The Market Continues To Climb The Wall Of Worry: Another leg up?

The historically bullish seasonal period for the stock market shifted from positive to negative on 04/31/16. The major averages have been trading sideways, working off an overbought condition from the low in February. The early part of May has been mostly uneventful, unable to generate momentum of any significance in either direction up or down, however this could change soon. On 05/24/16 a broad rally occurred, where all the major averages participated, ignited by good news about housing. The rise was unexpected, the largest gains since early May, however increased volume was missing. In recent trading reading too much into one day’s trading direction, has not proved to be significant.

Our trading models are not as bullish as they were, however they are neutral-positive, therefore no serious decline is expected. Most market breadth indicators for the stock market are more bullish than bearish. Strong market breadth is fuel for the market. When market breadth is very strong, market tops take a longer time to form. Time has passed, improving the short term technical picture, along with the averages not giving up much ground, this is bullish. The stock market continues to be very resilient climbing the wall of worry. As prices have moved within a narrow range, support levels have held.The big question is: Can the market continue to go higher during an unfavorably seasonal period, and when interest rates are expected to be raised at the same time. Market sentiment indicators show that many investors are pessimistic on the market, expecting a decline not looking for the start of another leg up.

Our trading models are not as bullish as they were, however they are neutral-positive, therefore no serious decline is expected. Most market breadth indicators for the stock market are more bullish than bearish. Strong market breadth is fuel for the market. When market breadth is very strong, market tops take a longer time to form. Time has passed, improving the short term technical picture, along with the averages not giving up much ground, this is bullish. The stock market continues to be very resilient climbing the wall of worry. As prices have moved within a narrow range, support levels have held.The big question is: Can the market continue to go higher during an unfavorably seasonal period, and when interest rates are expected to be raised at the same time. Market sentiment indicators show that many investors are pessimistic on the market, expecting a decline not looking for the start of another leg up.

What Are The Charts Saying?

