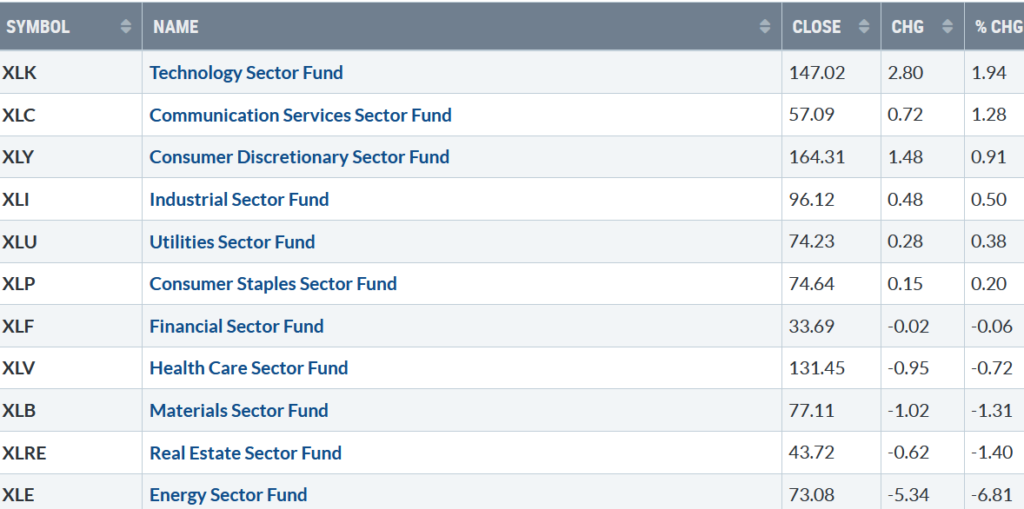

The positive tone of the market continued during the first week of August, with six S&P SPDR sectors higher last week, with Technology (XLK) and Communications Services (XLC) the strongest sectors, while Real Estate (XLRE) and Energy (XLE) lagged. The SPDR S&P 500 ETF Trust (SPY) rose by +0.36%.

S&P SPDR Sector ETFs Performance Summary

7/29/22 – 8/5/22

Figure 2: Bonnie’s Mix of ETFs

Performance Summary 7/29/22 – 8/05/22

Source: Stockcharts.com

No significant selling occurred after the major averages had their best month since 2020 in July. Investors continued to be willing to buy the more aggressive sectors as bargain hunting in U.S. Equities continued. Biotechnology, Transports, Semiconductors, Technology, and Small Cap stocks led the advance, all stronger than the S&P 500. On the other hand, international markets moved lower and weaker than the U.S market.

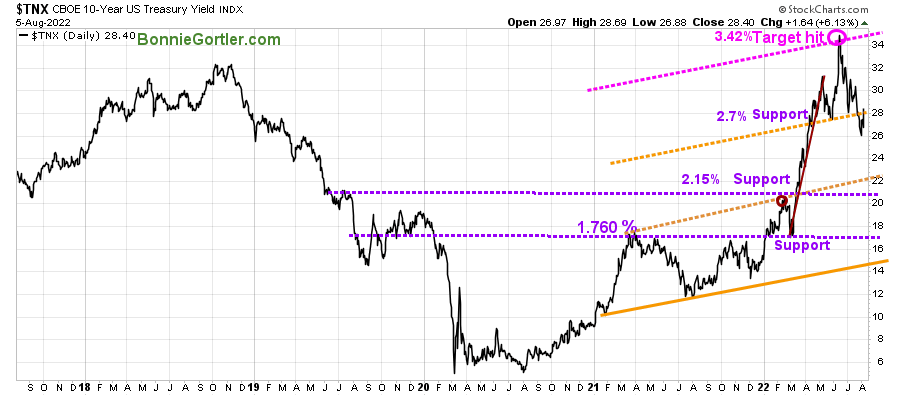

Figure 3: UST 10YR Bond Yields Daily

Source: Stockcharts.com

The 10-Year U.S. Treasury yields rose after the Friday jobs report to close at 2.840%. The near-term support area is 2.70%, followed by 2.20% and 2.15%.

