Bonnie’s Market Update 12/27/24

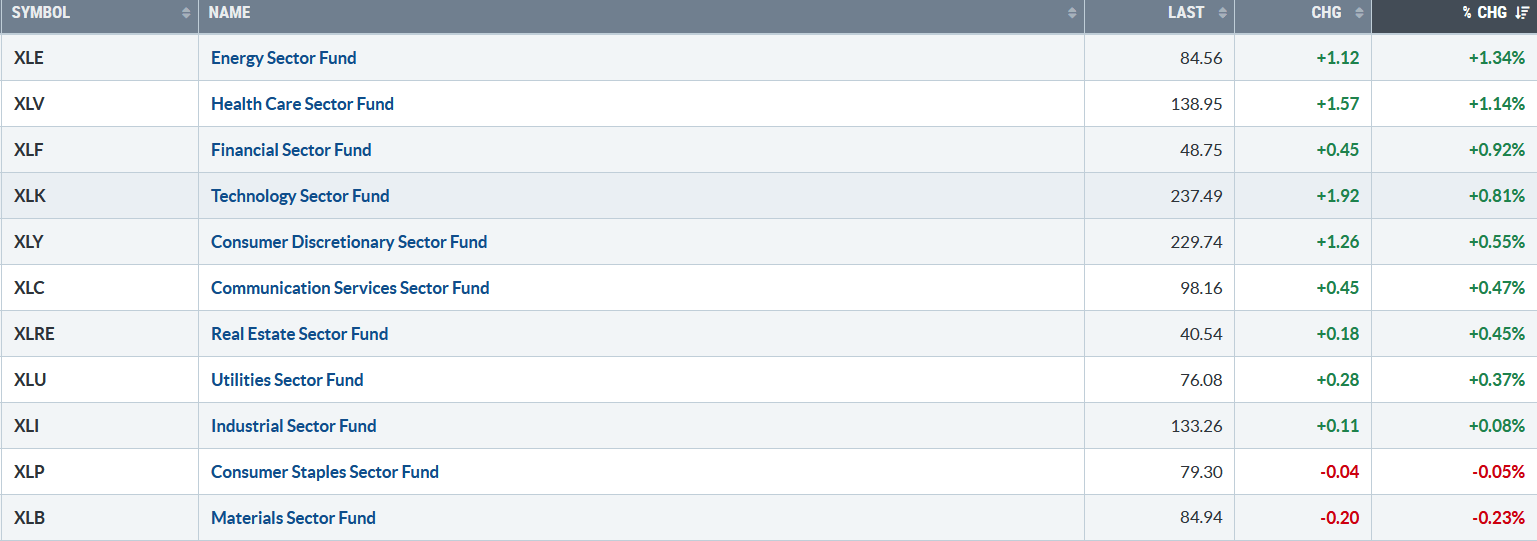

A sluggish end in a shortened week in the major averages. Nine of the eleven S&P SPDR sectors were higher last week. Energy (XLE) and Health Care (XLV) were the leading sectors, while Consumer Staples (XLP) and Materials (XLB) were the weakest sectors. The SPDR S&P 500 ETF Trust (SPY) rose +0.67%.

