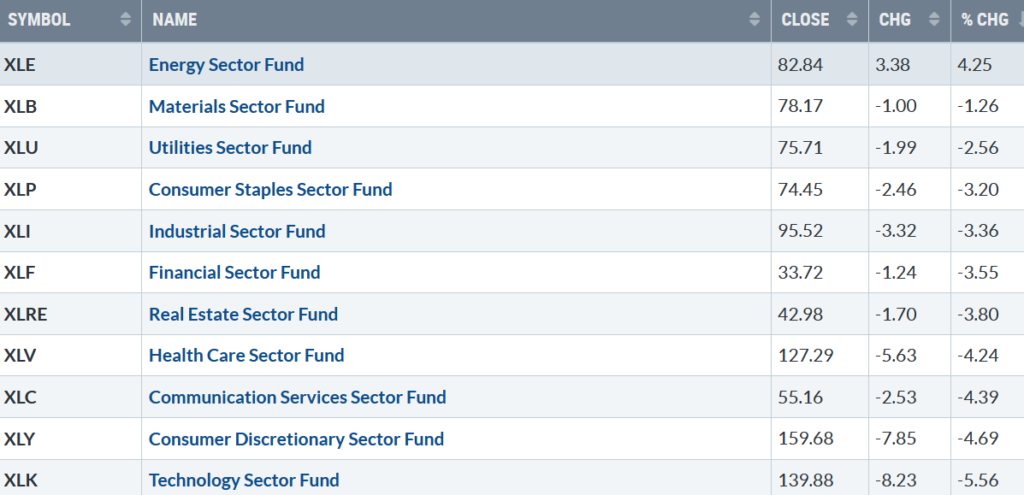

The decline accelerated last week. Energy (ELE) was the only S&P SPDR sector that moved higher, while Consumer Discretionary (XLY) and Technology (XLK) were the weakest, with the SPDR S&P 500 ETF Trust (SPY) falling by -3.99%.

S&P SPDR Sector ETFs Performance Summary

8/19/22 – 8/26/22

Source: Stockcharts.com

Figure 2: Bonnie’s Mix of ETFs

Performance Summary 8/19/22 – 8/26/22

Source: Stockcharts.com

A nasty sell-off on Friday after Chair Powell spoke, Technology and Semiconductors, led the broad market lower, with no place for investors to hide. International markets were mixed. China led the way, and Emerging Markets showed a small gain.

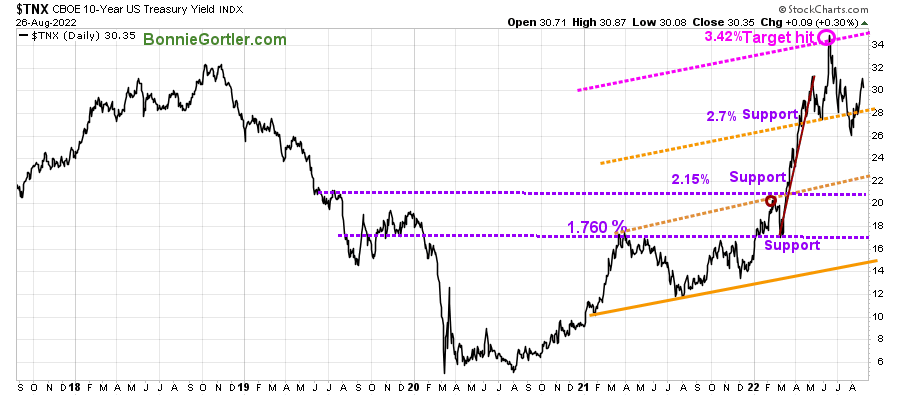

Figure 3: UST 10YR Bond Yields Daily

Source: Stockcharts.com

The 10-Year U.S. Treasury yields rose, closing at 3.035% last week, the highest since July. Support remains at 2.70%, followed by 2.20%. Resistance is at 3.20% and 3.40%.