The Dow fell slightly -0.13%, S&P 500 gained +0.36%, and the Nasdaq, the leading performer, rose +2.15%. The Russell 2000 Index rose +1.94%, while The Value Line Arithmetic Index (a mix of approximately 1700 stocks was higher by +0.72%.

Weekly market breadth was positive for the New York Stock Exchange Index (NYSE) and Nasdaq. The NYSE had 1987 advances and 1497 declines, with 109 new highs and 138 new lows. There were 3407 advances and 1826 declines on the Nasdaq, with 259 new highs and 314 new lows.

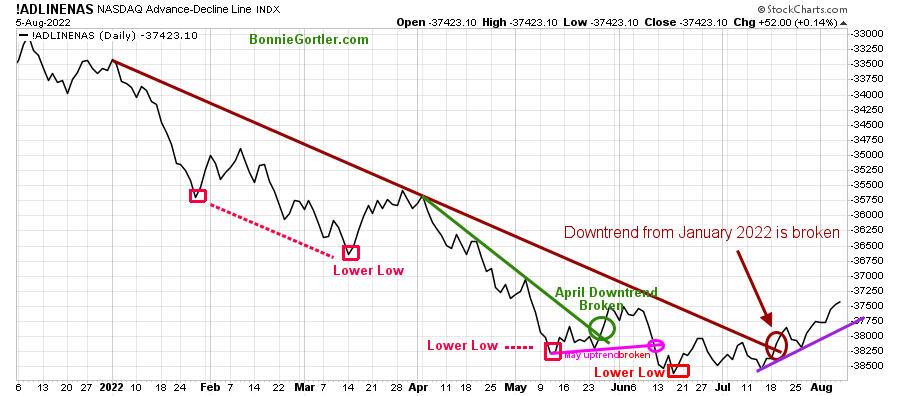

It’s Encouraging Market Breadth Continues to Improve

Figure 4: Nasdaq Advance-Decline Line (Daily)

Source: Stockcharts.com

There was an improvement in breadth at the end of May and early June after breaking its April downtrend (green line), but it was short-lived, followed by weakness in Nasdaq.

Since July, market breadth has steadily improved after breaking the January downtrend (brown line).

Nasdaq acted well last week, gaining more than the S&P 500 on positive breadth, now in an uptrend (purple line). As long as breadth is positive, Nasdaq is likely to continue higher.

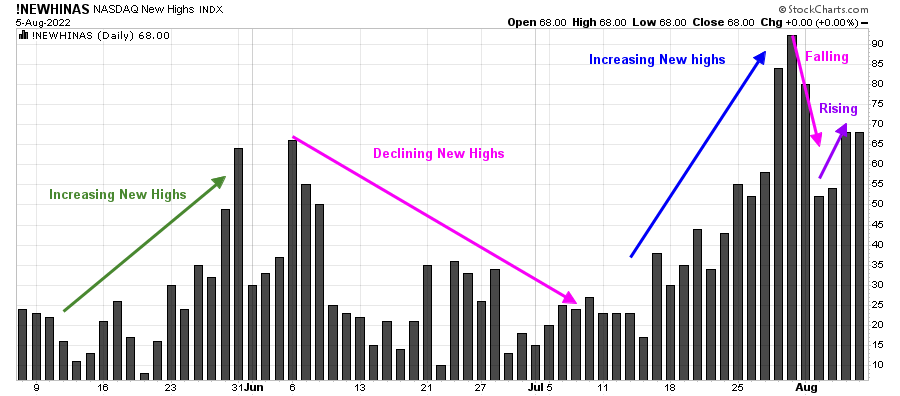

Figure 5: Nasdaq New Highs (Daily)

Source: Stockcharts.com

Its positive Nasdaq new highs are on the rise (purple line), and watch the daily new highs this week if they continue to expand as a clue if the advance will continue or run out of steam.