S&P SPDR Sector ETFs Performance Summary 12/20/24 – 12/27/24

Source: Stockcharts.com

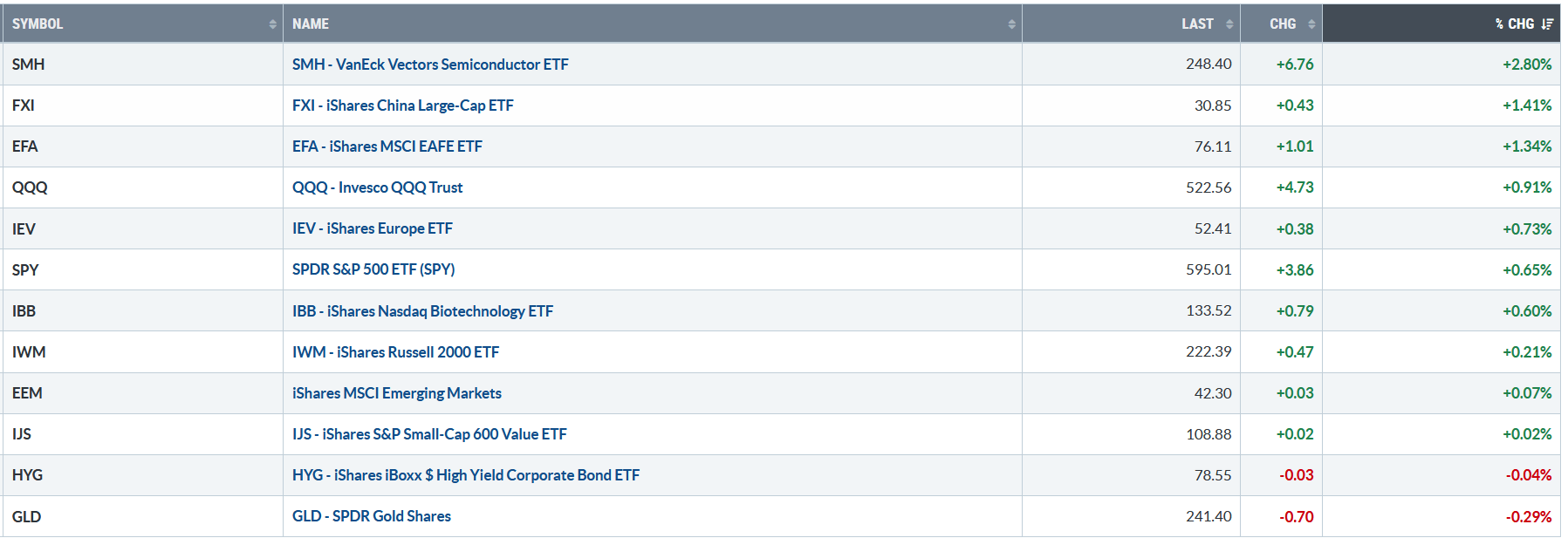

Figure 2: Bonnie’s ETFs Watch List Performance Summary 12/20/24 – 12/27/24

Source: Stockcharts.com

Semiconductors, China, and Technology, led, while Small Cap Growth, Small Cap Value, and Gold lagged underperforming the S&P 500 Index last week.

You can explore Bonnie’s market charts from last week and more HERE.

Charts to Watch:

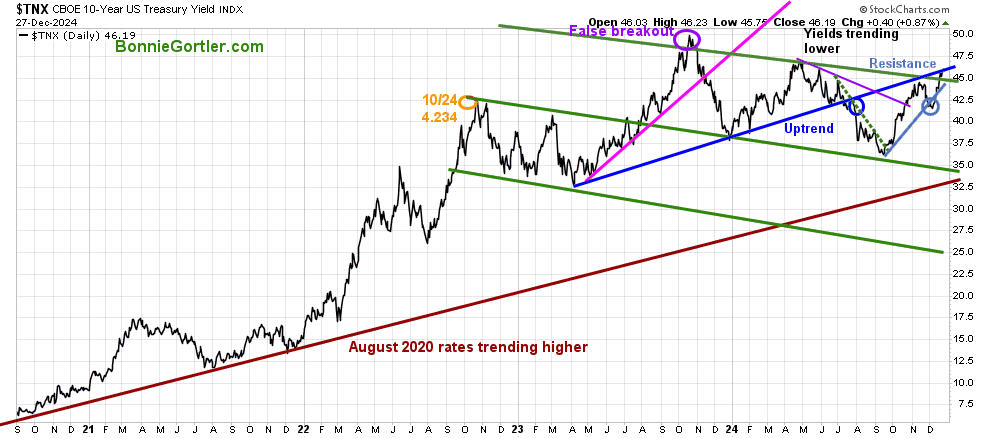

Figure 3: UST 10YR Bond Yields Daily

The 10-year U.S. Treasury rose last week, closing at 4.619 and continuing to trend higher since September.