After stalling at overhead resistance, the major averages fell sharply with most of the losses on Friday. The Dow was down slightly -4.22%, S&P 500 down -.4.04%, and the Nasdaq, the worst performer, down -5.19%. The Russell 2000 Index fell the least, down -2.94%, while the Value Line Arithmetic Index (a mix of approximately 1700 stocks was down by -3.18%.

Weekly market breadth was poor on the New York Stock Exchange Index (NYSE) and Nasdaq. The NYSE had 936 advances and 2551 declines, with 111 new highs and 208 new lows. There were 1551 advances and 3699 declines on the Nasdaq, with 246 new highs and 443 new lows. A continued lack of positive market breadth is not a good sign in the future. Unless this changes quickly, it will be hard to make money consistently.

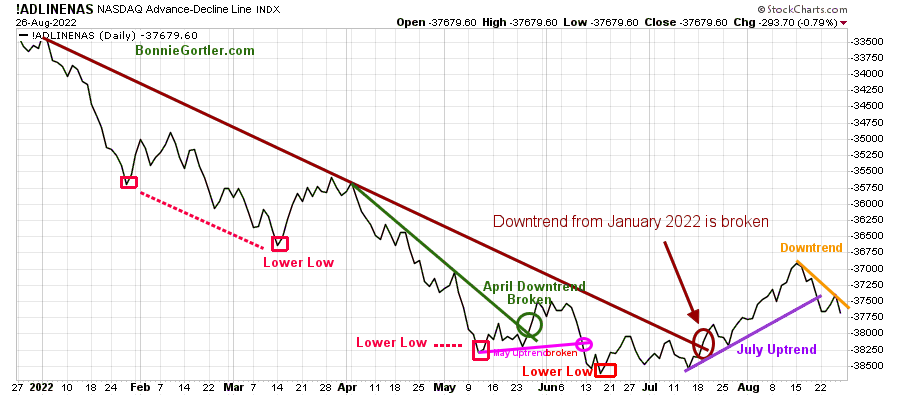

Figure 4: Nasdaq Advance-Decline Line (Daily)

Source: Stockcharts.com

There was an improvement in breadth at the end of May and early June after breaking its April downtrend (green line), but it was short-lived. Since July, market breadth steadily improved after breaking the January downtrend (brown line), leading to a powerful advance in the Nasdaq.

Nasdaq fell -4.00% on Friday, closing at its low for the week, which is negative short-term. The July uptrend in the AD Line is no longer in effect (purple line), a pattern of lower highs that does not bode well for Nasdaq.

Until the downtrend breaks, the risk is high of further weakness in Nasdaq and a continuation of the latest decline testing the lows.

On the other hand, a break of the downtrend (orange line), which appears unlikely at this time, could lead to another rally attempt. Time will tell.

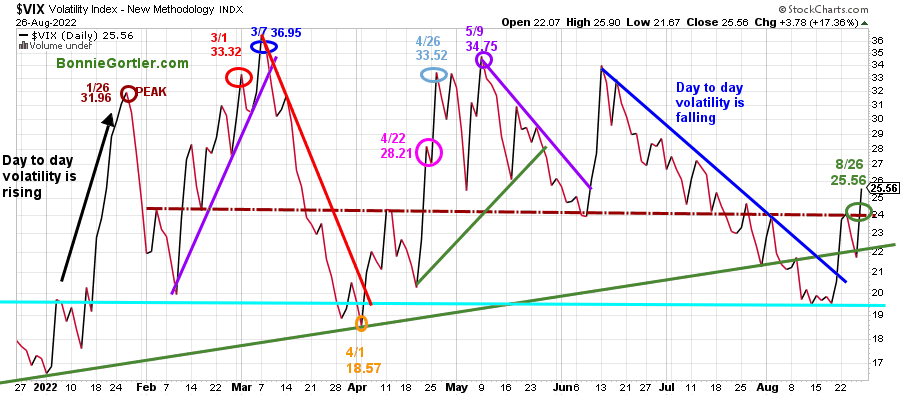

Figure 5: CBOE Volatility Index VIX

Source: Stockcharts.com

The CBOE Volatility Index ($VIX), a measure of fear, has been trading above 20.00 for most of 2022. In January, VIX made a high at 31.96 on 1/26 (brown circle), on 3/1 at 33.32 (red circle), and peaked at 36.95 on 3/7 (blue circle).

