Joy In Technology Stocks Now. However, Intermediate Patterns Say It Could Be Short Lived and Fizzle

The market remains very resilient. The bulls appear to be in control again after the bears were unable to take the market down. Major averages are only a few percent away from their highs after the recent short term decline. Investors continue to be enamored with technology stocks. Apple is (APPL) leading the way, making new all-time highs this past week. However, intermediate momentum patterns are weakening.

The good news is the market is oversold on a short term basis, suggesting more gains in the early part of the month are a good possibility. However, keep in mind September is not a favorable month historically. Also, intermediate and long term chart patterns are not in favorable position. Many have potential negative divergences that could cause the rally to fizzle if the buyers turn to sellers.

Our models remain overall neutral-positive for the intermediate term (weeks-months). If there is a decline, it should be limited.

Keep an eye on Technology for leadership or trouble ahead.

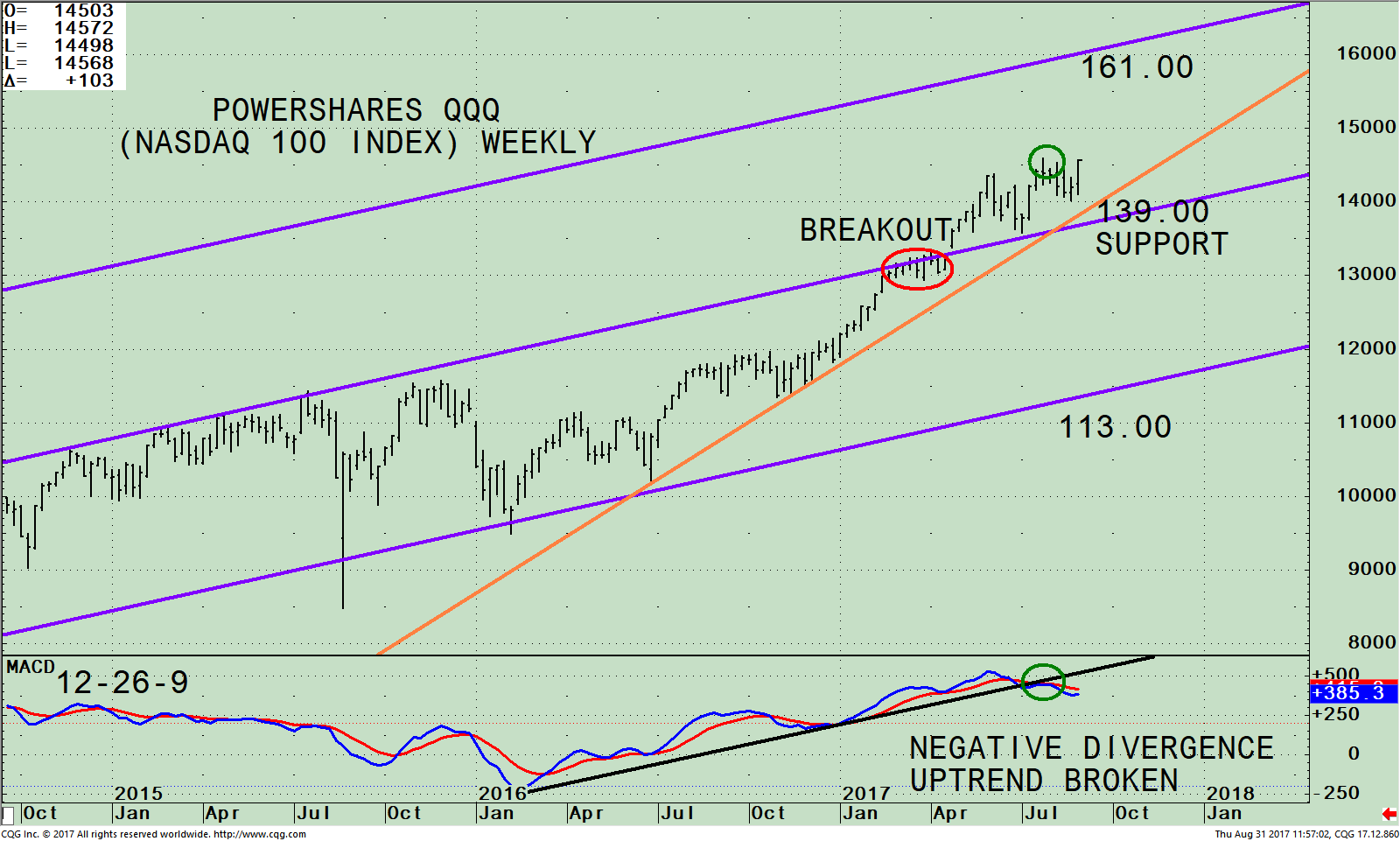

PowerShares QQQ ETF (Nasdaq 100 Index) Weekly Price and Trend Channels (Top), and MACD 12-26-9 (Bottom)

The top part of the chart shows the weekly Power Shares 100 (QQQ), an exchange-traded fund based on the Nasdaq 100 Index and its operative trend channel. The QQQ includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq stock market based on market capitalization. As of 08/30/17, Apple, (AAPL) is