Intermediate Momentum Patterns Warn of Possible Decline Ahead

“Money is hard to earn and easy to lose. Guard yours with care.” -Brian Tracy

During its most recent meeting the Federal Reserve announced that it still plans to most likely raise interest rates in the second half of this year, but investors were hoping they would delay raising rates until even later. Since rate hikes are normally not bullish, investors are more nervous and have been investing in the defensive areas of the market. The S&P 500 (SPY) declined in January but has reversed sharply to the upside to begin February. The S&P 500 (SPY) has been trading within a trading range, testing its lows already four times this year. On February 2, the December 16 low of 197.60 was successfully tested. Now this level is even more of a signifi cant support area that needs to hold going forward.

During its most recent meeting the Federal Reserve announced that it still plans to most likely raise interest rates in the second half of this year, but investors were hoping they would delay raising rates until even later. Since rate hikes are normally not bullish, investors are more nervous and have been investing in the defensive areas of the market. The S&P 500 (SPY) declined in January but has reversed sharply to the upside to begin February. The S&P 500 (SPY) has been trading within a trading range, testing its lows already four times this year. On February 2, the December 16 low of 197.60 was successfully tested. Now this level is even more of a signifi cant support area that needs to hold going forward.

Big intraday volatility is the theme for 2015. Large swings up and down have occurred during many trading sessions and we are only in the first week of February. This phenomenon is very different than the quiet market that we had for most of 2014 that sometimes lulled you to sleep, and gave a feeling of comfort and safety. Traders appear to be more optimistic and have moved into more aggressive areas with more volatility, commodities such as oil, gold, and silver.

Emerging markets have stabilized helping the foreign markets. The iShares S&P Europe 350 Index (IEV) ETF is acting better, gaining in relative strength, supporting the US market. Europe (IEV) has broken the weekly downtrend mentioned in the January 23 2015 newsletter, bullish for the US market if IEV holds from here and doesn’t turn back down. A possible change in sector leadership could be taking place. Traders don’t seem as high on healthcare, utilities, and staples.

Even with the successful test of the lows that we have had, and the strong recent rally to the upside I remain somewhat concerned with how far the advance will go. The technical patterns on the intermediate and long term charts of the US major averages have had large price gains over the past years, remain extended and momentum is weakening, not a good sign.

What Are The Charts Saying Now?

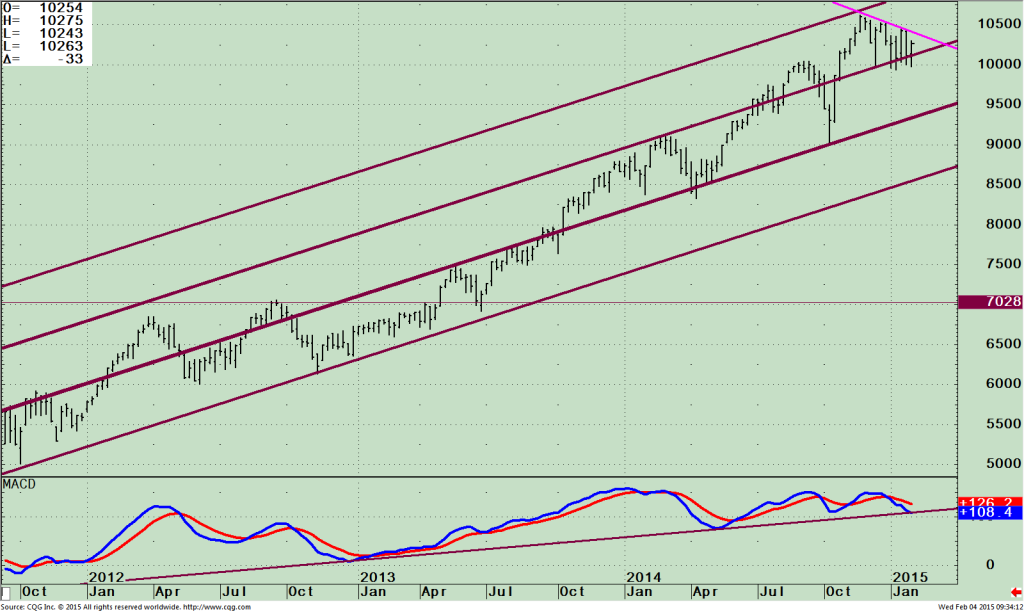

Power Shares QQQ Weekly price and trend channels (Top), and 12-26-9 week MACD (Bottom)

The top part of the chart is the Power Shares QQQ Trust, an exchange traded fund (ETF) based on the Nasdaq 100 Index. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. The top holdings as of 02/03/2015 are Apple (AAPL) 14.45%, Microsoft (MSFT) 7.12% Google Inc. (GOOG) 3.73%, Amazon AMZN 3.5% and Facebook Inc. (FB) 3.4%. Apple, the largest holding, has been consistently helping the index trading near its highs, while the other holdings have had wide up and down swings.