VIX rose for the second week as the major averages fell, closing at 25.66 (green circle), above 24.00 (brown dotted line), the highest since early July.

Be alert for increased intra-day volatility. The latest decline will likely continue until the VIX closes below 22.00 before volatility slows.

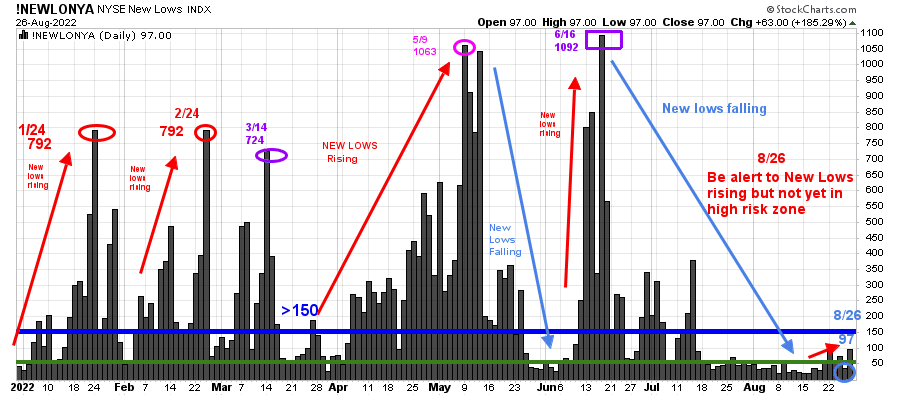

Figure 6: Daily New York Stock Exchange (NYSE) New Lows

Source: Stockcharts.com

Watching New lows on the New York Stock Exchange is a simple technical tool that helps awareness of the immediate trend’s direction.

New lows warned of a potential sharp pullback, high volatility, and “panic selling” for most of 2022, closing above 150. As the market started to move lower in January 2022, New Lows rose sharply, peaking at 792 on 1/24 and again on 2/24 (red circles), implying an increased risk of further selling pressure. Investors in early May unloaded stocks, and New Lows expanded to 1063 on 5/9 (pink circle), then on 6/16 (purple rectangle), New Lows made a new high of 1092.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

New Lows closed at 97 on 8/27 (light blue circle, below 150, the high-risk zone after contracting in June and July; be alert that they are now rising.

It would be encouraging if News Lows contracted immediately early in the week. But, on the other hand, a warning would occur if New Lows increase to above 150, then I would expect further weakness.

