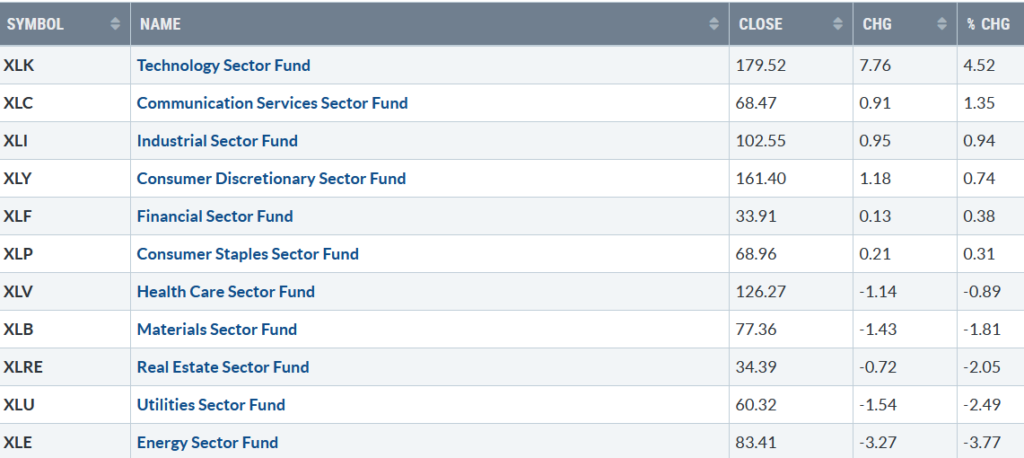

There was a strong close last week, but only six S&P SPDR sectors moved higher. Technology (XLK) and Communications (XLF) were the best sectors, while Utilities (XLU) and Energy (XLE) were the weakest. The SPDR S&P 500 ETF Trust (SPY) gained +1.36%.

S&P SPDR Sector ETFs Performance Summary 11/3/23-11/10/23

Source: Stockcharts.com

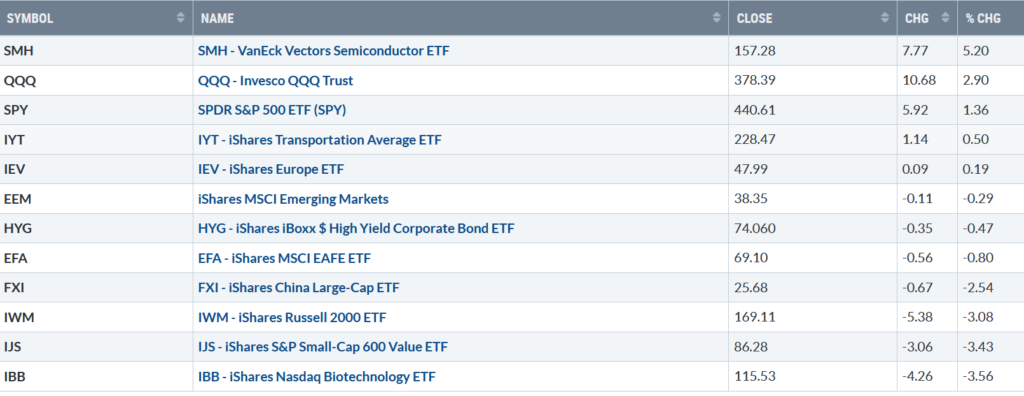

Figure 2: Bonnie’s ETFs Watch List Performance Summary 11/3/23-11/10/23

Source: Stockcharts.com

Semiconductors and Technology led the way, with Small Cap Value and Growth, Biotechnology lagging and much weaker than the S&P 500.

