Market Wealth Update Week Ending 1/22/21

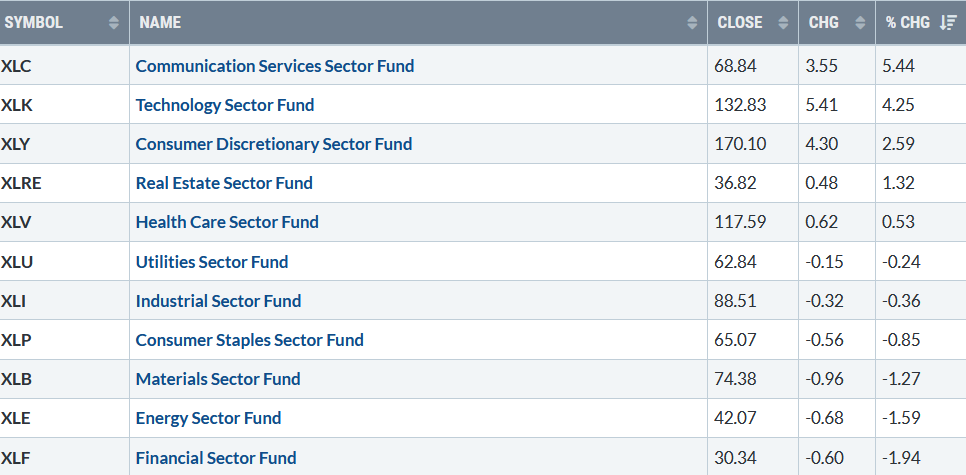

The major averages, Dow, S&P 500, and Nasdaq, closed higher for the week. Five of the 11 S&P sectors for the week ending 1/22/21 finished the week higher. Communication Services (XLC) and Technology (XLK) were the best sectors gaining +5.44% and +4.25%, respectively, more than doubling the gains in the S&P 500 (SPY). The Financial Sector (XLF) was the biggest loser, down -1.94%. Energy (XLE) and Materials (XLB) also were weak, losing their luster. The S&P 500 (SPY), in comparison, gained +1.91%.

S&P SPDR SECTOR ETFs SUMMARY

Week of 01/22/21

Chart Source: Stockcharts.com

Stocks reversed to the upside last week as Technology stocks broke out to the upside, with the Nasdaq Composite up 4.2% showing its biggest gain since November. Financials (XLF) lagged this past week. However, so far has held support at 29.00, after stalling at the upper channel mentioned in my Market Wealth Update Week ending 1/8.

All three major averages, Dow, S&P 500, and the Nasdaq, closed higher. The Russell 2000, the benchmark for small-cap stocks, continued higher, gaining 2.15 %, no follow-through to the downside from 1/15, continuing to show strong leadership, a positive sign for the broad market.

