MACD Confirms the Advance: Higher Prices Anticipated

Support levels on the major averages are intact, despite the decline in early March. Technical indicators based on market breadth and volume is in the process of working off its overbought condition from the rise since the election. In addition historical research shows after January and February are strong months; the year has the potential for additional gains. This doesn’t mean a short term decline will not occur, however the odds favor declines could be a buying opportunity.

The optimistic tone of the market has changed somewhat as the expectations of rising rates became a concern for investors. The 10-year Treasury note yields have been rising steadily since the end of February spooking investors. There has been an overall weakening in market breadth indicators that need to be monitored. Our stock market timing models remain neutral-positive indicating a potentially profitable market climate and further gains over the next several weeks.

The overall technical picture of the market remains positive. The cumulative advance decline line of the NYSE advance/decline line confirmed the highs made in February. When market breadth confirms price, usually that suggests the final high has not been made. The Technology sector is acting well. The NASDAQ 100 (QQQ) is not far from its recent all-time high. It’s also bullish that the Nasdaq Composite is leading in relative strength vs the S&P 500, a condition which has historically overall characterized more profitable market climates.

Watch The Strength of Technology:

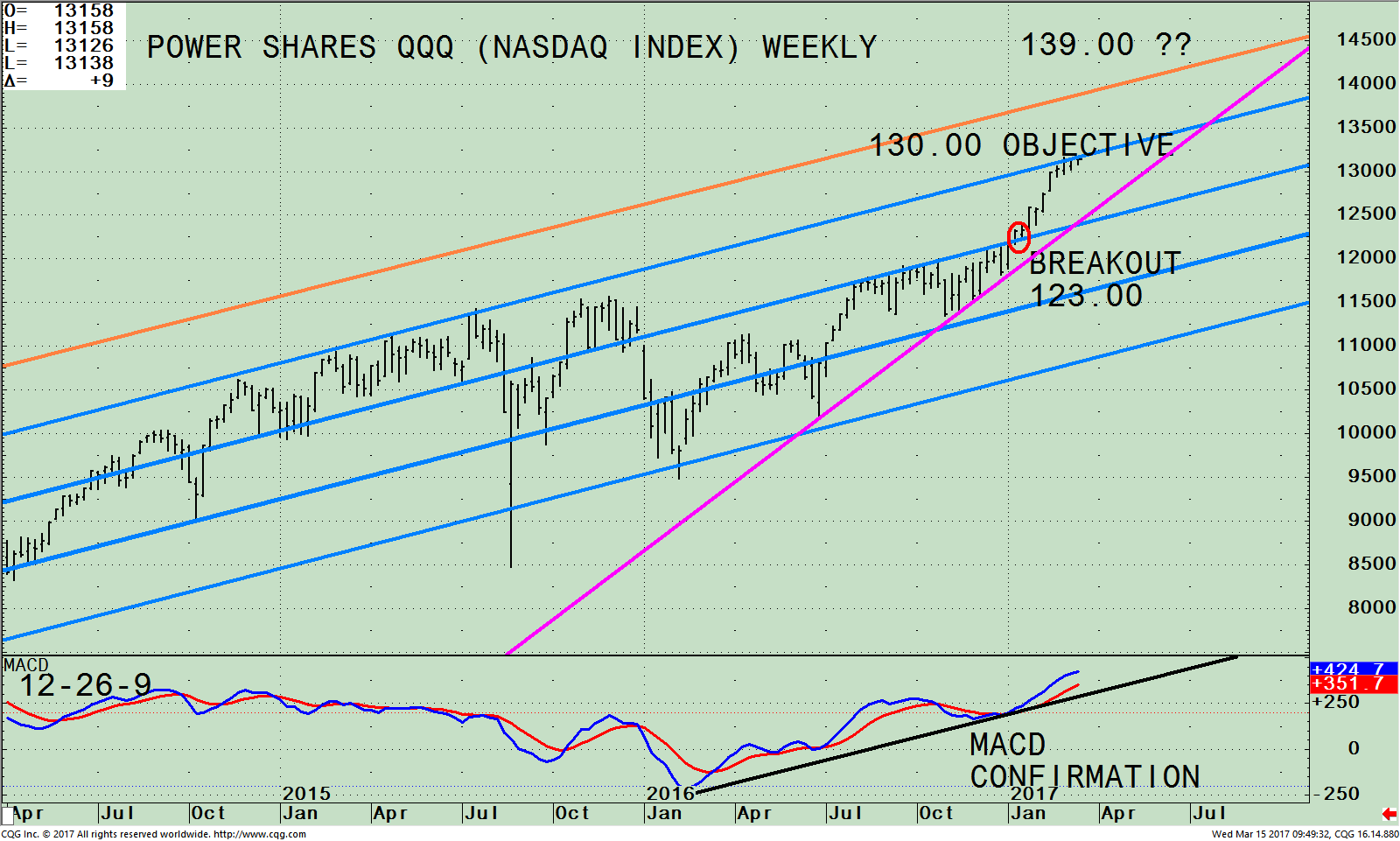

PowerShares QQQ ETF (Nasdaq 100 Index) Weekly Price and Trend Channels (Top), and MACD 12-26-9 (Bottom)

The top part of the chart shows the weekly Power Shares 100 (QQQ), an exchange-traded fund based on the Nasdaq 100 Index and its active trading channels. The QQQ includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq stock market based on market capitalization. As of 03/10/17, Apple, (AAPL) is the largest holding comprising 11.91%, Microsoft Corp (MSFT) 8.11%, Amazon.com, Inc. (AMZN) 6.50%, Facebook, Inc. Class A (FB) 5.22%. Alphabet Inc. Class C (GOOG) 4.67% and Alphabet Inc. Class A (GOOGL) 4.11% totaling 40.52%.

The QQQ broke out at 123.00 (red circle above) on January 6 and has been steadily rising. The QQQ has now slightly penetrated the channel objective at 130.00 (top blue channel line), now trading at 131.30. The intermediate trend is up as long as the QQQ remains above the up trendline line (pink). The next upside target is 139.00. Keep an eye on Apple, (AAPL) the largest holding of QQQ. Apple has moved sideways for 10 days giving up no ground. If Apple continues making new highs, this could be positive for the technology sector over the next several months. If the QQQ falls below 123.00, breaking the up-trend, my bullish outlook would be negated.

The bottom half of the chart is MACD (12, 26, 9) a measure of momentum. Its bullish MACD has confirmed the price high made in QQQ suggesting any weakness in the QQQ most likely would be temporary.

A Breakout in the S&P 500 ETF (SPY) is Possible?