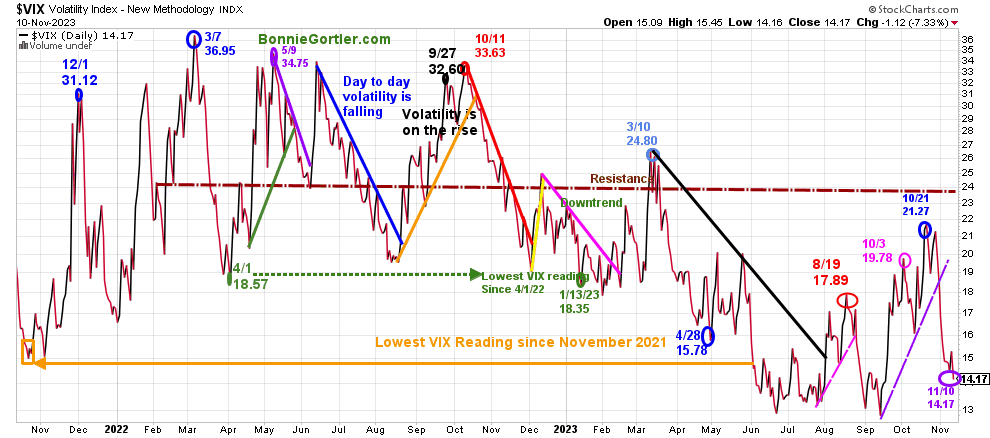

Figure 3: CBOE Volatility Index VIX

Source: Stockcharts.com

The CBOE Volatility Index (VIX), a measure of fear, traded above 20.00 for most of 2022, with a high at 36.95 on 3/7 (blue circle). A new VIX low did not occur until 1/13/23 at 18.35 (green circle) after peaking in October 2022 at 33.63 (red circle).

After VIX fell 30% the previous week, one of the largest weekly declines in history, VIX fell last week, closing at 14.17 (purple circle). If the VIX remains below 18, look for intraday volatility contained.

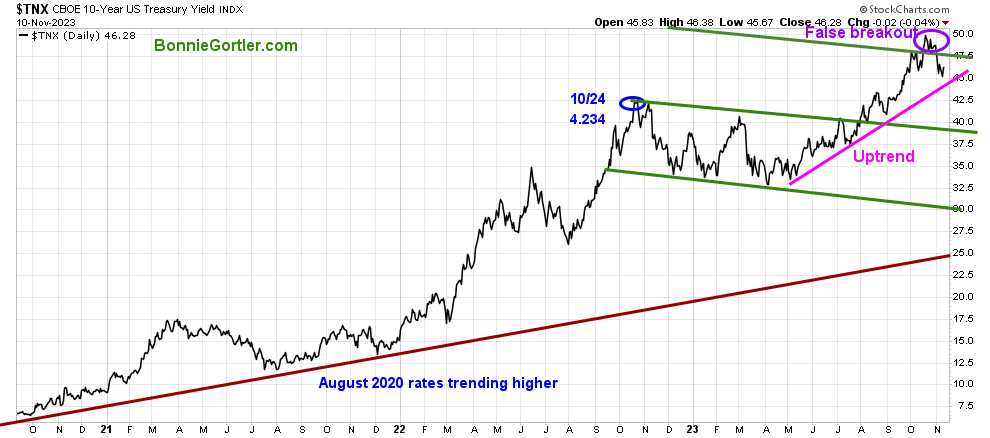

Figure 4: UST 10YR Bond Yields Daily

Source: Stockcharts.com

The 10-year U.S. Treasury yields closed higher last week at 4.628% in volatile trading, remaining in the May uptrend (pink line), pulling back from the top of the channel (top green line), closing below and remaining in its March uptrend. A drop in yields breaking the May uptrend would be short-term positive.

Last week, the major market averages rose thanks to Friday’s strong close. The Dow gained +0.65%, the S&P 500 gained +1.31%, Nasdaq +2.37%. The Russell 2000 Index lagged again, down -3.15%, despite being positive on Friday.

Are you interested in learning about the stock market in the comfort of your home? Learn how to implement a powerful wealth-building mindset and simple, reliable strategies to help you Grow Your Wealth. Learn more here: https://bonniegortler.lpages.co/wealth-made-simple-ecourse/.