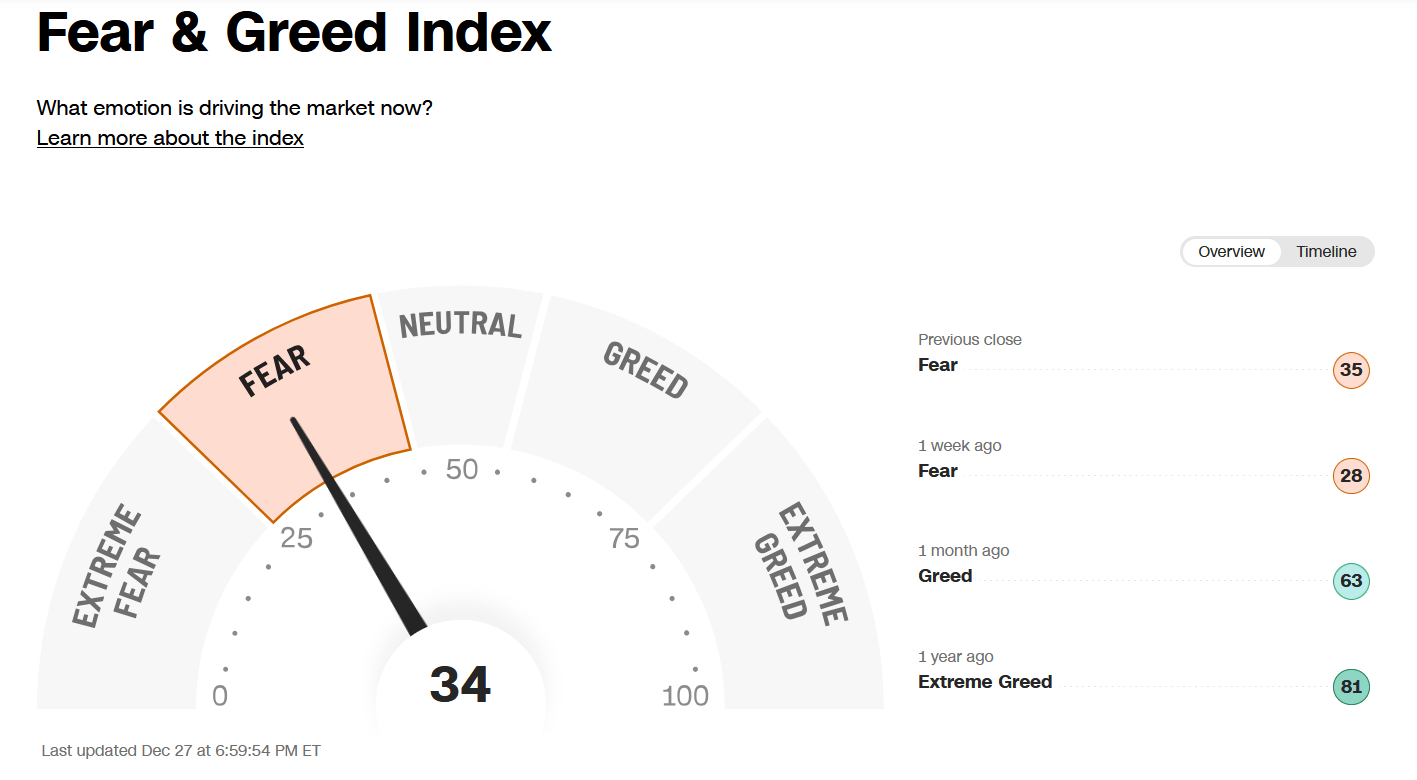

Figure 4: Fear & Greed Index

Source. CNN.com

Investor sentiment based on the Fear and Greed Index (a contrarian index) measures the market’s mood. The Fear and Greed Index upticked from 28 to 35 last week but still shows fear after only one month ago showing greed.

Learn how to implement a powerful wealth-building mindset and charting strategies to help you grow your wealth in the comfort of your home in my eCourse Wealth Through Investing Made Simple. Learn more here.