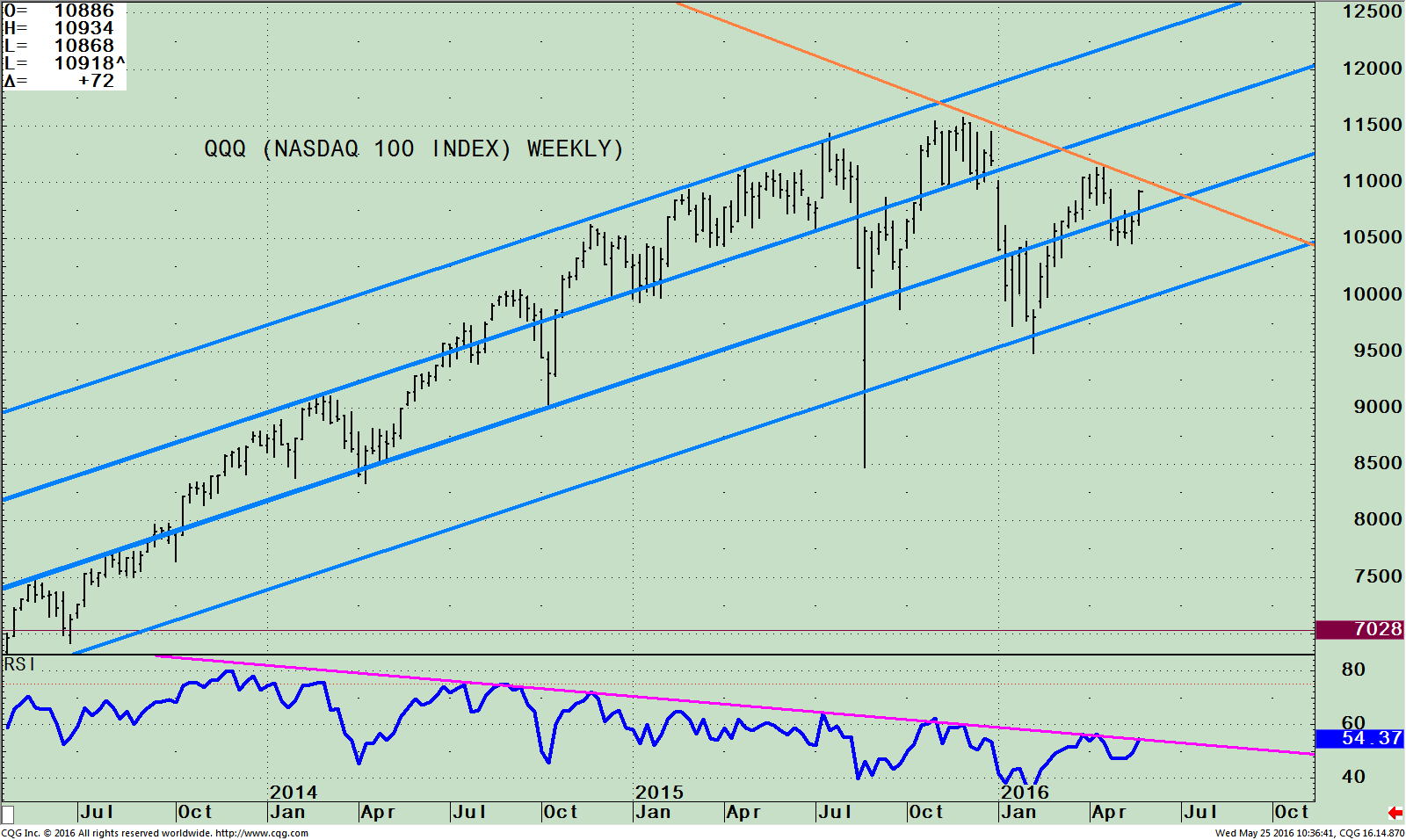

QQQ (Nasdaq 100 Index) Weekly Price and Trend Channels (Top), and RSI 14 (Bottom)

The top part of the chart is the weekly Nasdaq 100 (QQQ), an exchange traded fund (ETF) representing the Nasdaq 100 Index, along with price and trend channels that are acting as support and resistance areas. The QQQ includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq stock market based on market capitalization. As of 05/24/16, Apple, (AAPL) is the largest holding comprising 10.59%, Microsoft Corp (MSFT) 7.96%, Amazon.com, Inc. (AMZN) 6.47%, Facebook, Inc. Class A (FB) 5.27%. Alphabet Inc. Class C (GOOG) 4.66%, and Alphabet Inc. Class A GOOGL 4.19% totaling 39.14%.

The Nasdaq100 (QQQ) is generally riskier than the S&P 500 (SPY). Historically when the QQQ is strong it’s a bullish condition for the entire market, not the case now. The QQQ has been losing momentum not gaining momentum, especially with Apple the largest holding of QQQ, under continuous selling pressure. The Nasdaq 100 QQQ has been unable to penetrate the highs made in August 2015 and is still in a downtrend, (orange line).

Notice the QQQ has traded within the channel (blue lines) since July 2013, except for a one day blip that occurred in August 2015. The QQQ tested the lows falling below the channel line, and now with the latest rise, is above the channel line that was previously acting as resistance. This is a good sign. If the QQQ can break the downtrend, get through resistance at 111.00 on a closing basis for two days, I believe the stops would be triggered and investor selling would turn into more aggressive buying. Next resistance is 115.00, near the old highs followed by 123.00. A break below 104.00 would negate my positive outlook.

The lower portion of the chart shows the Relative Strength Index, a measure of momentum developed by Welles Wilder. RSI is based on the ratio of upward price changes to downward price changes. RSI has formed a rising double bottom a bullish formation. If there is further strength in the QQQ, the down trend from June 2015 would be broken (pink line). This would be a sign indicating that the QQQ is gaining momentum, and investors want to take on more risk and move their money into technology, bullish for the overall market.

Summing Up

Seasonal trends for stocks are negative however market breadth remains strong supporting the overall market. The major averages have been trading sideways, but a change could be taking place now. The Nasdaq has been out of favor by investors, losing momentum for the long term, however could fuel the market higher if it can break through resistance at 111.00. A break below 104.00 would negate my positive outlook and tell the story that the rally from February is nothing more than a bear market rally and lower prices would be ahead.

I would love to hear from you. Please share your thoughts, comments or ask any question you might have. Call me at 1-516-829-6444 or send an email to bgortler@signalert.com.

*******Article in Systems and Forecasts May 26, 2016

Discover the right wealth building attitude…

Download a

Free chapter

of my book

Journey To Wealth

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.