Bonnie’s Market Update 6/7/24

Bonnie’s Market Update 6/7/24

It was a winning week, but concerning that only five out of the eleven S&P SPDR sectors finished higher. Technology (XLK) and HealthCare (XLV) were the strongest, while Energy (XLE) and Utilities (XLU) were the weakest. The SPDR S&P 500 ETF Trust (SPY) gained +1.25%.

S&P SPDR Sector ETFs Performance Summary 5/31/24-6/07/24

Source: Stockcharts.com

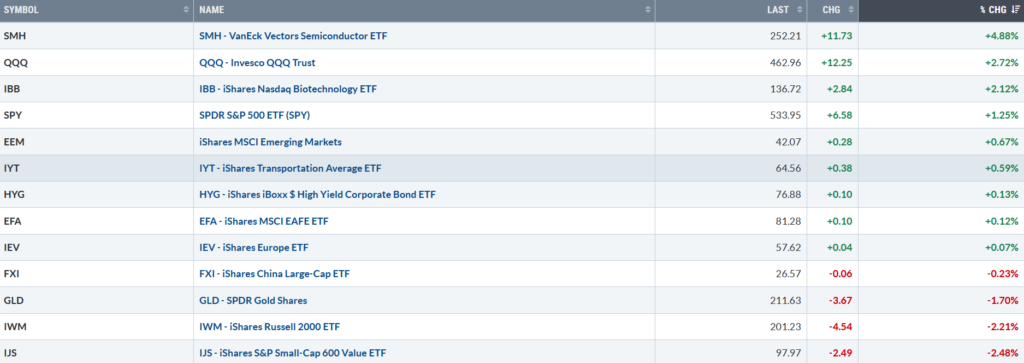

Figure 2: Bonnie’s ETFs Watch List Performance Summary 5/31/24-6/07/24

Source: Stockcharts.com

Semiconductors and Technology led the market higher last week. Gold lost its luster, reversing sharply lower, with the most of the loss on Friday. Small-cap growth and Value remain weak, continuing to underperform.

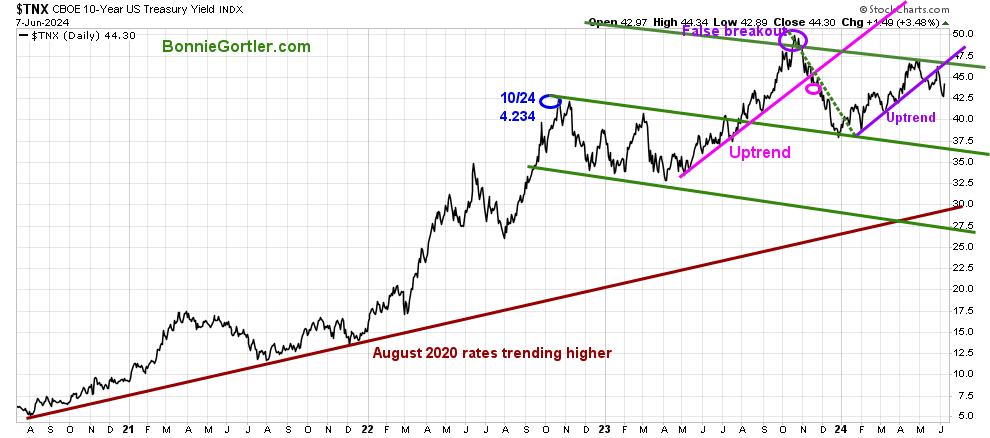

Figure 3: UST 10YR Bond Yields Daily

Source: Stockcharts.com

The 10-year U.S. Treasury fell last week, closing at 4.430%, but rose Friday after the May payrolls report. Yields trending down would likely be positive for U.S. Equities. On the other hand, yields trending higher and closing above 4.75% could fuel selling pressure in U.S. Equities.

The major market averages all rose last week. The Dow gained +0.29%, the S&P 500 gained +1.32%, and the Nasdaq was up +2.38%. The Russell 2000 Index continues to lag, falling -2.10%.

Market Breadth is Weakening

Fewer Stocks Participating in the Rally

Weekly market breadth was negative on the New York Stock Exchange Index (NYSE) and for the Nasdaq. The NYSE had 1115 advances and 1777 declines, with 264 new highs and 114 new lows. There were 1756 advances and 2852 declines on the Nasdaq, with 285 new highs and 354 new lows.