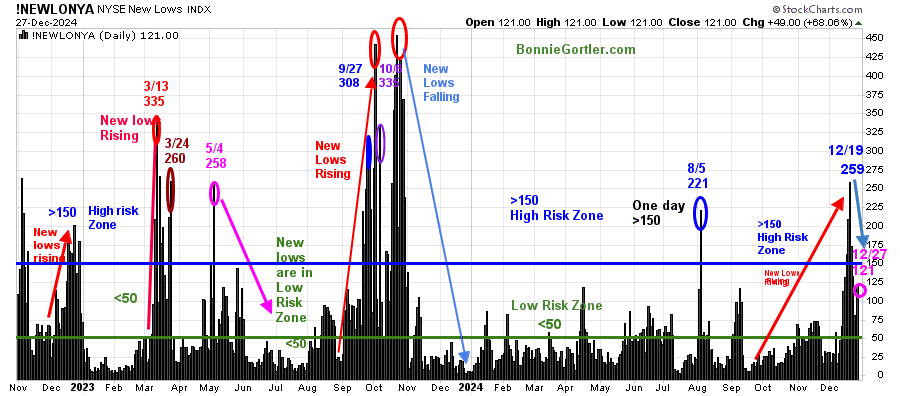

It’s a positive sign that New Lows on the NYSE and Nasdaq are falling.

Figure 5: NYSE New Lows

Source: Stockcharts.com

New Lows on the NYSE rose in December, peaking at 259, but then stabilized, falling last week from the high-risk zone above 150 to below, closing at 121 (pink circle) on 12/27/24.

Watch New Lows closely now to see if they rise or fall. If new lows fall between 25 and 50, it will be positive in the short term. On the other hand, an increase above 150 and continuing to expand would be a warning sign of more weakness ahead.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

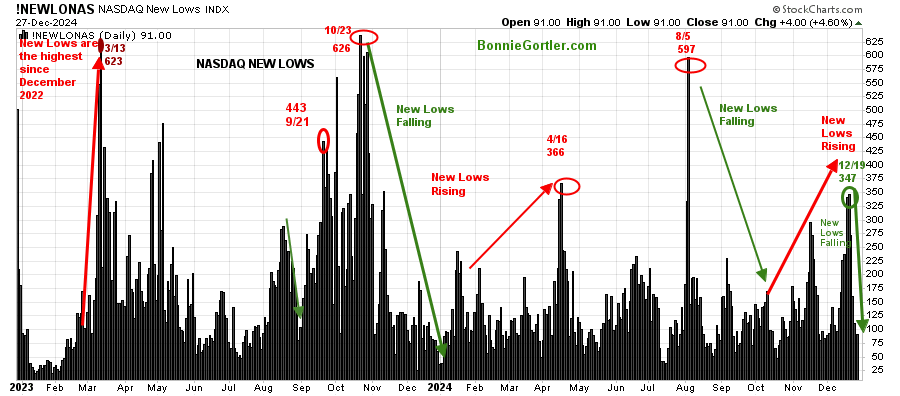

Figure 6: Nasdaq New Lows

Source: Stockcharts.com

It’s encouraging Nasdaq New Lows are no longer rising and are now falling, closing at 91 from its latest peak of 347 on 12/19.

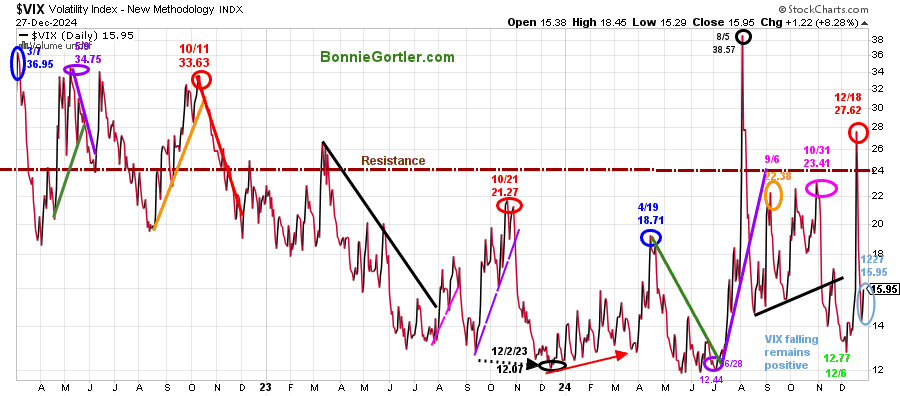

Figure 7: CBOE Volatility Index (VIX)

Source: Stockcharts.com

The CBOE Volatility Index (VIX), a measure of fear, after a low on 12/6 of 12.77, rose to 27.62 on 12/18. Last week, VIX fell to close at 15.95 as equity prices stabilized. A further decline in VIX would be positive for equities.