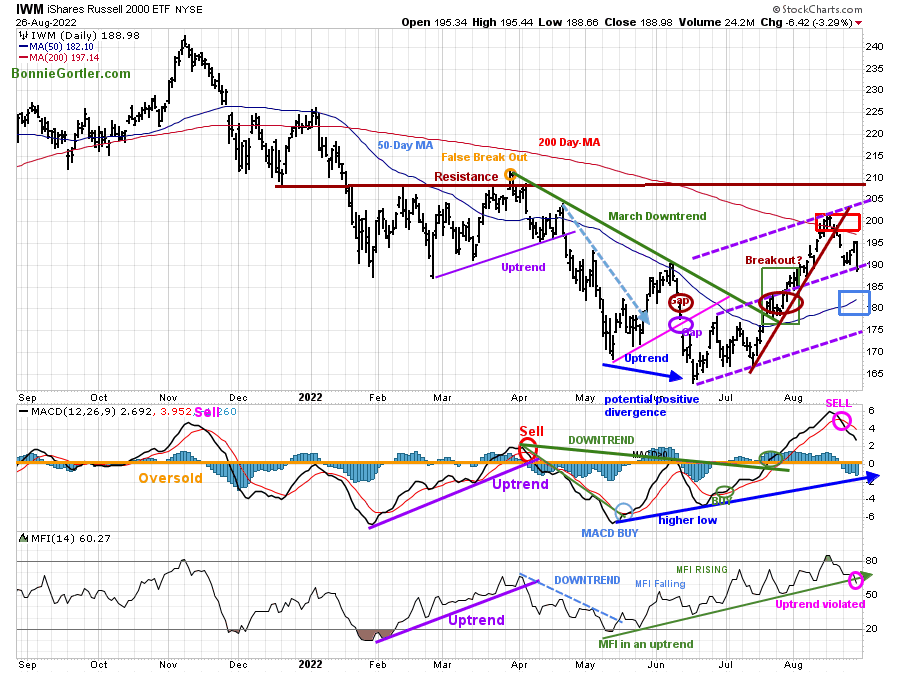

Figure 7: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top portion of the chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue line) and 200-Day Moving Average (MA) that traders watch and use to define trends. At the end of March, IWM failed to break out above resistance at 210.00 (orange circle) and turned down, forming a downtrend (green line). In late July, IWM broke its March downtrend.

There was follow through to the downside after IWM broke below its steep uptrend (brown line), closing at 188.98, down -2.91%. Its positive IWM remains above the 50-Day Moving Average (blue rectangle), but it’s concerning IWM closed below the 200-Day Moving Average (red rectangle).

IWM closed slightly below support at 190.00 and is at the middle channel, which needs to hold giving home for the bulls. Weakness early in the week would suggest further downside to the next support at 180.00, followed by 175.00. On the other hand, a close above 195.00 would be short-term favorable for at least another attempt toward resistance between 200.00 and 205.00. Short-term resistance is 195.00, 200.00, and 205.00.

MACD (middle chart) is now on a sell. With MACD making higher highs in July and August, a second rally attempt is possible following the completion of the latest decline, but no guarantee.

Money Flow (lower chart) broke the May uptrend (green line), implying money is now flowing out of small caps.

Caution: Intermediate Trend in Jeopardy of Another Leg Down

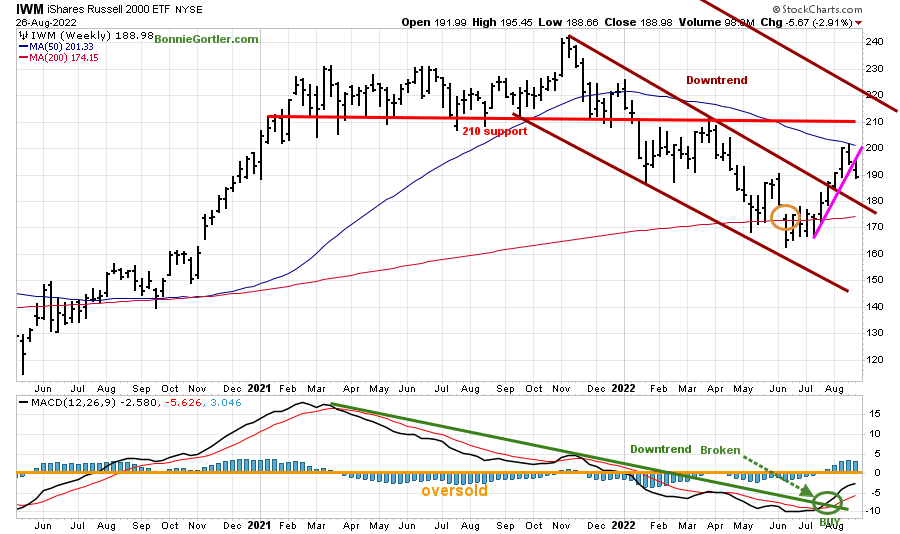

Figure 8: Weekly iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The Russell 2000 (IWM) closed above its price downtrend from November 2021 (brown line) four weeks ago but turned down last week IWM stalling below the 50-Week Moving Average.