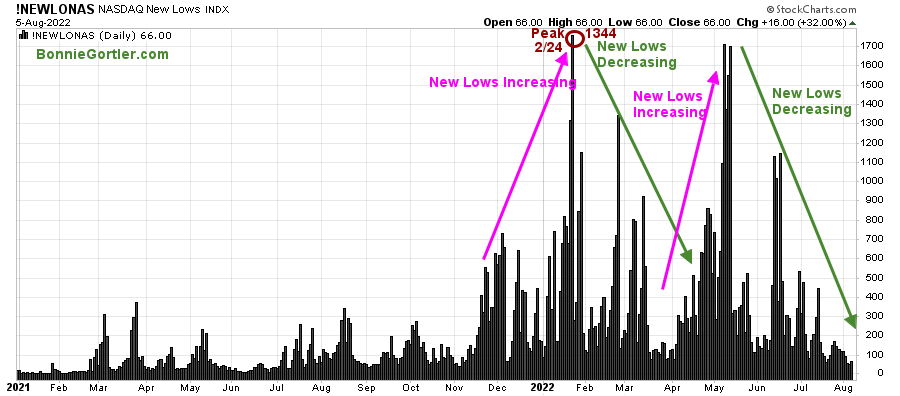

Figure 6: Nasdaq New Lows (Daily)

Source: Stockcharts.com

It’s encouraging that Nasdaq’s new lows are decreasing (green line). Watch the daily new lows if they remain low or begin to expand.

Figure 7: NYSE Cumulative Advance-Decline Line

Source: Stockcharts.com

The chart above is a breadth indicator representing the cumulative difference between the number of advancing and declining stocks on the New York Stock Exchange (NYSE).

There has been a steady improvement in market breadth to break the 2022 downtrend (purple line), implying underlying market strength. However, another hurdle confirming more gains is likely is for the downtrend since November 2021 (green line) to be broken.

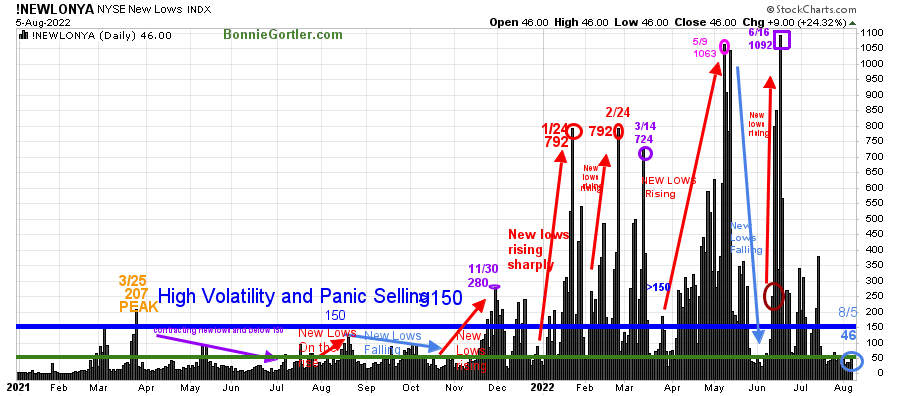

Figure 8: Daily New York Stock Exchange (NYSE) New Lows

Source: Stockcharts.com

Watching New lows on the New York Stock Exchange is a simple technical tool that helps awareness of the immediate trend’s direction.

New lows warned of a potential sharp pullback, high volatility, and “panic selling” for most of 2022, closing above 150. As the market started to move lower in January 2022, New Lows rose sharply, peaking at 792 on 1/24 and again on 2/24 (red circles), implying an increased risk of further selling pressure.

Investors in early May unloaded stocks, and New Lows expanded to 1063 on 5/9 (pink circle), then on 6/16 (purple rectangle), New Lows made a new high of 1092.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. Here is an excerpt, when new lows are above 150, the market is negative, higher risk, and selling is taking place. Sometimes it could be severe, and sometimes on a very nasty day, you can have “panic selling,” and big wild swings (high volatility) to the downside may occur. If you would like a preview, get a free chapter here.

New Lows remain below the high-risk zone above 150, closing at 46 on 8/5 (light blue circle) for the second week. This week look for News Lows to contract to below 25, indicating low risk and further confirmation that the short-term rally will continue.

New Lows remain below the high-risk zone above 150, closing at 46 on 8/5 (light blue circle) for the second week. This week look for News Lows to contract to below 25, indicating low risk and further confirmation that the short-term rally will continue.