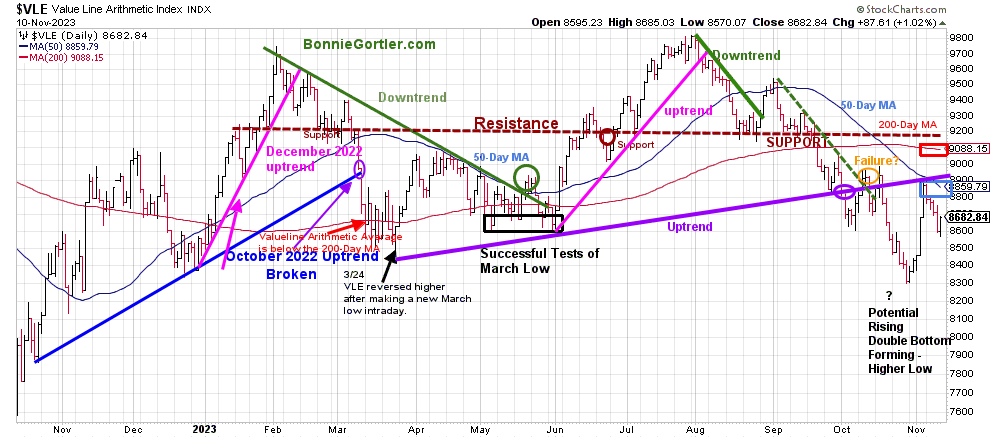

Figure 5: Value Line Arithmetic Average

Source: Stockcharts.com

The Value Line Arithmetic Index ($VLE) is a mix of approximately 1700 stocks. VLE broke the October 2022 uptrend in early March 2023 (blue line), and April, May, and June successfully tested the March low and ultimately made a new low in October 2023.

VLE fell last week, closing at 8682.49, down -2.10%, turning down at the 50-day MA (blue rectangle), closing below along with the 200-day MA (red rectangle).

Support is 8600, 8400, and 8300. Resistance is at 8700, 8900, and 9100.

VLE failed to get above the uptrend line where VLE broke down (purple line). With the decline, there is a potential rising double bottom pattern of a higher low formed if VLE turns up. Strength in VLE this week would imply a broadening rally and be short-term positive, potentially testing September’s high. On the other hand, if VLE stalls now and takes out the low, this would be a short-term negative.

Do you want to go deeper into charting? Learn more in the comfort of your home today with my Free 33-minute Training, Charting Strategies to Cut Risk and Trade with the Trend. Sign up here.

Market breadth needs improvement.

Weekly market breadth was negative on the New York Stock Exchange Index (NYSE) and for the Nasdaq. The NYSE had 967 advances and 2022 declines, with 101 new highs and 184 new lows. There were 1650 advances and 3104 declines on the Nasdaq, with 159 new highs and 633 new lows.

Weekly breadth remains unimpressive, and rallies will likely be narrow if the market breadth does not improve.

If you want to go more in-depth with charts, I invite you to join my FB group, Wealth Through Market Charts.