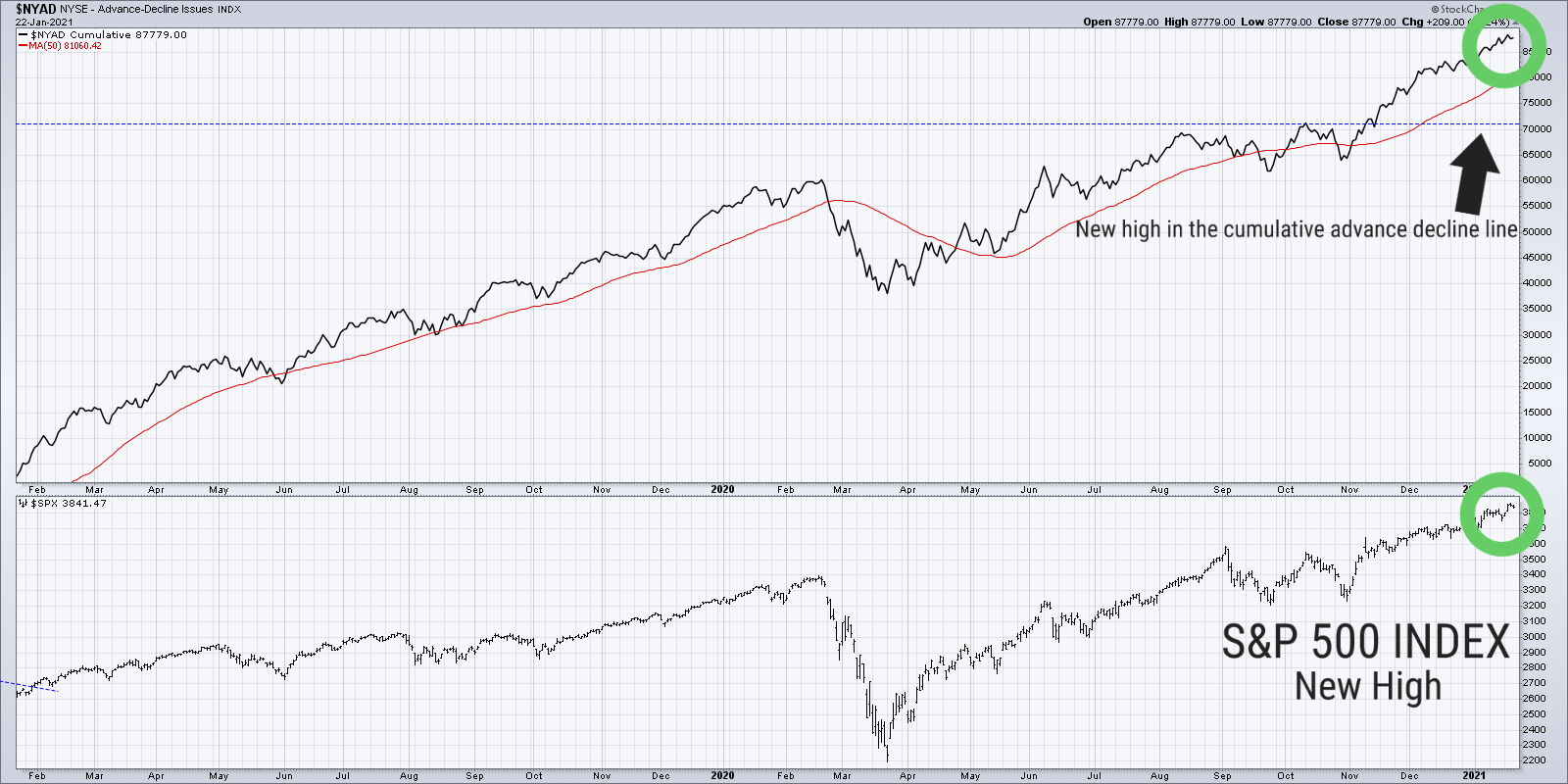

The week’s market breadth on the New York Stock Exchange Index continues to be healthy, with 1956 advances and 1285 declines. It’s bullish a new high was made in the cumulative advance-decline line, confirming the advance’s strength. See the chart below.

New York Stock Exchange Advance-Decline Line Top and S&P 500 Index Bottom 1/22/21

Chart Source: StockCharts.com

The advance/decline line (A/D) is a technical indicator that measures market breadth. The A/D line shows how many stocks are participating in a stock market rally or decline. It represents a cumulative total of the number of stocks advancing versus the number of stocks declining. When the A/D Line rises, it means that more stocks are rising than declining (and vice versa).

As you see in the top chart above (green circle), a new high was made in the New York Stock Exchange Advance-Decline Line A/D line as the S&P 500 Index also made a new high (lower chart green circle). Historically, this is bullish, rarely does the market make a final peak when the cumulative advance-decline line makes a new high.

Sum Up:

Weakness in Energy stocks joined the Financial last week. Some short-term oscillators, which are leading indicators of price, are beginning to show signs of weakening momentum, implying an early warning of potential trend change and increased day to day volatility. Any correction that may occur is likely to be short-term, followed by another rally. On the positive side, market breadth continues to be healthy, a new high in the cumulative A/D line on the New York Stock Exchange implying further gains are likely. The short-term trend remains up. Continue to enjoy the rally but be alert to a change in the short-term direction.

I would love to hear from you. If you have any questions or comments, click here or Email me at Bonnie@bonniegortler.com. For more investment insight, I invite you to join my FB Group Grow Your Wealth and Well-Being

If you liked this article, you would love my Free report, Grow and Sustain Your Wealth. Please get it here

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.