Market Wealth Update Week Ending 12/29/20

Wishing you and your family a happy and prosperous 2021.

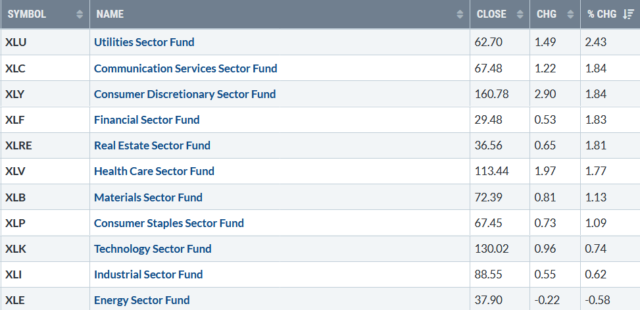

2020 is in the books. Trading was relatively quiet during the holiday-shortened week. For the week ending 12/29/20, 10 of the 11 S&P sectors finished the week higher. Energy (XLE) was the laggard, down -0.58%. Utilities were the best sector, gaining +2.43%. The S&P 500 (SPY), in comparison, gained +1.32%. The Dow and S&P 500 finished at record highs, while the Nasdaq and Russell 2000 ended just below.

Week of 12/29

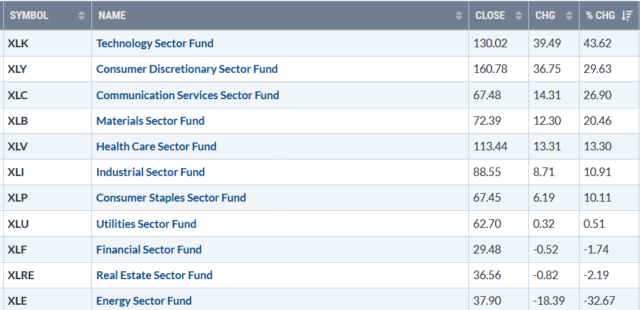

2020 Year To Date

Charts Source: Stockcharts.com

For 2020, year-end, 8 of the 11 S&P sectors finished higher. Technology (XLK) was the best sector, gaining +43.62% while Energy (XLE) was the big loser, down -32.67%. The Dow and S&P 500 finished at record highs, while the Nasdaq and Russell 2000 ended just below.

The major averages peaked in February 2020 and then fell sharply before making a low in late March as the Federal Reserve stepped in to support the credit market. Who would have thought that the major averages and so many stocks would rebound to record highs? Personally, I was hoping for a break-even. Happily, there were huge gains achieved and investors had more money to end the year than when they began.

In 2020 the Nasdaq Composite led the rally up 43.64 %, while the S&P 500 rose 16.26% up almost 50% over the past two years. The Dow gained 7.25% and the small-cap Russell 2000 gained 18.36%.

Look for 2021 to work its way higher at the beginning of the year but expect volatility to increase. I am a big believer in investing when the probabilities are on your side. I believe the risk is contained when a healthy stock market environment is present when the market technical picture is good, and favorable momentum is likely to be on your side.

A clue to potential trouble right now is to watch is the number of new lows on the New York Stock Exchange. When a large number of stocks are making new 52-week highs and few stocks are making new 52-week lows on the New York Stock Exchange, the market is considered healthy. It will be a period where there is less risk, a time when the market tends to rise, and this gives you good opportunities to make money. This is the present environment. Market breadth has been favorable. New lows have been less than 10 since early November, presently at 5. If new 52-weeks lows start to increase and get above 50, it’s an alert or warning of possible market weakness or a change in the tone of the market.

You can learn more information about this indicator I use and how the technical and mental side of investing go together in my book “Journey to Wealth” Get your FREE Chapter Excerpt here

If you like this article you will love my Free Report Grow and Sustain Your Wealth Get it here

Learn more about Bonnie