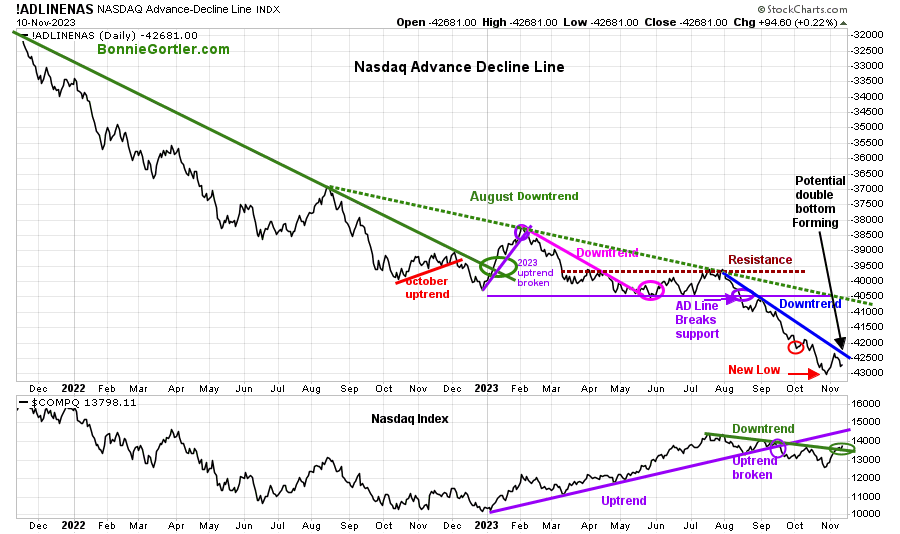

Figure 6: Nasdaq Advance Decline Line Daily (Top) and Nasdaq (Bottom)

Source: Stockcharts.com

The top chart is the Nasdaq Daily Advance-Decline Line, a technical indicator that plots the difference between the number of advancing and declining stocks. In January 2023, the October 2022 downtrend was broken (solid green line) but quickly reversed lower in February 2023, when most of the stock participation was the large Mega Cap Stocks.

The AD-Line (top chart) broke support (purple circle) in August and continued making new lows in October (red arrow). However, a potential favorable double formation has formed if market breadth improves this week that is likely also to break the August downtrend (blue line), which would be bullish.

The Nasdaq (lower chart) rose last week, slightly breaking the downtrend from July (green line), but not confirmed yet by the AD line, which is needed to imply a broadening of the rally in the Nasdaq.

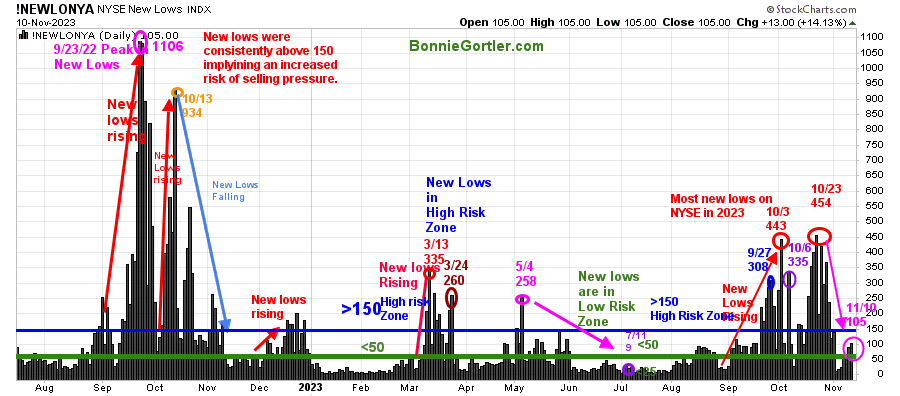

Figure 7: Daily New York Stock Exchange (NYSE) New Lows

Source: Stockcharts.com

Watching New Lows on the New York Stock Exchange is a simple technical tool that helps awareness of the immediate trend’s direction. New lows warned of a potential sharp pullback, high volatility, and “panic selling” for most of 2022, closing above 150. The peak reading was 9/23/22 when New Lows made a new high of 1106 (pink circle), and New Lows expanded to their highest level in 2023 on 3/13/23 (red circle) to 335.

New Lows increased in September (red arrow on the right) toward the high-risk zone greater than 150, peaking at 443 on 10/3, the highest reading since October 2022.

New lows had stopped accelerating in early October. However, the decline was not complete until the end of the month as New Lows made only a slight new high, peaking at 454 (red circle) on 10/23.

New lows are inching higher, closing at 105 (pink circle), but remain below the high-risk zone >150. It would be positive if New Lows contract to below 50 and then stay in the lowest risk zone, <25, not rising above 150, which would be a warning sign of potential weakness.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

No follow-through last week in Small Caps.