Are you interested in learning more about investing in the stock market? Discover how to implement a powerful wealth-building mindset and simple, reliable strategies to help you grow your wealth in my eCourse Wealth Through Investing Made Simple. Learn more here.

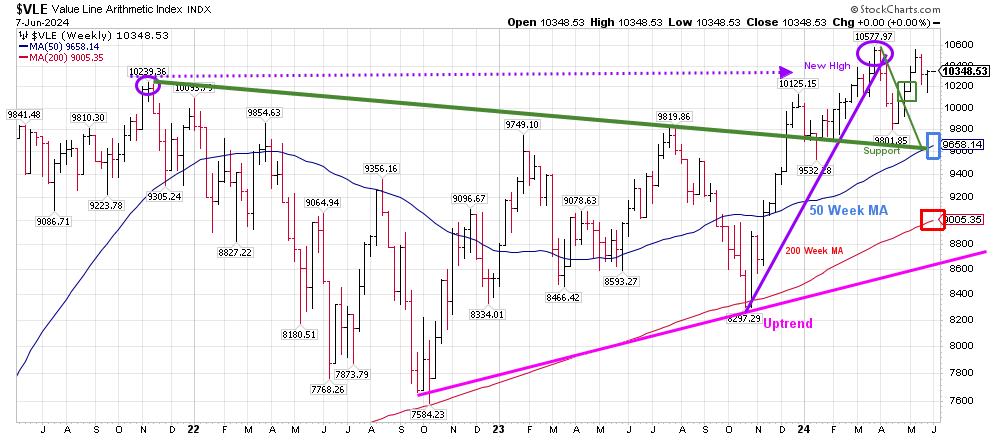

Figure 4: Weekly Value Line Arithmetic Average

Source: Stockcharts.com (Chart through 5/31/24)

The top chart is the weekly Chart of the Value Line Arithmetic Index ($VLE), which includes approximately 1700 stocks. The longer-term uptrend from October 2022 (pink line) remains.

VLE fell by -1.56%, closing at 10186.78, yet to take out the March high of 10577.97.

VLE closed above the 50-week MA (blue rectangle) and 200-week MA, which is positive. On the other hand, failure to take out the high within a few weeks would be a warning sign of a limited, not a broad-based, rally in the future.

Support is 10000, 9600, 8900, and 8700. Resistance is at 10400 and 10600.

The odds of further upside in the short term will increase if VLE closes above resistance at 10400. On the other hand, a weekly close below the first support of 10000 would be a short-term negative.

Are you interested in learning more about the stock market? Learn how to implement a powerful wealth-building mindset and simple, reliable strategies to help you grow your wealth in my eCourse Wealth Through Investing Made Simple. Learn more here.

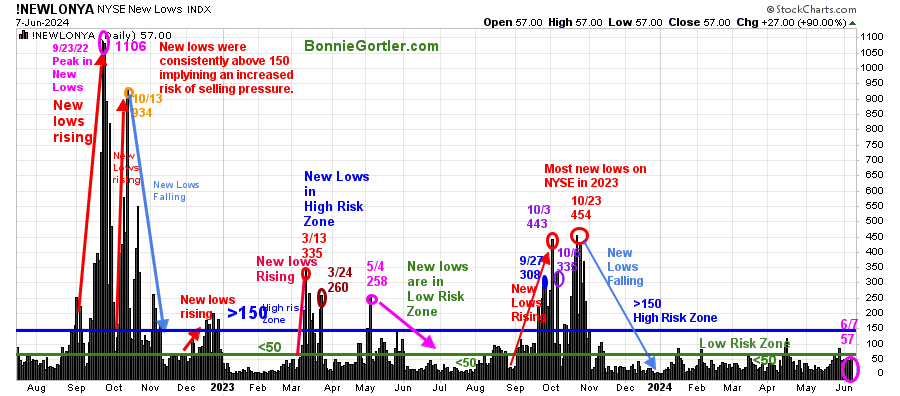

Figure 5: New York Stock Exchange (NYSE) New Lows

Source: Stockcharts.com

Watching New Lows on the New York Stock Exchange is a simple technical tool that helps increase awareness of the direction of an immediate trend.