On the other hand, it would not be favorable for New Lows to increase to above 150, then I would expect weakness in the near term.

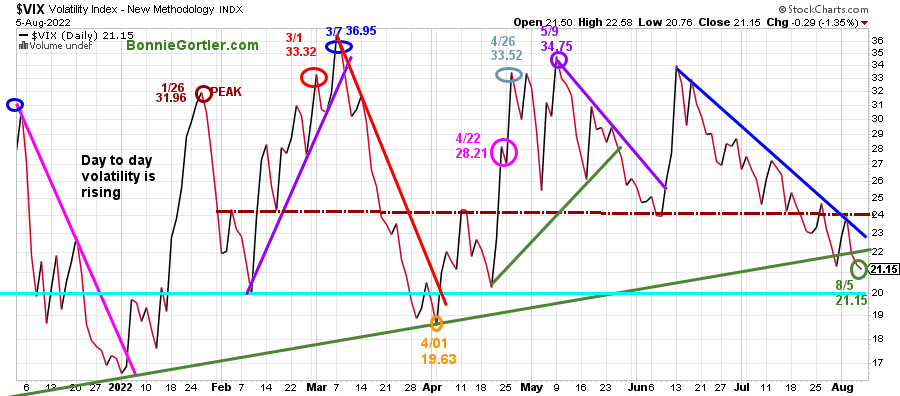

Figure 9: CBOE Volatility Index VIX

Source: Stockcharts.com

The CBOE Volatility Index ($VIX), a measure of fear, has been trading above 20.00 for most of 2022. In January, VIX made a high at 31.96 on 1/26 (brown circle), on 3/1 at 33.32 (red circle), and peaked at 36.95 on 3/7 (blue circle).

VIX fell slightly last week, closing at 21.15 (green circle) and getting closer to the 4/01 low (orange circle) at 19.63.

Day-to-day volatility is calmer as the short and intermediate trends are now favorable.

On the other hand, a close above 24.00 would imply an increase in short-term volatility and a sign that a short-term pullback could begin.

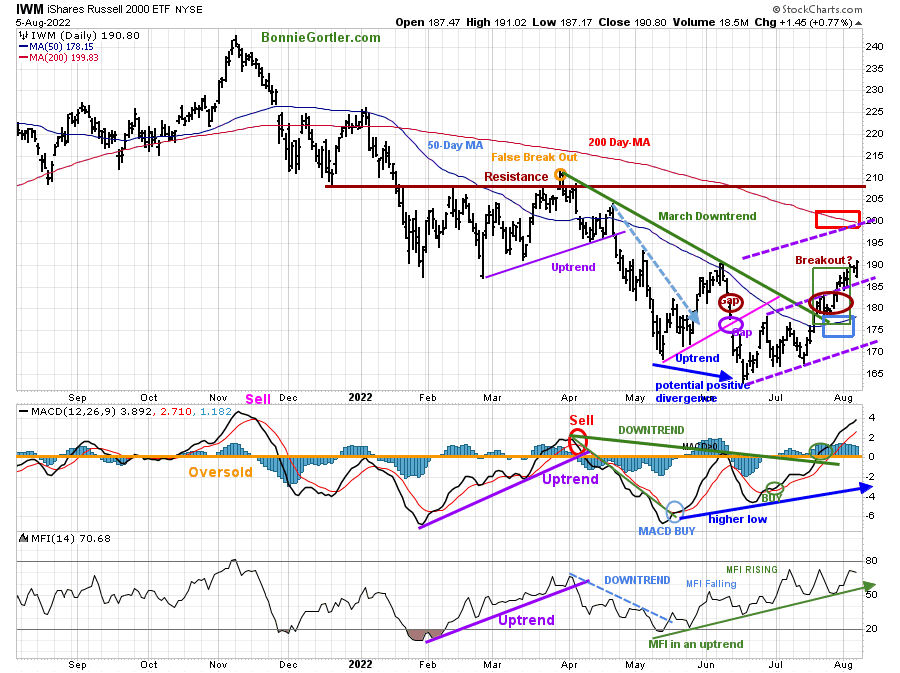

.Figure 10: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top portion of the chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue line) and 200-Day Moving Average (MA) that traders watch and use to define trends. At the end of March, IWM failed to break out above resistance at 210.00 (orange circle) and, in late July, broke its downtrend (green line).