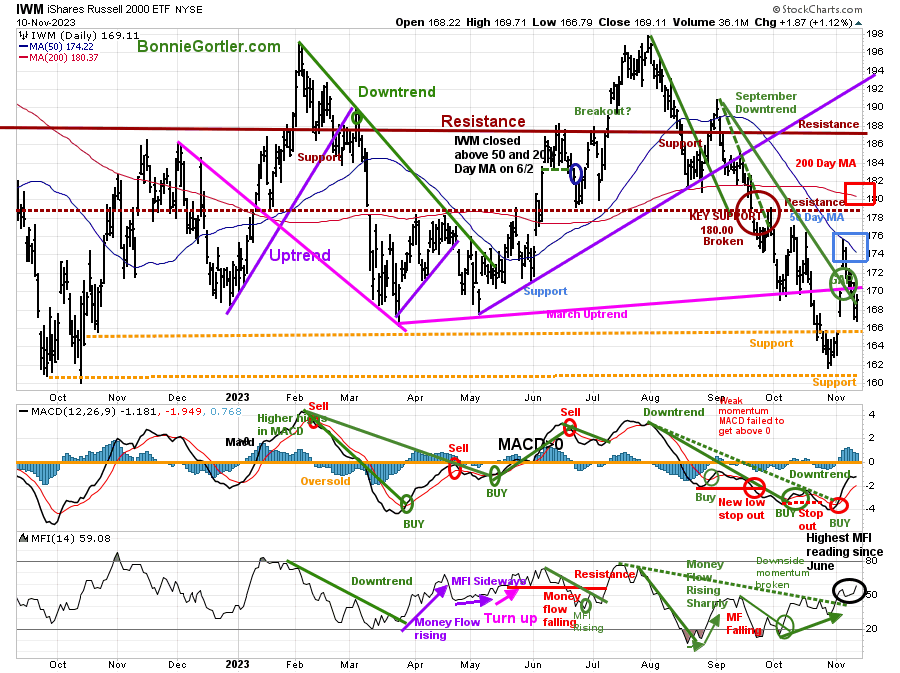

Figure 8: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle and Money Flow (Bottom)

Source: Stockcharts.com

The top chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue line) and 200-Day Moving Average (MA) (red line) that traders watch and use to define trends.

IWM pulled back last week after breaking the September downtrend, falling -3.11% after the previous week’s +7.57% gain, closing at 169.11. IWM filled the gap (green circle), closing below the 50-day MA, which closed at 175.83 and below the 200-day MA (blue rectangle).

Support is at 166.00 and 161.00. Resistance is at 170.00, 176.00, 182.00, and 188.00.

MACD (middle chart) remains on a buy, below 0, and has been showing strength since breaking the August downtrend.

Money Flow (lower chart) is positive, rising, turning up after forming a positive divergence (a higher low as IWM made a lower low) and breaking the downtrend (green dotted line) since July and at its highest level since June (black circle).

Keep an eye on the Russell 2000 (IWM) for a clue for this week if it strengthens, showing leadership and stronger than the S&P 500, which would be positive, or if IWM lags, which would be negative for the overall market.

