Bonnie’s Market Update 2/7/25

Bonnie’s Market Update 2/7/25

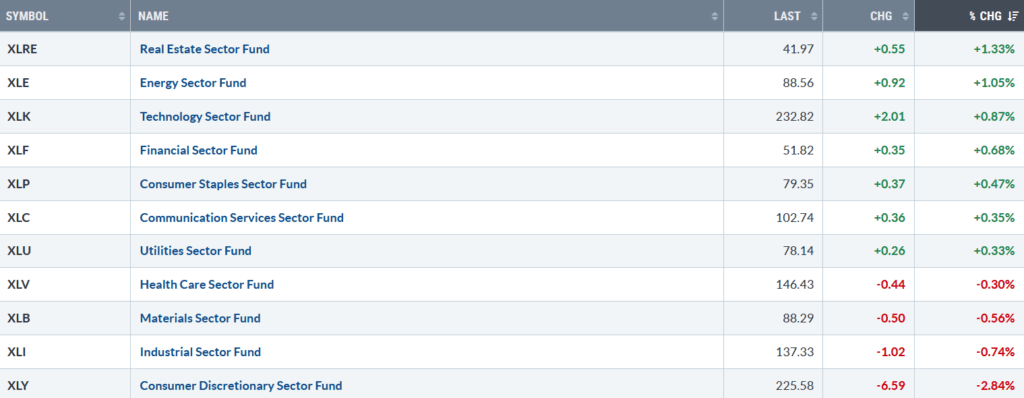

The S&P 500, Dow, and Nasdaq were all lower last week. Seven of the eleven S&P SPDR sectors were higher. Real Estate (XLRE) and Energy were the best sectors, while Industrials (XLI) and Consumer Discretionary (XLY) were the weakest. The SPDR S&P 500 ETF Trust (SPY) fell -0.17%.

S&P SPDR Sector ETFs Performance Summary 1/31/25 – 2/7/25

Source: Stockcharts.com

Figure 2: Bonnie’s ETFs Watch List Performance Summary 1/31/25 – 2/7/25

Source: Stockcharts.com

China and Gold led. Global markets are performing better and could strengthen further if the dollar weakens.

You can explore this week’s market charts and more HERE.

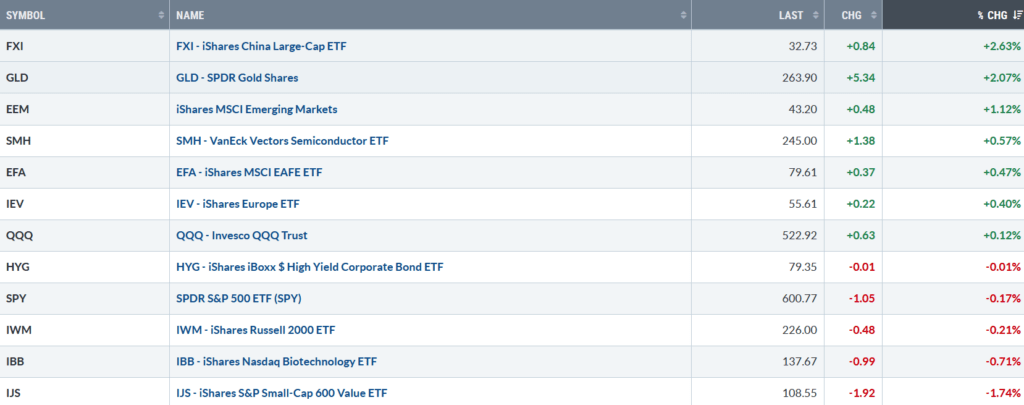

Keep an Eye on NYSE New Lows

Figure 3: NYSE New Lows

Source: Stockcharts.com

New Lows on the NYSE rose in December 2024, with a high of 259, then briefly contracted before peaking at 286 (purple circle) on 1/13/25, and then fallen into a low-risk zone for the last few weeks.