the largest holding comprising 12.51%, Microsoft Corp (MSFT) 8.40%, Amazon.com, Inc. (AMZN) 6.80%, Facebook, Inc. Class A (FB) 5.90%, Alphabet Inc. Class C (GOOG) 4.74%, and Alphabet Inc. Class A (GOOGL), 4.13 % totaling 42.48%.

The QQQ breached the middle channel after a 9-week consolidation (red circle) on 04/24/17. Buyers stepped in and the QQQ rallied for several weeks. However, the rally was not strong enough to reach the upper channel. At the present time, the QQQ has successfully pulled back for the second time, testing the breakout from June, as of this writing at 145.48. The intermediate trend remains up as long as the QQQ remains above its trend line (see the orange line). As long as the QQQ remains above key support at 139.00, the QQQ could work its way higher, potentially to the upside channel objective at 161.00.

The bottom half of the chart is MACD (12, 26, 9), a measure of momentum. MACD is giving a different message than price. In June, MACD confirmed the price high suggesting further gains ahead and any decline would be short lived and contained. This is not what MACD is saying now. MACD has given a sell. Notice the clear negative divergence in MACD (green circles). Price made a high that wasn’t confirmed by MACD. The sell might be a bit early, however tops take a longer time to form than bottoms. I recommend keeping an eye on the top holdings in the QQQ over the next several weeks for when and if they start to decline and causing pressure on the QQQ, giving an advanced warning of a trend change.