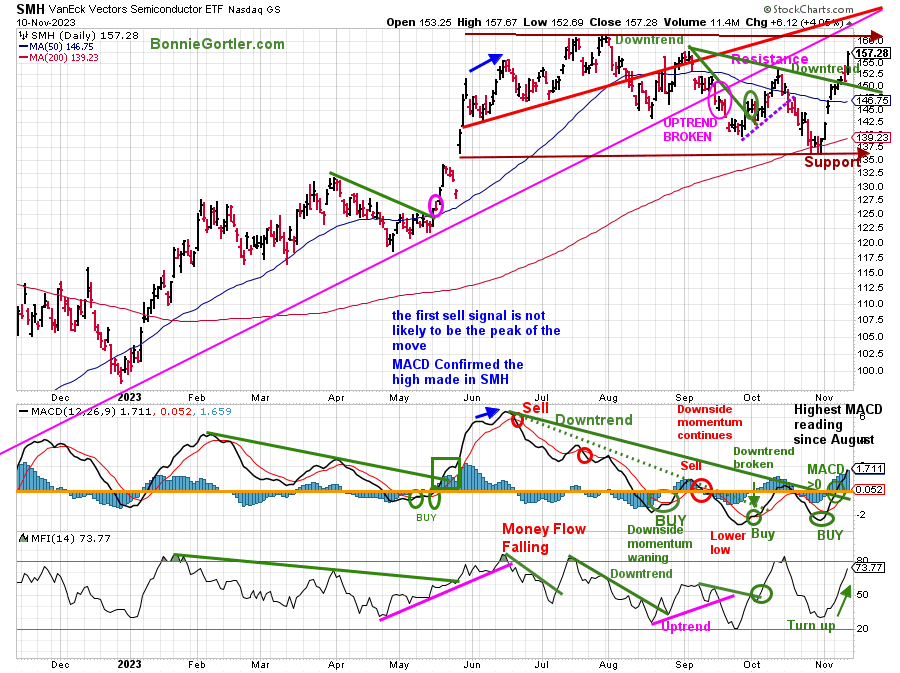

Figure 9: Daily Semiconductors (SMH) (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top chart shows the Daily Semiconductors (SMH) ETF, concentrated mainly in US-based Mega-Cap Semiconductors companies. SMH tends to be a lead indicator for the market when investors are willing to take on increased risk and the opposite when the market is falling.

Semiconductors (SMH) gained +5.20%, back-to-back solid gains showing leadership after breaking the September downtrend and penetrating resistance at 151.00, closing at 157.28.

Support is at 150.00, 145.00, 140.00, and 135.00. Resistance is at 160.00. Two closes above will give higher objectives toward 185.00.

MACD (middle chart) is on a buy and has broken the June downside momentum trendline (green line) at its highest MACD reading since August.

Money Flow (lower chart) continues to rise, confirming the MACD buy and implying strong interest in Semiconductors.

Technology leads

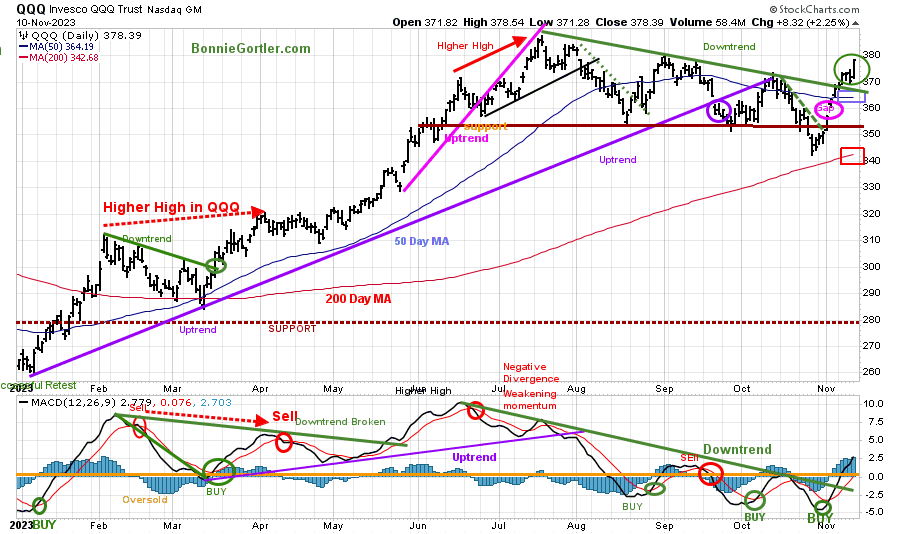

Figure 10: Daily Invesco QQQ Trust (QQQ) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The chart shows the daily Invesco QQQ, an exchange-traded fund based on the Nasdaq 100 Index. QQQ made a low in October 2022 (red circle), followed by a successful retest of the low in early January 2023 and the start of an uptrend.

QQQ had its first positive week in the last four, breaking its 2023 uptrend (purple circle) after a few attempts at the July high.