IWM closed at its lows on Friday, breaking the July uptrend last week, which is concerning. Support is at 180.00, and resistance is at 200.00 and 210.00.

MACD (bottom chart) is on a buy (green circle) along with breaking the downtrend from March 2021 (green line) but has failed to get above 0, which is a sign of weakness.

In Sum:

Caution is warranted. A nasty reversal to the downside last week could lead to IWM falling towards 180.00, which needs to hold, or there will likely be a test of the June lows unless buyers step in and IWM closes above last week’s high of 195.46.

More Selling Pressure Ahead?

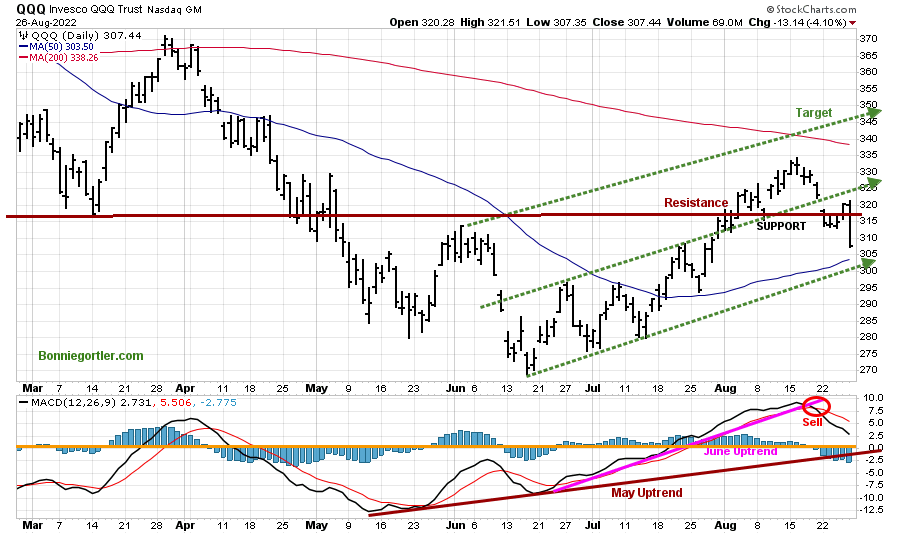

Figure 9: Daily Invesco QQQ Trust (QQQ) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The chart shows the daily Invesco QQQ, an exchange-traded fund based on the Nasdaq 100 Index. The two top holdings in QQQ are Apple (AAPL) and Microsoft, with over 20.00%. The direction of both these stocks will impact the direction of QQQ.

QQQ fell by -4.78%, closing at 307.44 and quickly falling through support levels as sell stops were hit on Friday. Support is at 305.00 and 300.

The bottom chart is MACD (12, 26, 9), a measure of momentum remains on a sell. For now, the May uptrend is intact but could break down on any short-term weakness.

With the magnitude of the retracement in QQQ, there is an increased probability selling will continue. However, If 300.00 holds, then look for a rally attempt toward 315.00, and then 325.00, the middle channel.