IWM closed at 190.80, near their weekly highs, up +1.90%, and stronger than the S&P 500, which bodes well for the broad market. IWM remains above the 50-Day Moving Average (blue rectangle) but below the 200-Day Moving Average (red rectangle), and a close above would likely attract more buying.

Short-term resistance is 200.00 and 210.00. Support is between 185.00 and 175.00.

MACD (middle chart) remains on a buy after forming a clear positive divergence (one of my favorite patterns). It’s been a strong rally off the lows, with MACD breaking the momentum downtrend from April, rising above 0, and continuing to make higher highs. To learn more about MACD divergences, email me at Bonnie@BonnieGortler.com, and I will send you my article MACD Made Simple.

Money Flow (lower chart) broke the April downtrend (dotted blue line) and accelerated to its highest reading since the April peak implying money was moving into small caps. After Money Flow fell for a few days, it rose again, continuing its uptrend as money continued to flow into small caps.

The IWM Intermediate Trend is Now Positive

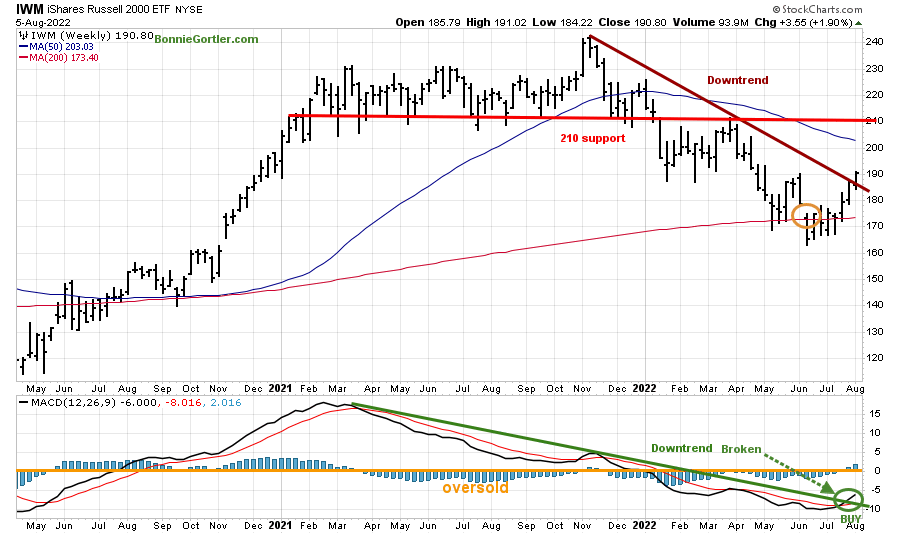

Figure 11: Weekly iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

It’s bullish that IWM (top chart) closed above its price downtrend from November 2021(brown line).

MACD (lower chart) is on a buy (green circle) along with breaking the downtrend from March 2021 (green line). As a result, the intermediate trend is up. The worst of the downside momentum is likely completed.