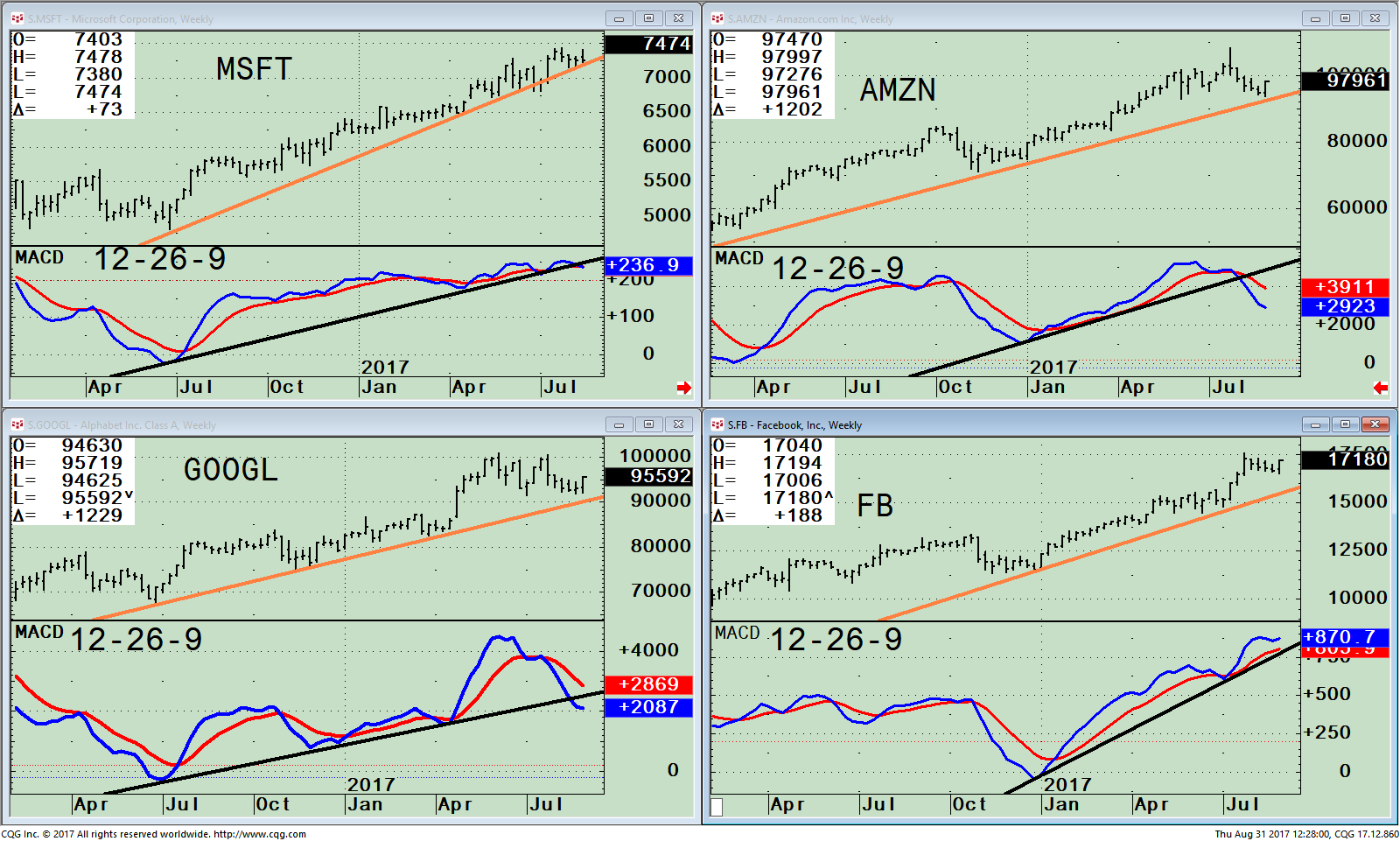

Weekly Price of Microsoft (MSFT), Amazon (AMZN), Alphabet Inc Class A (GOOGL), and Facebook, (FB) and MACD 12-26-9

Microsoft (MSFT), Amazon (AMZN), Alphabet Inc Class A (GOOGL), and Facebook, (FB) are all top holdings of the QQQ, and are in weekly price uptrends (orange line). MACD in all four stocks is overbought. Alphabet Inc A (GOOGL) and Amazon (AMZN) remain in an uptrend based on price similar to the QQQ. Both stocks are on a MACD sell with the uptrend broken, not a favorable pattern. The risk is high at this time. Microsoft (MSFT) is at key price support, MACD has stopped rising, and threatening to break it’s up trend. Facebook, (FB) is under its all-time high and looks to be the strongest of the four stocks. MACD has made higher highs confirming the strength of the stock. As long as these stocks remain firm, the QQQ should continue higher towards the upside objective of 161.00.

Summing Up:

Our models remain overall neutral-positive for the intermediate term which means upside potential remains greater than downside risk. Investors continue to find joy in technology stocks that are leading the latest advance. The intermediate uptrend in the Nasdaq 100 (QQQ) price and four of its top holdings, Microsoft (MSFT), Amazon (AMZN), Alphabet INC A (GOOGL), and Facebook, (FB) are all intact which is bullish. As long as the QQQ remains above its key support of 139.00, the QQQ could work its way higher to the upside channel objective at 161.00. If the QQQ falls below 139.00 on a weekly close, the risk would increase, as the intermediate trend would change from up to down implying weakness could occur, towards the lower channel at 113.00. The rally has come to life. However, intermediate momentum patterns say it could be short lived and fizzle.

I would love to hear from you. Please call me at 516-829-6444 or email at bgortler@signalert.com to share your thoughts or ask me any questions you might have.

*******Article published by Bonnie Gortler in Systems and Forecasts September 01, 2017

If you like this article, then you will love this!

Free Instant Access to Grow

Your Wealth and Well-Being E-Book HERE

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.