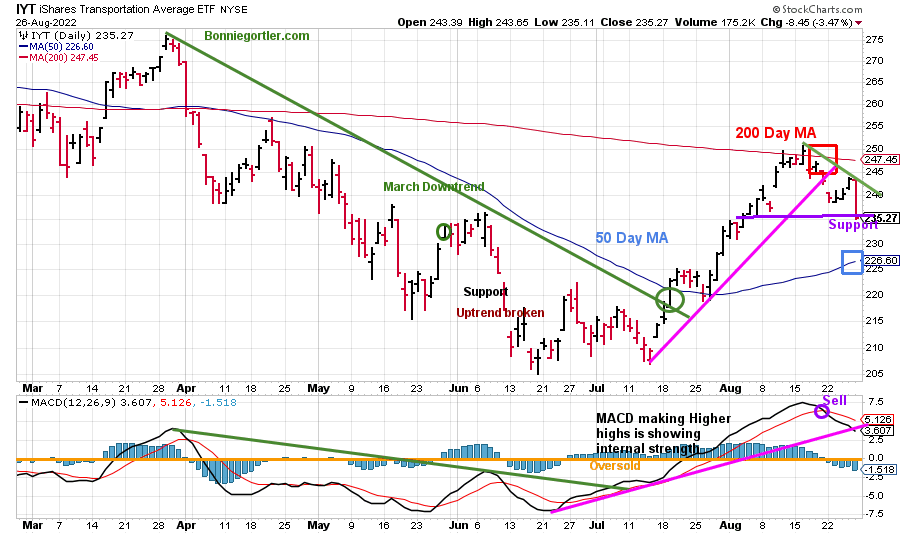

Figure 10: iShares Transportation Average (IYT) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The Transportation Average (IYT) broke its price downtrend from March (green circle) in July and then consolidated near the 50-Day Moving Average before moving higher.

Selling continued last week in IYT after stalling at and below the 200 – Day MA closing at 235.27, down -3.16% at a key support area. The next support is 226.00. Resistance is at 245.00

MACD is on a sell and threatening to break the uptrend from June.

It would be a short-term positive if IYT could turn up, penetrating 245.00 and showing leadership leading the market higher.

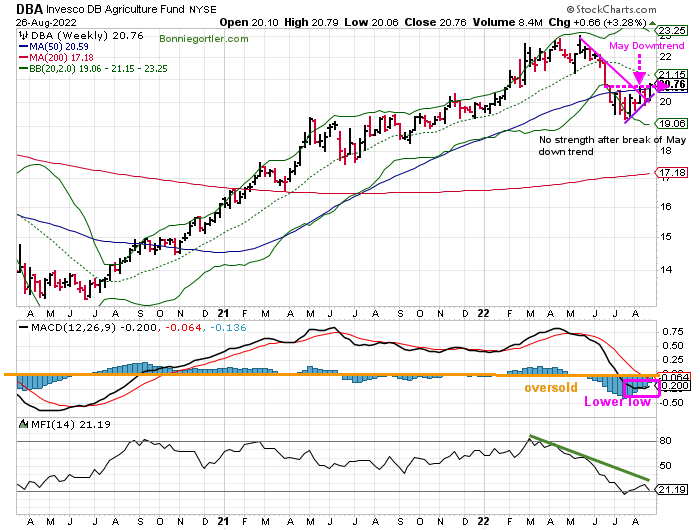

Figure 11: Weekly Invesco Agriculture Fund (DBA) (High Risk) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

The Invesco Agricultural Fund (DBA) broke the steep May downtrend (pink line) but stalled. However, this week as equities fell. DBA rose +3.28% last week, closing at 20.76. It was one of the few gainers on Friday, up 1.27%

MACD, a measure of momentum, is flattening but no buy as of yet, but it could occur soon if DBA shows continued strength.

Money flow is falling and remains in a downtrend despite last week’s gains in DBA.

For those of you who did buy, as mentioned on the 8/12 market update to manage risk, continue keeping a tight stop if you invested in DBA and close your position (sell stop) if DBA closes below 19.80. The low last week was 20.06.

