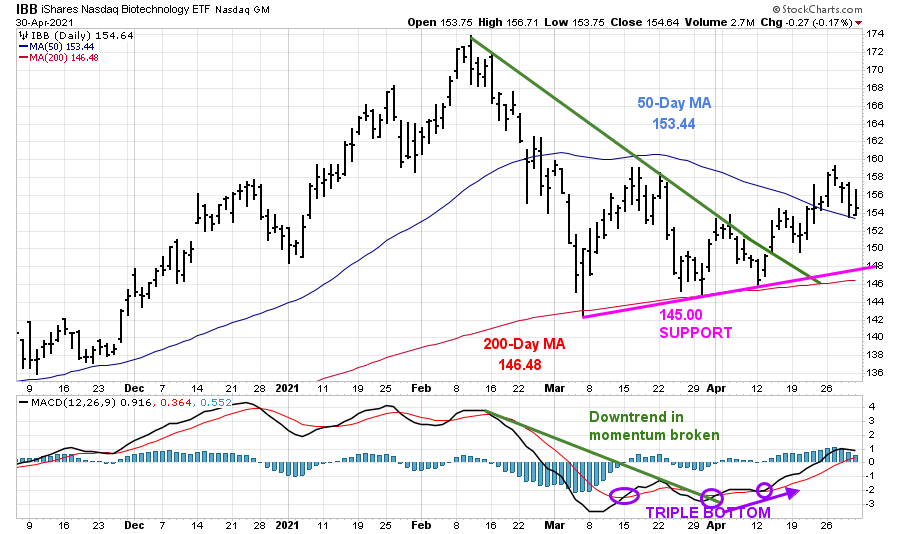

Update on Speculative Buy Biotechnology (IBB) from 4/16 Wealth Update

Figure 9: Daily Ishares Nasdaq Biotechnology (IBB) Price (Top) and 12-26-9 MACD Bottom)

Source: Stockcharts.com

Biotechnology (IBB) successfully tested its March and April low breaking the downtrend from February on 4/14/21.

Biotechnology (IBB)* remains in a short-term uptrend, closing at 154.64, down -0.43%. The upside objective is 167.00. Support is at 152.00 followed by 149.00. A close below 145.00 would negate the upside projection.

MACD (bottom chart) remains on a buy from a triple bottom formation, one of the most bullish technical patterns. Continue to hold.

*Effective on or around June 21, 2021, the iShares Nasdaq Biotechnology ETF (Nasdaq: IBB) will seek to track the ICE Biotechnology Index. The fund will also undergo changes to its name and investment objective. No action is necessary for investors in the impacted ETFs and no capital gains distributions are currently expected as a result of the transition. Source: Business Wire https://www.businesswire.com/news/home/20210422006109/en/BlackRock-Announces-Product-Updates-to-Two-iShares-ETFs

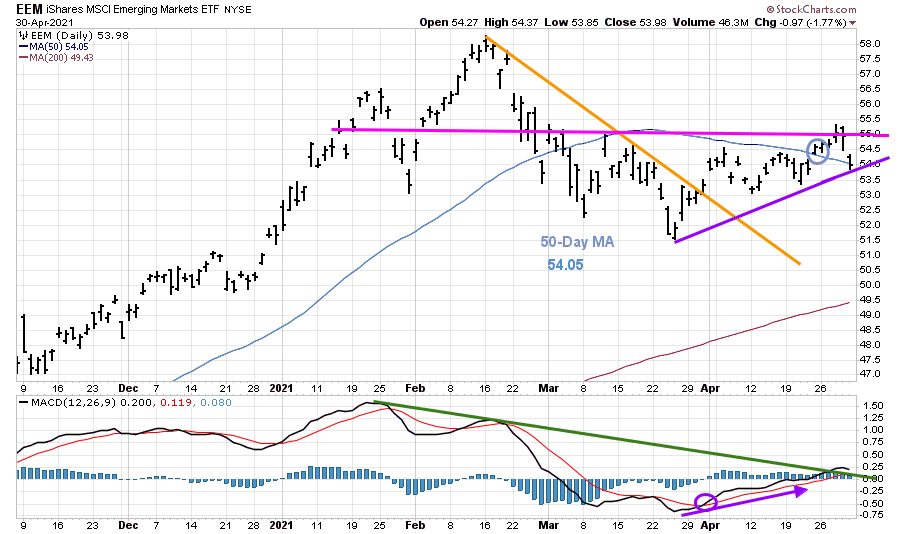

Figure 10: Speculative Buy iShares Emerging Markets (EEM) Update 04/30/21

Source: Stockcharts.com

The top part of the chart is Emerging Markets (EEM), an exchange-traded fund with its 50-Week Moving Average and 200-Week Moving Average. EEM has exposure to large and mid-cap emerging market equities. The top three countries are Hong Kong (32.94%), Taiwan 13.47%, and Korea 12.86% as of 4/27/21. Source: https://www.etf.com/EEM

Emerging Markets (EEM) remains in an uptrend from March (purple line) and in a trading range since early April. EEM started the week higher but could not hold onto its gains, down -1.19%, closing at 53.98. EEM slightly below its 50-Day Moving Average after being above for the first time since February.

A close above 55.00 would give an upside objective to 59.00, followed by 65.00. A close below 52.50 would negate the upside projection.

With MACD on a buy and the downtrend from February (green line) broken and EEM above 52.50 continue to hold.

Summing Up:

The major averages were up early in the week as companies reported excellent earnings but could not hold onto their gains. It’s positive that key support areas have held so far, even with investors concerned about rising inflation and possible tax hikes. Momentum oscillators are oversold in the short term (hourly basis). If Semiconductors, Technology, Biotechnology, Small Caps, and Emerging Markets show strength early in the week, further upside is likely in the near term. With the uptrend intact and support levels holding, the bulls remain in control for now. On the other hand, a close below 207.21 for IWM and below 305.00 for QQQ would imply the longer-term trend is in jeopardy.

Remember to manage your risk, and your wealth will grow.

I would love to hear from you. If you have any questions or comments or would like to chat about the market, click here.

If you liked this article, you would love my Free report, Grow and Sustain Your Wealth. Please get it here

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.