Last week the Nasdaq 100 (QQQ) broke out to the upside, gaining +2.90%, closing at 378.39, near the high for the week after breaking above resistance at 372.00 and July’s downtrend (green line). QQQ closed above the 50-day Moving Average (blue rectangle) and the 200-day Moving Average (red rectangle), a sign of strength.

Support is 372.00, 365.00, 350.00, and 342.00, with resistance at 380.00, 385.00 and 390.00

The bottom chart, MACD (12, 26, 9), remains on a buy and broke the June momentum downtrend (green line), a sign of strength.

It would be bullish if the QQQ gap (pink circle) remains unfilled this week and QQQ closes above 380.00, forcing more shorts to cover and fueling QQQ to move higher.

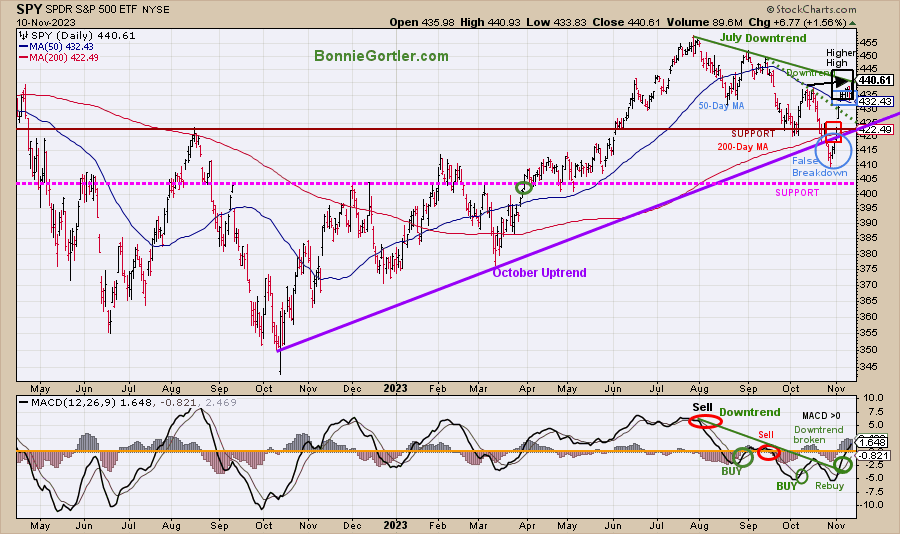

Figure 11: The S&P 500 Index (SPY) Daily (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The S&P 500 (SPY) had a false breakdown (blue circle) in October after being in an uptrend (purple line). Two downtrends were in effect: the September downtrend (green dotted line) broken the previous week and the August (green solid line) downtrend where the SPY closed.

SPY finished higher, for the 9th time in the last ten trading days, closing at 440.61, above 439.00 resistance. SPY was up +1.36% for the week, making its first higher high since July. SPY closed above the 50-day Moving Average (blue rectangle) and above the 200-day Moving Average (red rectangle), a sign of strength.

Resistance is at 446.00, 452.00, and 455.00. Support is at 440.00, 433.00, 425.00, and 415.00.

MACD (bottom chart) is on a buy above 0, rising, and just broke the August momentum downtrend (green line), which is bullish

Higher prices are likely if SPY remains above last week’s low of 433.40.

Summing Up:

Stocks rebounded Friday after selling pressure on Thursday, with Semiconductors and Technology stocks leading. The Nasdaq and S&P 500 showed gains for the second consecutive week, closing near their weekly highs. Although market breadth continues to be unimpressive, the Russell 2000 underperforming the S&P 500, and weakness in the Nasdaq AD-Line, its positive short-term momentum patterns have formed a potential bullish double bottom. With downside momentum slowing, downtrends breaking, and November, the second-best monthly performance historically, give the bulls the benefit of the doubt.

Remember to manage your risk, and your wealth will grow.

Let’s talk investing. You are invited to set up your Free 30-minute Wealth and Well-Being Strategy session by clicking here or emailing me at Bonnie@BonnieGortler.com. I would love to schedule a call and connect with you.

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.