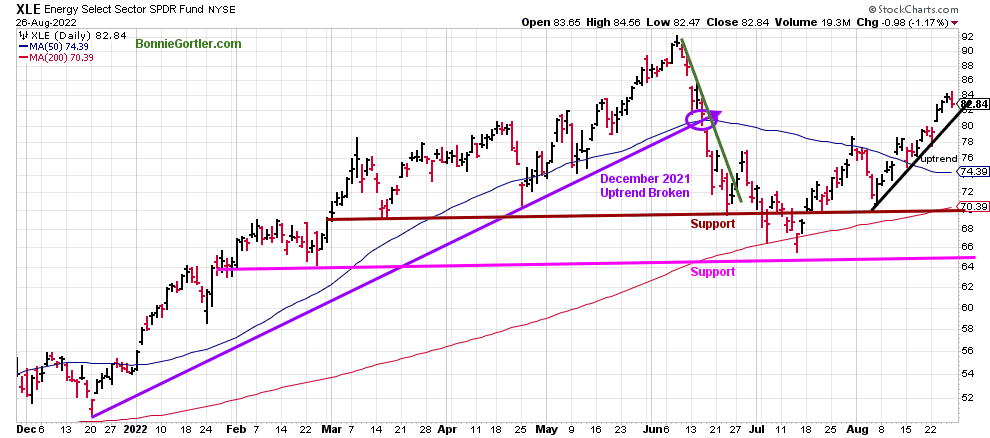

Figure 12: Energy SPDR Daily (XLE)

For those of you in Energy (XLE), I thought the above chart would be of interest.

The strongest sector of 2022 Energy (XLE) has risen sharply since August, after its pullback from June highs, now up +52.38% for the year. Notice the August uptrend is intact and ELE remains above the 50 and 200-Day Moving Averages.

Support is at 80.00, 74.00, 70.00 (brown line), and 85.00 (pink line). Resistance is 86.00 and 90.00. If you are invested, make sure you protect your profits. If you are considering buying Energy, place a tight stop to minimize risk in case of a sudden unexpected pullback.

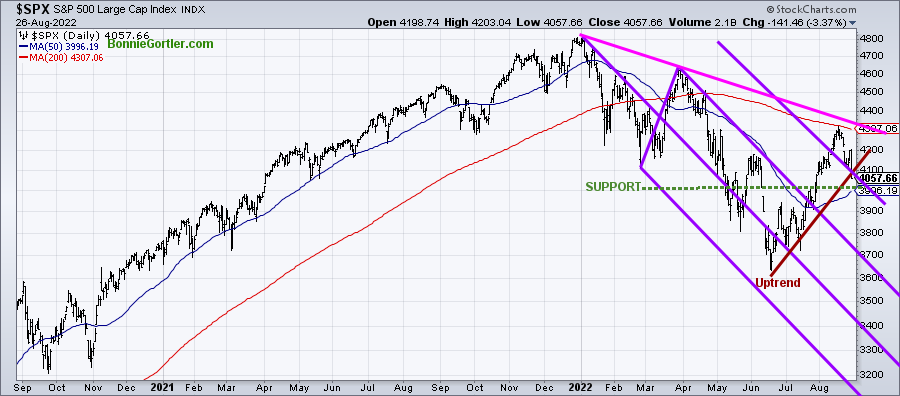

Figure 13: The S&P 500 Index ($SPX) Daily

Source: Stockcharts.com

The S&P 500 (SPX) fell by -4.04%, closing at 4057.66, remaining below the January downtrend (pink line) and the 200-Day Moving Average. A close above both would be bullish, attract more buying from institutions, and squeeze the shorts.

Support of 4100.00 broke last week. The next support is 4000.00. It will be favorable if SPX has enough strength to close above 4200.00 and then break the January downtrend of 4400.00.

If you are interested in following this chart and other charts during the week, I invite you to join my FB group Wealth Through Market Charts, where I post updated charts intraday throughout the week.

Summing Up:

The old saying “Don’t Fight the Fed” may need to be respected until more information unfolds. A nasty decline occurred after Chair Jerome Powell’s hawkish speech on Friday, with all three major averages closing at their lowest level in one month. Market breadth was poor in combination with uptrends penetrated. The September-October period historically tends to be a seasonally volatile time for the market. Short and intermediate-term technical indicators have not followed through to the upside thrust in July through early August and have weakened substantially. Another rally attempt cannot be ruled out, but after Friday’s decline, it appears the bears have gained control, and a more cautious strategy is warranted until at least last week’s highs are penetrated.

Remember to manage your risk, and your wealth will grow.

If you liked this article, you will love my Free Grow and Sustain Your Wealth Report. Get it here:

Do you like charts, I invite you to my FB group Wealth Through Market Charts or email me at Bonnie@Bonniegortler.com.

I would love to hear from you. If you have any questions or comments or would like to talk about the market, click here.

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.