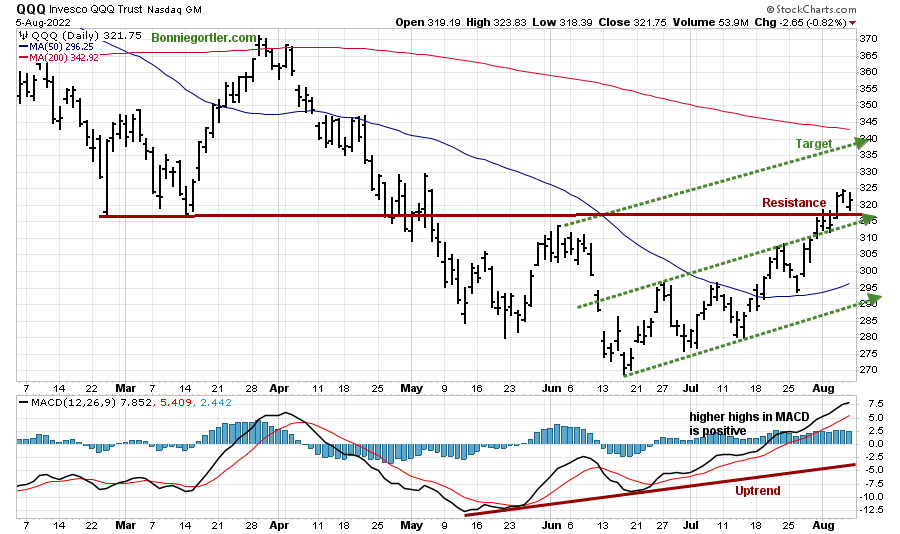

Figure 12: Daily Invesco QQQ Trust (QQQ) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The chart shows the daily Invesco QQQ, an exchange-traded fund based on the Nasdaq 100 Index. The top holding in QQQ is Apple (AAPL), 13.25% as of 8/4/22.

QQQ rose +1.99%, closing at 321.75 above short-term resistance with a positive pattern of higher lows with an upside target of 335.00. Support is at 315.00 and 290.00.

The bottom chart is MACD (12, 26, 9), a measure of momentum; MACD remains on a buy with a pattern of higher highs in a clear uptrend.

Note: MACD is on a weekly buy (chart not shown) with a break in the downtrend, confirming the daily breakout above resistance.

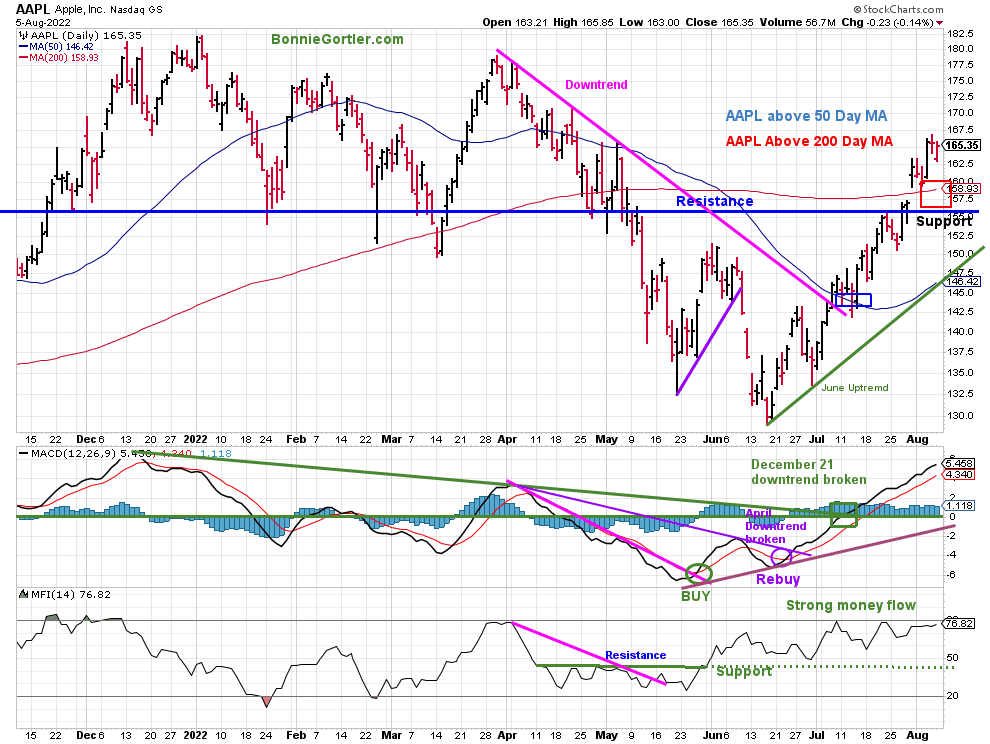

Figure 13: AAPL – Apple, Inc (AAPL) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

Apple (AAPL) is acting well, leading the market higher. AAPL closed above key resistance last week up +1.89% in an uptrend since the middle of June (green line) and closed above its 50 and 200-Day Moving Average, which you will not find in many stocks.

Support is at 155.00 and 145.00. Resistance is at 170.00, followed by 180.00.