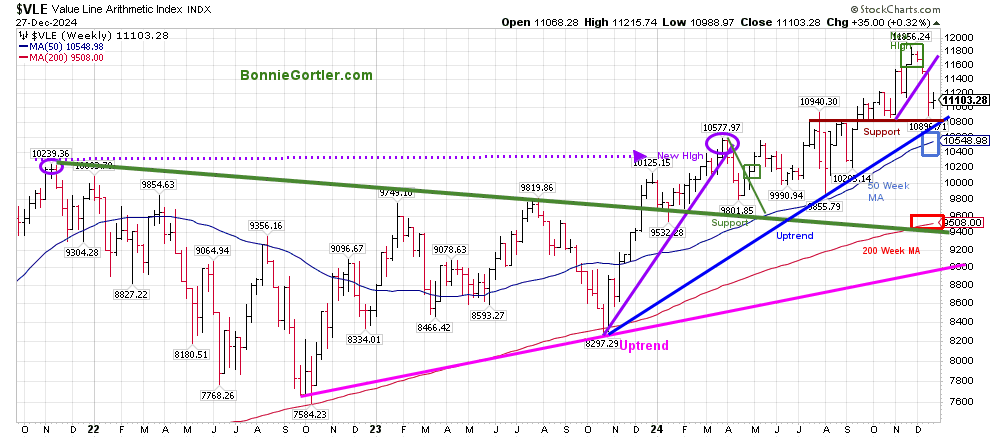

Figure 8: Value Line Arithmetic Average

Source: Stockcharts.com

The Value Line Arithmetic Index ($VLE) is a mix of approximately 1700 stocks.

The VLE uptrend from October 2022 (pink line) and October 2023 (blue line) remains in effect.

The October 2024 trendline (purple line) broke two weeks ago, and a pullback followed so far, holding support. It remains positive that VLE closed above the 50-week MA, which is rising (blue rectangle), and the 200-week MA (red rectangle) is a sign of underlying strength.

Support is 10800, followed by 10500. Resistance is 11600. It would be positive if VLE closes above the 11/25 high at 11856.24.

I invite you to join my Facebook Group. Learn more about it here: Wealth Through Market Charts.

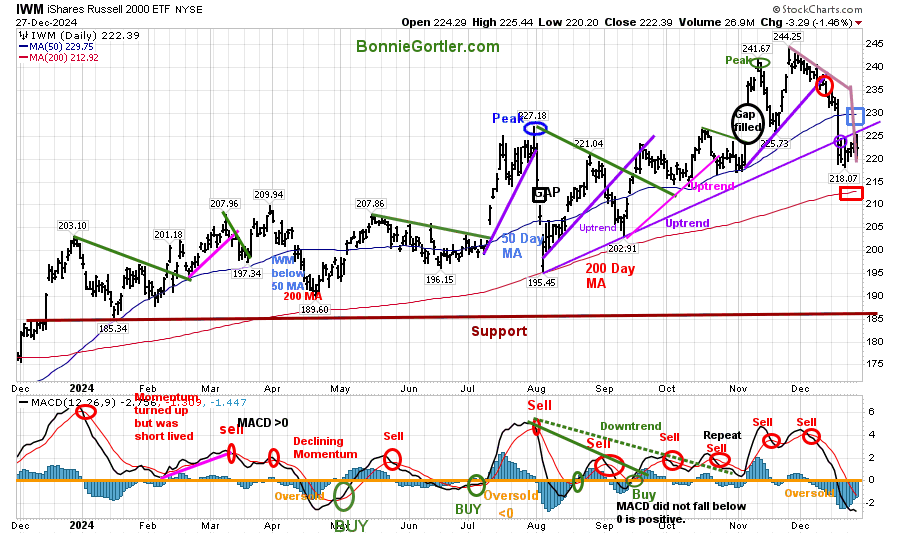

Small Caps are weak and underperforming the S&P 500

Figure 9: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue rectangle) and 200-Day Moving Average (MA) (red rectangle) that traders watch and use to define trends.