For most of 2022, new lows warned of a potential sharp pullback, high volatility, and “panic selling,” closing above 150. The peak reading of New Lows in 2022 was on 9/23 at 1106, not exceeded in 2023.

In 2024, New Lows have stayed below 150, and a good part of the year below 50, a sign of a healthy market.

Last week, New Lows on the NYSE closed at 57 (pink circle), in a low-risk zone. If new lows fall between 25 and 50, it will be positive in the short term. On the other hand, an increase above 150 would be a warning sign of a market correction.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

Small Caps Continue to Weaken

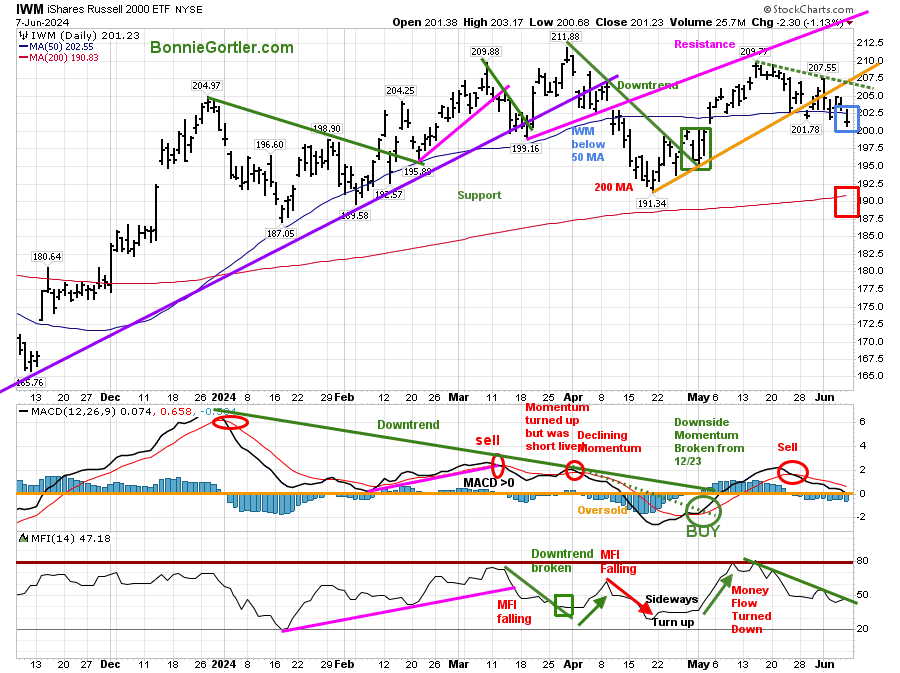

Figure 6: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle and Money Flow (Bottom)

Source: Stockcharts.com

The top Chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue rectangle) and 200-Day Moving Average (MA) (red rectangle) that traders watch and use to define trends.

IWM peaked in March and fell below the 50-day MA in early April before reversing higher in May. However, IWM could not make a new high and turned down, and it is now in a downtrend (green dotted line).

IWM closed at 201.23, falling -2.21%, weaker than the S&P 500, and closed below the 50-day MA, a sign of underlying weakness. Support is at 200.00 and 191.00. Resistance is at 203.00, 208.00, and 215.50.

MACD (middle chart) remains on a sell, falling with weakening momentum.

Money flow (lower chart) continues in a downtrend. However, a light turn-up on Friday gives the Bulls some hope.

The odds of IWM testing the high will increase if IWM breaks the downtrend (green dotted line) and closes on 6/14 above last week’s weekly high of 203.17. On the other hand, a weekly close below 200.68 would imply more weakness in the future.