MACD (middle chart) remains on a buy and continues to make higher highs after breaking the December 2021 downtrend.

Money Flow (lower chart) is strong and above support (green dotted line).

As long as support at 155.00 holds in APPL, the rally in technology stocks will likely continue.

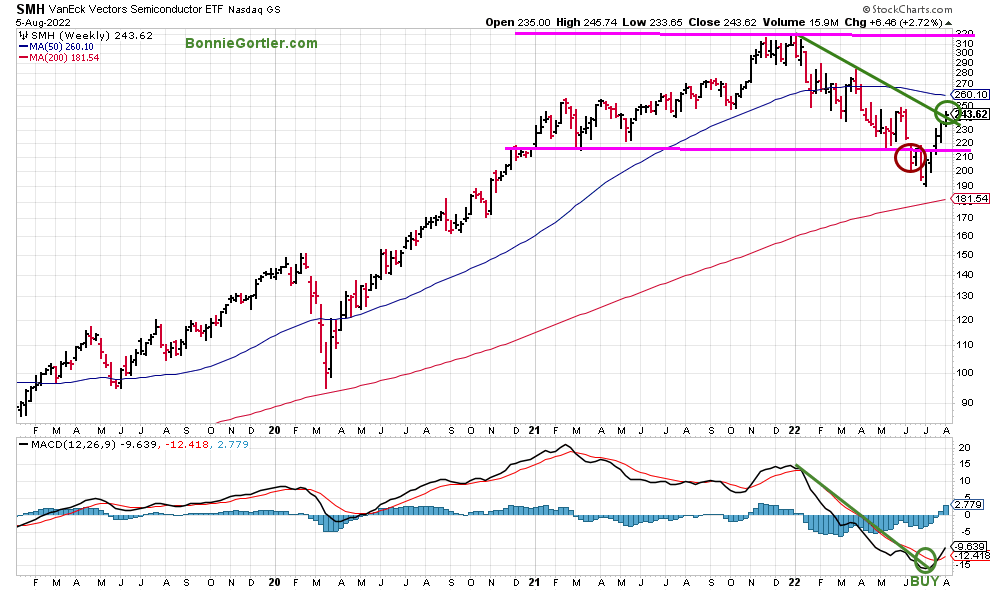

The Intermediate Trend in Semiconductors is Up

Figure 14: Van Eck Semiconductors (SMH) Weekly Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

SMH closed below its weekly channel support in June but has since rebounded sharply, breaking the downtrend from January 2022, confirmed by a MACD buy (lower chart).