It’s unfavorable that IWM broke its short-term November uptrend and is now trading below the August uptrend (purple line) and the 50-day Moving Average. On the other hand, IWM is short-term oversold and in position for a fresh buy signal from MACD if IWM turns up now and shows strength. Two closes above 231.00 would be positive in the short term.

You can explore Bonnie’s market charts from last week and more HERE.

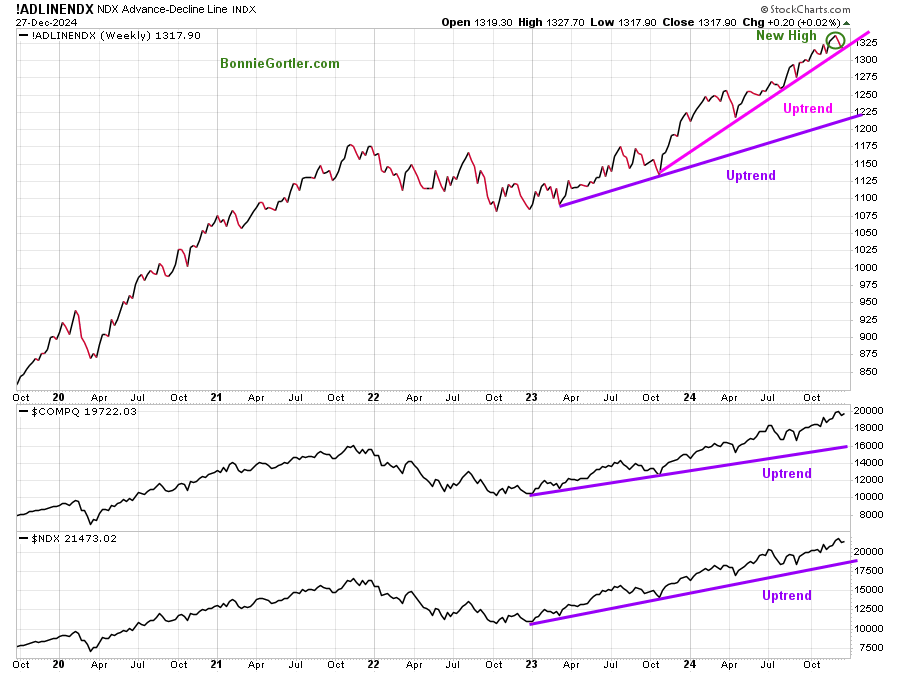

Figure 10: Nasdaq Advance Decline line (Top) Nasdaq Composite (Middle) Nasdaq 100 (Bottom)

Source: Stockcharts.com

The uptrend remains for the intermediate term for the NDX Advance Decline Line, Nasdaq Composite, and NDX Index.

The bulls continue to get the benefit of the doubt as long as the uptrends in price and breath remain intact.