Semiconductors and Technology Continue Higher

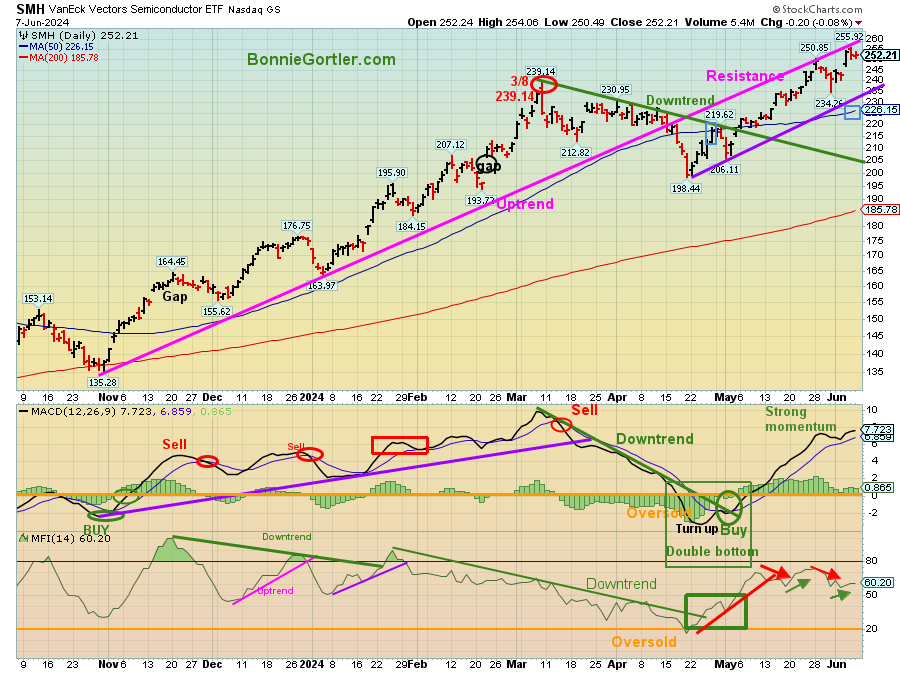

Figure 7: Daily Semiconductors (SMH) (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top chart shows the Daily Semiconductors (SMH) ETF, concentrated mainly in US-based Mega-Cap Semiconductor companies. SMH tends to be a leading indicator for the market when investors are willing to take on increased risk, and the opposite is true when the market is falling.

The Semiconductor ETF (SMH) powered ahead, closing at 252.21, gaining +4.88%, as NVIDIA, the top holding of almost 25%, was up +10.27% for the week before its 10:1 stock split.

SMH remains well above the 50-day (blue rectangle) Moving Average, a sign of underlying strength. However, be alert to a potential double top in MACD if SMH weakens and momentum turns down.

Support is 246.00 (old resistance), 235.00, 223.00, and 205.00. The upside objective of 320.00 remains (see the weekly chart below).

MACD (middle chart) remains on its buy, rising above 0, and has had strong momentum.

Money Flow Index (MFI), lower chart) has been whipsawing in May under the overbought level of 80 (red and green arrows). In June, Money Flow is rising.

Further strength in SMH is positive for the broad market.

Figure 8: Weekly Semiconductors (SMH) (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The Semiconductors (SMH have broken out above the intermediate channel (green circle). The upside objective is 320.00. A weekly close below 223.00 would negate the upside objective and break the weekly uptrend.

MACD, a measure of momentum, remains on a sell but is rising as SMH had another leg higher. Be alert that if a resell occurs without MACD, a higher high (negative divergence) will increase the odds of the rally slowing down and coming to an end.

If you would like to talk to me and go deeper into charts, email me at Bonnie@BonnieGortler.com