Friday, New lows closed at 80 (pink circle). Continue to watch New Lows to see if New Lows will begin to expand above 150, a sign of increased risk weakness ahead.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

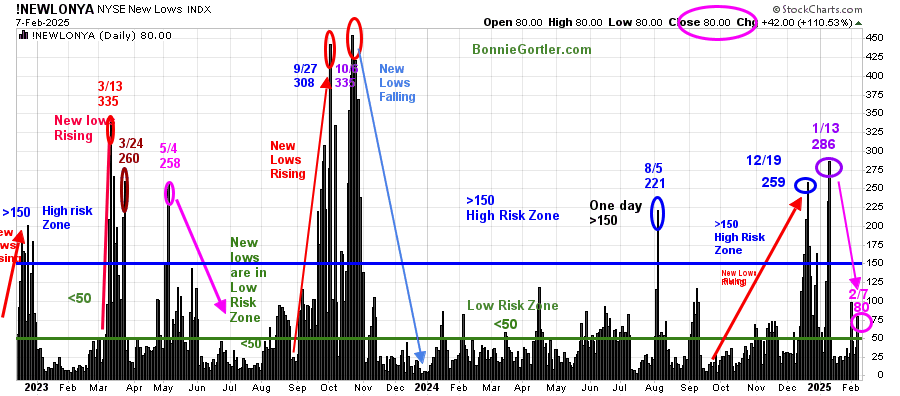

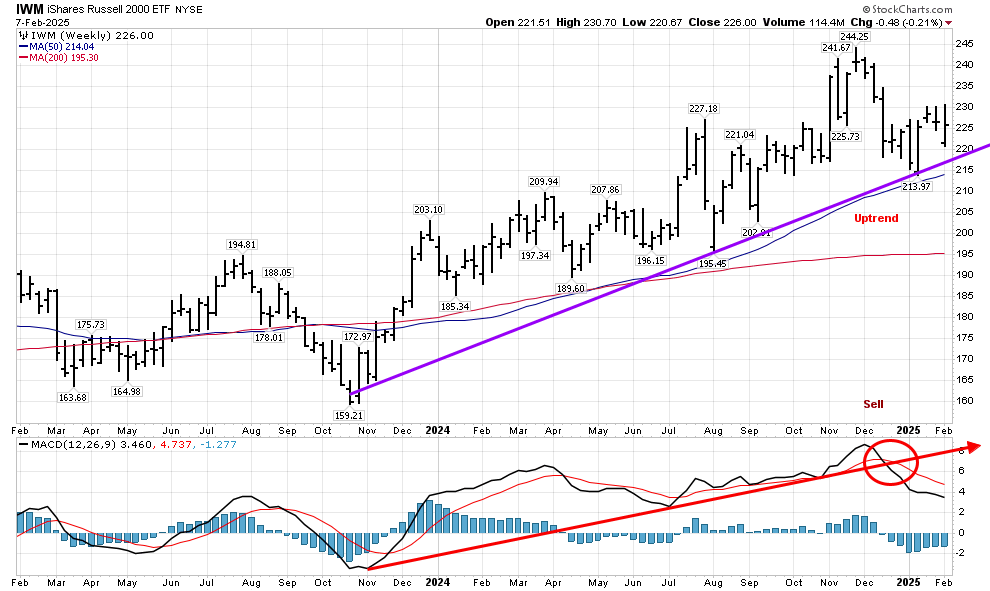

Watch the strength or lack of strength of the Russell 2000

Figure 4: Weekly iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The Weekly iShares Russell 2000 Index ETF (IWM) did not experience selling pressure last week, down only -0.21%.

It’s positive that the IWM intermediate trend from November 2023 (purple line) remains intact. However, it is worrisome that the momentum uptrend from November 2023 (red line) broke, and MACD remains on a sell.

Sum Up:

Earning season continues. Intermediate momentum patterns show declining momentum, which bears watching. If selling pressure on Technology and Semiconductor stocks and the underperformance of small-cap stocks on poor market breadth, the risk of a more significant pullback increases.

If you want to discuss the charts further and get to know each other better, reply to this email, or if you prefer, you can go directly to my calendar to schedule a time. Click Here:

If you like this market update, you will love my free Charting Charting Master Class. Learn more HERE.