Buying Opportunity in Mid Cap Growth

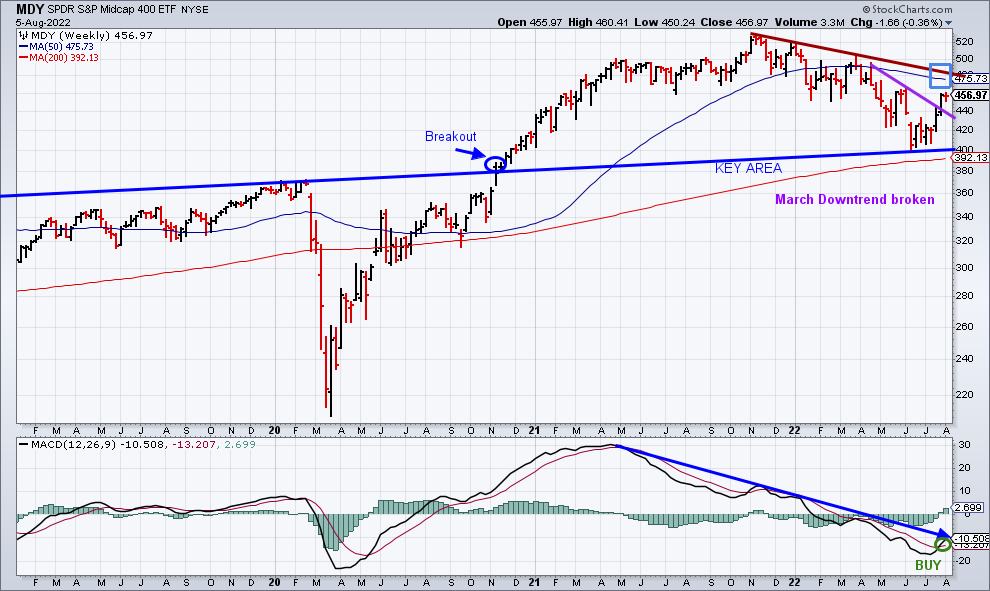

Figure 15: SPDR S&P MidCap 400 (MDY) Weekly Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The SPDR S&P MidCap 400 (MDY) (top chart) has acted much better lately after holding critical support in June. It’s bullish that MDY has closed above the March price downtrend for two weeks, and this week MACD (lower chart) gave a new buy (green circle) and is extremely close to breaking the downtrend (blue line), which would increase the odds of higher prices ahead.

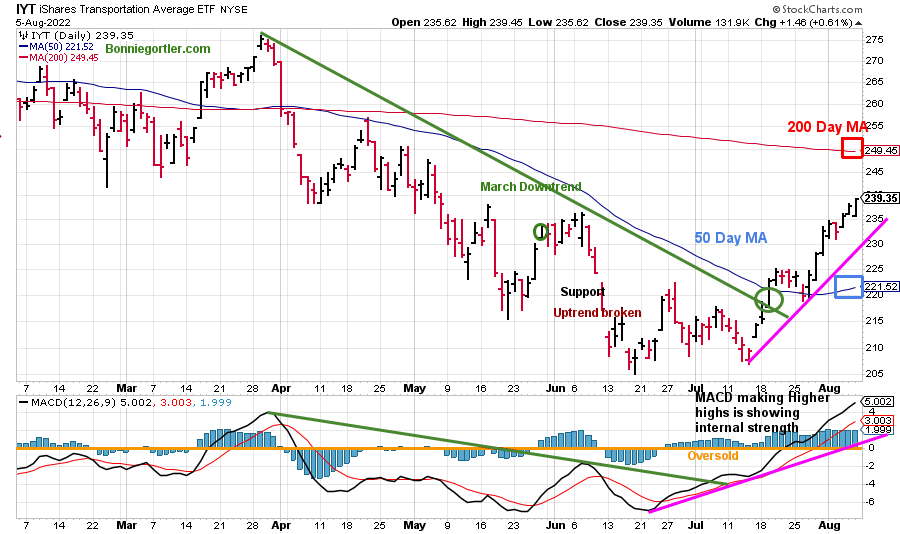

Figure 16: iShares Transportation Average (IYT)

Source: Stockcharts.com

The Transportation Average (IYT) broke its price downtrend from March (green circle) in July and then consolidated near the 50-Day Moving Average before moving higher.

Resistance is at 245.00 and 249.00. Support is at 230.00 and 211.00.

MACD remains on a buy, above 0, making higher highs showing internal strength. It would be short-term positive if IYT shows continued strength and can lead the market higher and close above its 200–day MA (red rectangle), which stands at 249.45 as of this writing.

Recommendation:

The best rallies are the ones that don’t give up much ground. With the intermediate trend changing from down to up, if you have significant cash positions and low equities, I recommend reviewing your portfolio and beginning to increase your equity investments by 10-15 %. If you want assistance, email me at Bonnie@Bonniegortler.com.

Summing Up:

The trend remains up, not falling on bad news and the short-term overbought. Day-to-day volatility has quieted. Although there are concerns about earnings, recession, and rising interest rates, the technical picture of the market internals continues to strengthen with favorable chart patterns of higher highs and higher lows. Its bullish market breadth is improving in combination with downtrends penetrated for the short term (daily) and the intermediate term (weeks to months. More new highs than new lows consistently for both the New York Stock Exchange Index and Nasdaq would signify higher prices.

Remember to manage your risk, and your wealth will grow.

If you liked this article, you will love my Free Grow and Sustain Your Wealth Report. Get it here:

Do you like charts, I invite you to my FB group Wealth Through Market Charts or email me at Bonnie@Bonniegortler.com.

I would love to hear from you. If you have any questions or comments or would like to talk about the market, click here.

I would love to hear from you. If you have any questions or comments or would like to talk about the market, click here.

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.