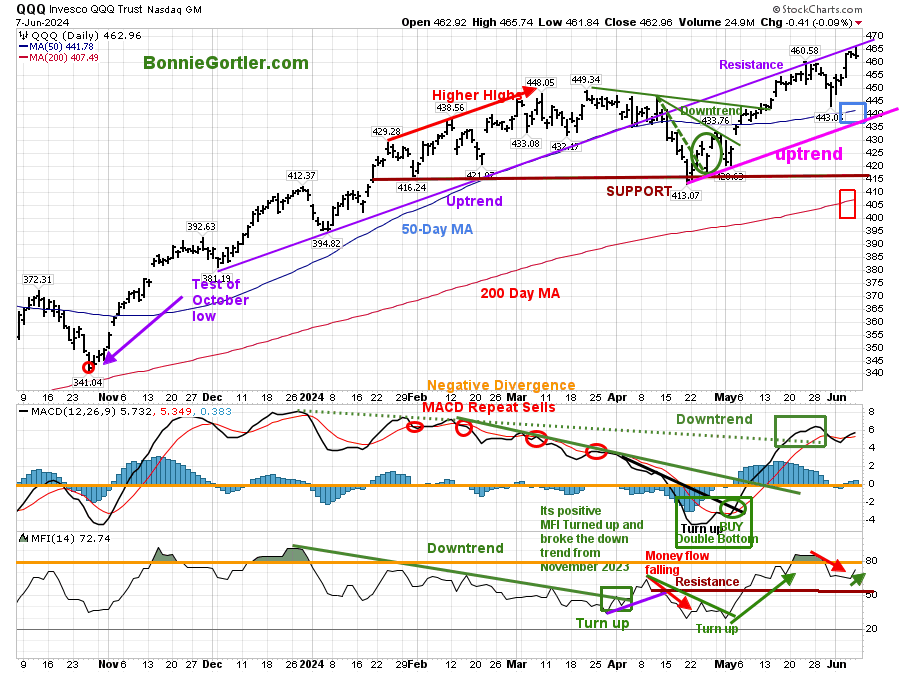

Figure 9: Daily Invesco QQQ Trust (QQQ) Price (Top) and 12-26-9 MACD (Bottom) and Money Flow (Bottom)

Source: Stockcharts.com

The Chart shows the daily Invesco QQQ, an exchange-traded fund based on the Nasdaq 100 Index. QQQ made a low in October 2023 (red circle), followed by an uptrend at the start of 2024. QQQ broke the 50-day MA in April 2024 but held support and started a new uptrend, which remains in effect.

Nasdaq 100 (QQQ) rose +2.72 % last week, closing at 462.96, remaining above the 50-day MA (blue rectangle) and the 200-day MA (red rectangle).

Support is at 455.00, 440.00, 430.00, and 410.00,. Resistance is at 465.00. The intermediate-term objective is 520.00 (chart not shown). A weekly close below 410 would negate the upside objective.

The bottom chart, MACD (12, 26, 9), remains on a buy, above 0, rising, and broke the December downtrend (green rectangle), which is positive. However, be alert to a potential negative divergence and double top if momentum turns down.

Money flow (lower chart) turned up in April, breaking the downtrend. There was a brief turndown in May, and then it turned up, hitting 80 (orange line) before pulling back. As long as it stays above 50, I view MFI as positive.

In Sum:

QQQ has had a solid rally, beginning from an oversold condition to making a new all-time high, helped by Apple no longer lagging other Technology stocks and being near its high of the year before its Worldwide Developers Conference on Monday, June 10. I would like to see QQQ remain above 455.00, implying potential further gains towards 520.00, the intermediate upside target.

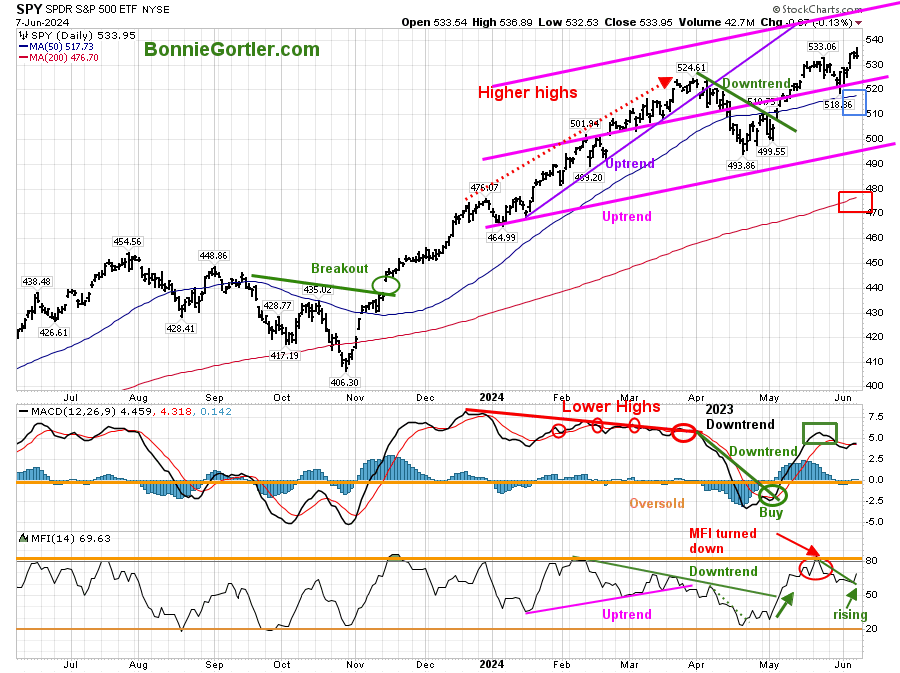

Figure 10: The S&P 500 Index (SPY) Daily (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The SPY April downtrend (green line) broke in early May, shifting the short-term trend to up.