The top portion of the chart shows how the QQQ made its high stopping at the top of the channel on 11/26/14, at 106.24. Each subsequent rally attempt has not been able to penetrate this high. Instead, QQQ has a made a series of lower highs to from a down trend, not a good sign. QQQ would have to trade above 105.00 to break the weekly down trend.

The lower portion of the chart is MACD, a momentum oscillator. The oscillator is trading above 0, but falling, which shows weakening momentum. The chart also shows a negative divergence in place, which is potentially bearish. (QQQ made a new high in November, but the November peak in MACD was lower than its late-August peak.) On each pullback, QQQ held its ground near the previous lows before prices rebounded. The uptrend in MACD from January 2013 is threatening to be violated to the downside. If the trend line is violated then I would expect further weakness ahead. So far, we have not seen any violation. If the highs aren’t taken out on this latest rally attempt and prices fall back down and take out the lows of January 2015 at 99.36 then I expect the QQQ to move toward the lower channel 93.

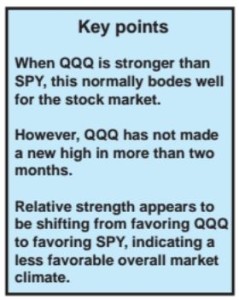

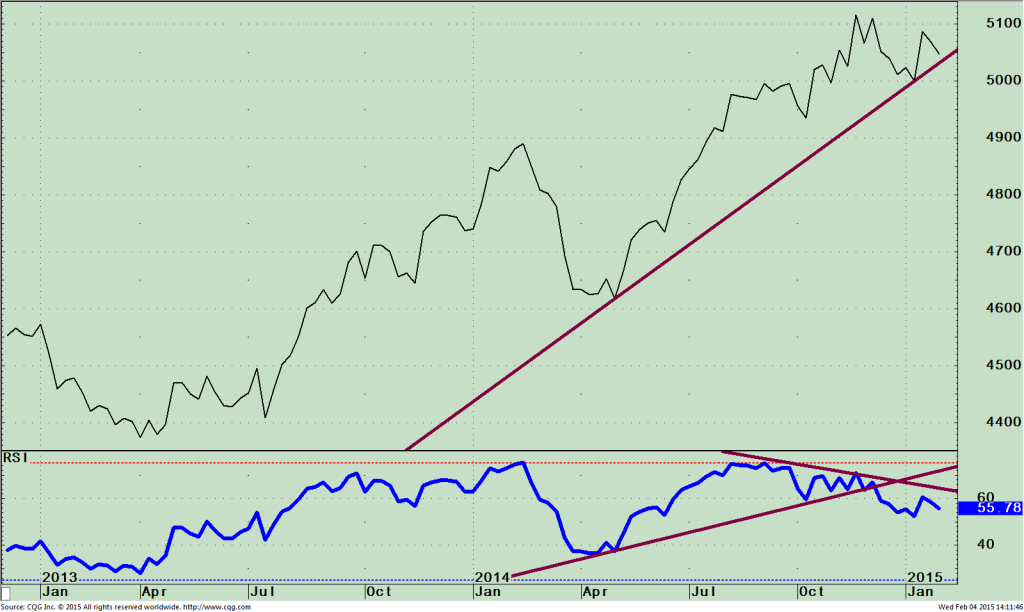

Weekly QQQ/SPY Ratio (Top) RSI of QQQ/SPY Ratio (Bottom)

Notice in the top chart the ratio peaked in October 2014, followed by another rally attempt which failed to take out the high. In January the

Notice in the top chart the ratio peaked in October 2014, followed by another rally attempt which failed to take out the high. In January the

QQQ/SPY ratio once again showed some strength, but didn’t generate enough momentum to make a new high.

When QQQ is stronger than SPY, this normally bodes well for the stock market. This was the case for most of 2014 when the line was rising. Now the QQQ/ SPY ratio has turned down and is also threatening to break the uptrend from April 2014 which would change the trend and not be bullish for the market.

The RSI of the QQQ/SPY Ratio (lower chart) is also looking worrisome. The uptrend from April 2014 has already been violated to the downside in 2014 and momentum continues to weaken, not a good sign. There is a good possibility that the high in QQQ/SPY has been made and that the overall leadership has changed to now favor SPY over QQQ.

Just To Sum Up.

Big intraday volatility is happening every day and expected to continue. The international sector appears more stable with Europe, my favorite sector breaking its weekly downtrend supporting the overall US market for the time being. The US major averages have a stalled near their upper ranges and have made slight lows near the bottom of their range for the past few months. There are conflicting signals with our models bullish, but charts imply increased risk. It would be bullish if the QQQ trades above 105.00 which would break the weekly down trend and bearish suggesting a further decline if the recent low of 99.36 is violated. Review your portfolio and make sure that you are comfortable with your portfolio if the recent lows are violated and a decline was to start sooner rather than later on this year.

I invite you to share your insights by calling me at 1-844-829-6229 or Email me at bgortler@signalert.com with your questions or comments.