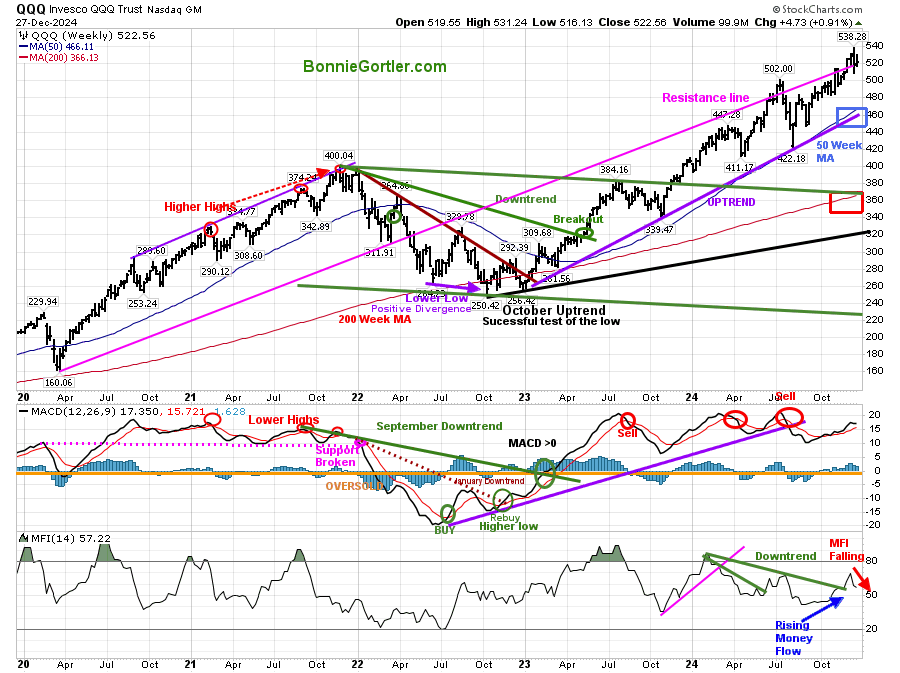

Figure 11: QQQ Weekly

Source: Stockcharts.com

It’s positive the QQQ intermediate uptrend from October 2023 remains intact (purple line).

QQQ rose +0.91% but was down on Friday as sellers were unwilling to take on risk and not in the holiday spirit.

Support is at 515.00, 500.00, followed by 480.00 and 460.00. Resistance is at 530.00 and 540.00.

The intermediate trend remains up, but the pace of gains has slowed. It’s key for QQQ to remain above first support at 515.00.

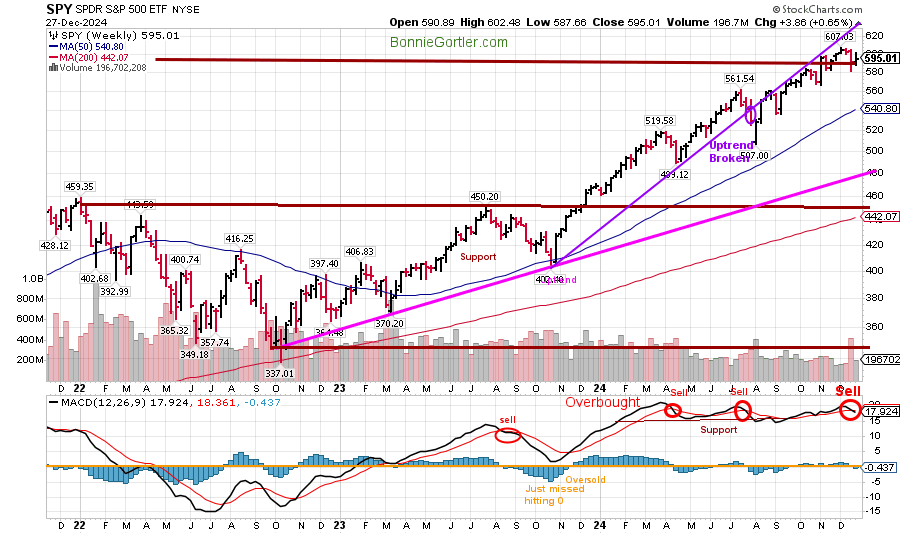

Figure 12: SPY Weekly

Source: Stockcharts.com

The Intermediate trend in the S&P 500 from October 2022 remains in effect (pink line). Its positive SPY remains above the 50 and 200-week MA. However, momentum is weakening, and a repeat signal has occurred.

Support is at 580.00, followed by 560.00 and 540.00. Resistance is at 603.00. It remains positive that the S&P continues to follow a pattern of higher lows and higher highs.

For more of Bonnie’s market charts, Click HERE.

Summing Up:

Friday’s tape action was concerning as the major averages rose last week. The intermediate and long-term trends remain up. This December is historically weaker than a typical December. Rising longer-term interest rates, tax selling, and profit-taking have led to a pullback. If weakness continues, expect more selling and support violated, tripping sell stops and increasing volatility. The good news is the technicals are short-term oversold and in a favorable position for a rally. Look for a turn-up early next week with the Santa Claus Rally often lifts stock prices during the last five trading days in December and the first two in January. Manage your risk, and your wealth will grow.

Let us get to know each other better. If you have any questions or want to explore charts together, contact me at Bonnie@Bonniegortler.com.

If you like this market update, you will love my free Charting Charting Master Class. Sign up HERE.