SPY closed at 533.95, up +1.25%, remaining above the 50-day Moving Average (blue rectangle) and the 200-day Moving Average (red rectangle).

Support is at 522.00, 515.00, 493.00 and 480.00. Resistance is at 533.00, with an upside potential objective of 550.00.

MACD (middle chart) is on a sell above 0, rising.

Money flow (bottom chart) accelerated higher after breaking the February downtrend (green line), peaked above 80 (orange circle), and fell for much of May but turned up last week.

Two closes above 536.89 would imply the SPY rising towards the 550.00 short-term objective.

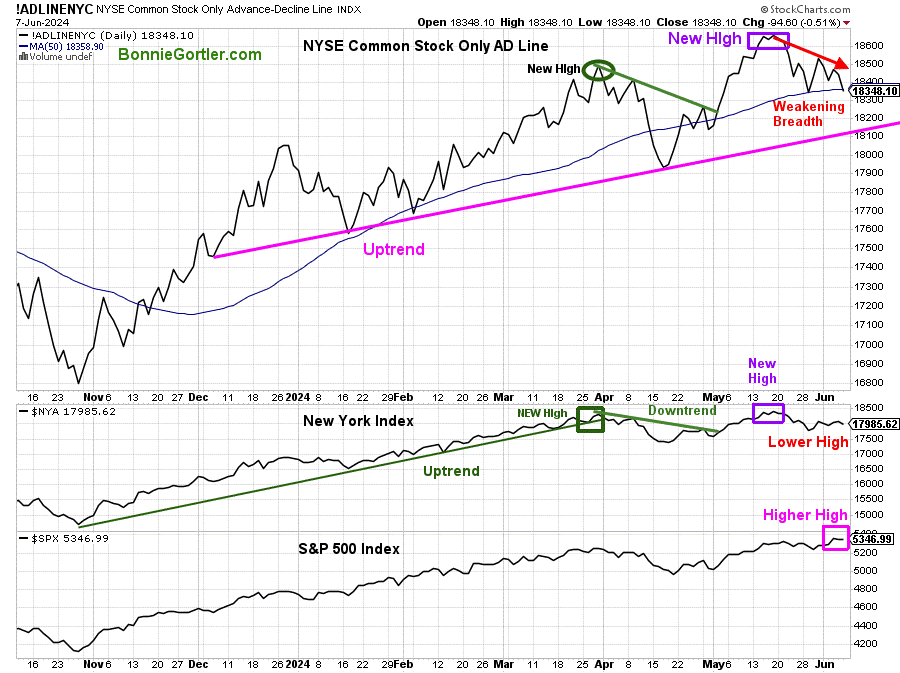

NYSE Tape Action is concerning as the S&P 500 makes a New High

Figure 11: Daily NYSE Common Stock Only Advance-Decline Line (Top) New York Index (NYA) Middle and S&P 500 Index (Bottom)

The Top chart is the Daily NYSE AD line (top chart), which includes only common stocks. Market breadth is weakening. Notice that no new high was made on the recent rally in the NYSE Common Stock AD line as it did in May.

The New York Index (middle chart) made a New High in May (purple rectangle) but now has a pattern of lower highs as the S&P 500 Index (lower chart) made a higher high.

Summing Up:

Although Semiconductors and Technology stocks are leading the major averages higher, market breadth is narrowing with fewer sectors participating in the rally. The weakening momentum in the Russell 2000 is disturbing and worth watching, and if it continues to trend lower, it will be harder to make money. Review your portfolio to ensure you have an exit plan if support levels break, momentum turns down, and the selling intensifies quickly.

Remember to manage your risk, and your wealth will grow.

Let’s talk about investing together. You are invited to schedule your Free 30-minute consultation by signing up here or emailing me at Bonnie@BonnieGortler.com. I would love to schedule a call and connect with you.

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.