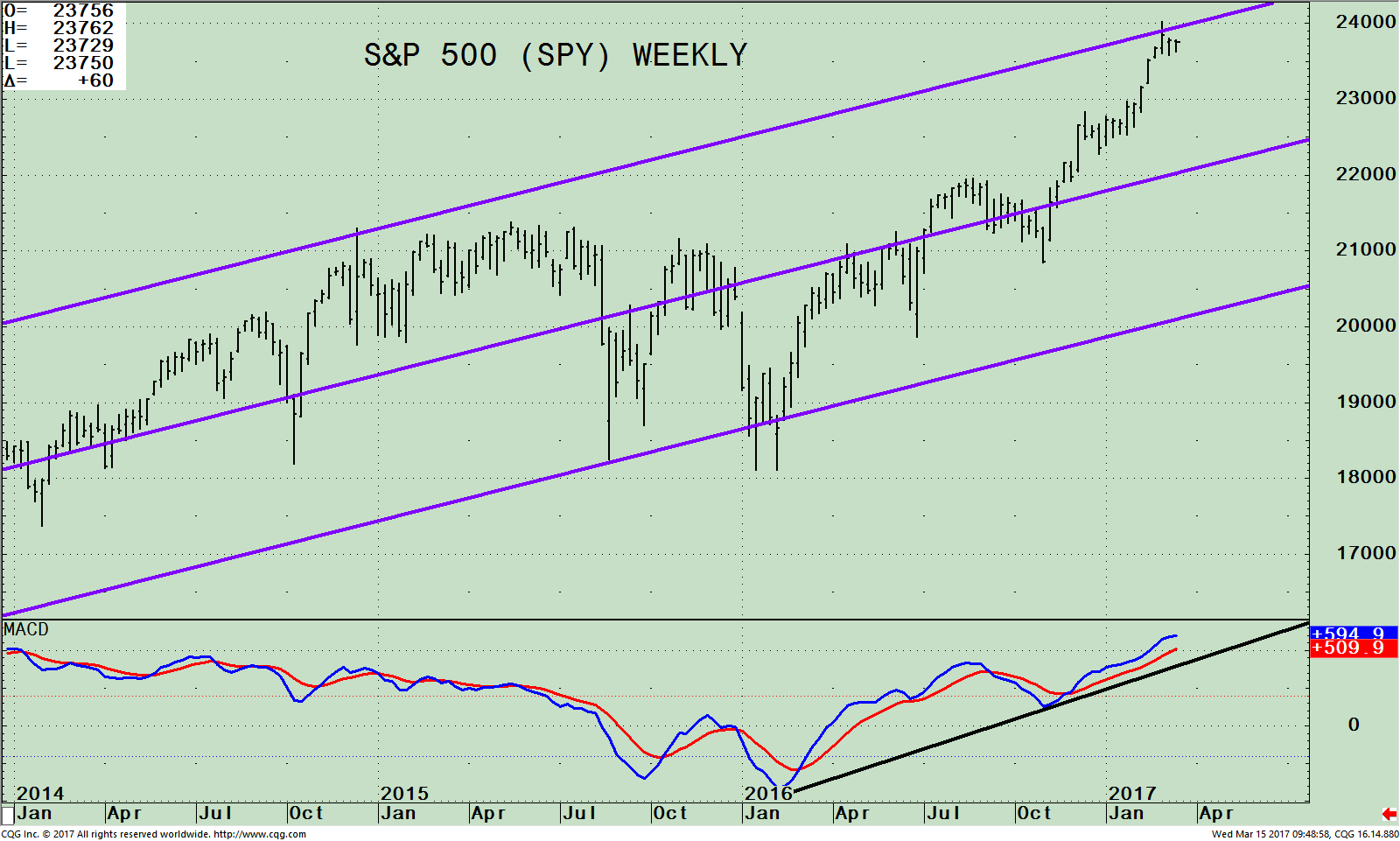

The chart above is the weekly SPDR S&P 500 (SPY) ETF that is comprised of 500 stocks of the largest companies in the U.S. The S&P 500 (SPY) hit its weekly upside channel on March 1st at 240.32 and pulled back. Market breath has weakened however the SPY has not given up much ground over the last two weeks, a bullish sign. If the SPY can get through the old highs, higher projections above 260.00 will be given.

The lower portion of the chart is the 12-26-9 MACD, a measure of momentum. Like the QQQ discussed above, MACD has confirmed the price high in the SPY and is in a clear uptrend. This is the sign of a healthy market. Look for the SPY to at least test the old highs.

Summing Up:

Market breadth has been weak as of late after being very strong for many months. There has been no real thrust on the advancing days to get excited about, however not much ground has been given up either. Market breath indicators have worked off its overbought condition since the election. Our stock market timing models remain neutral-positive indicating a potentially profitable market climate and potential further gains over the next several weeks. MACD over the intermediate term for the Nasdaq 100 (QQQ) and the S&P 500 (SPY) have confirmed the strength of the overall market. Continue to give the benefit of the doubt to the bulls.

I would love to hear from you. Please call me at 516-829-6444 or email at bgortler@signalert.com to share your thoughts or ask me any questions you might have.

If you like this article, then you will love this!

Click here for a free report: Top 10 Investing Tips To More Wealth

*******Article published by Bonnie Gortler in Systems and Forecasts March 15, 2017

Discover the right wealth building attitude…

Download a Free chapter of my book

Journey To Wealth

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.