Bonnie’s Market Update 10/04/24

Bonnie’s Market Update 10/04/24

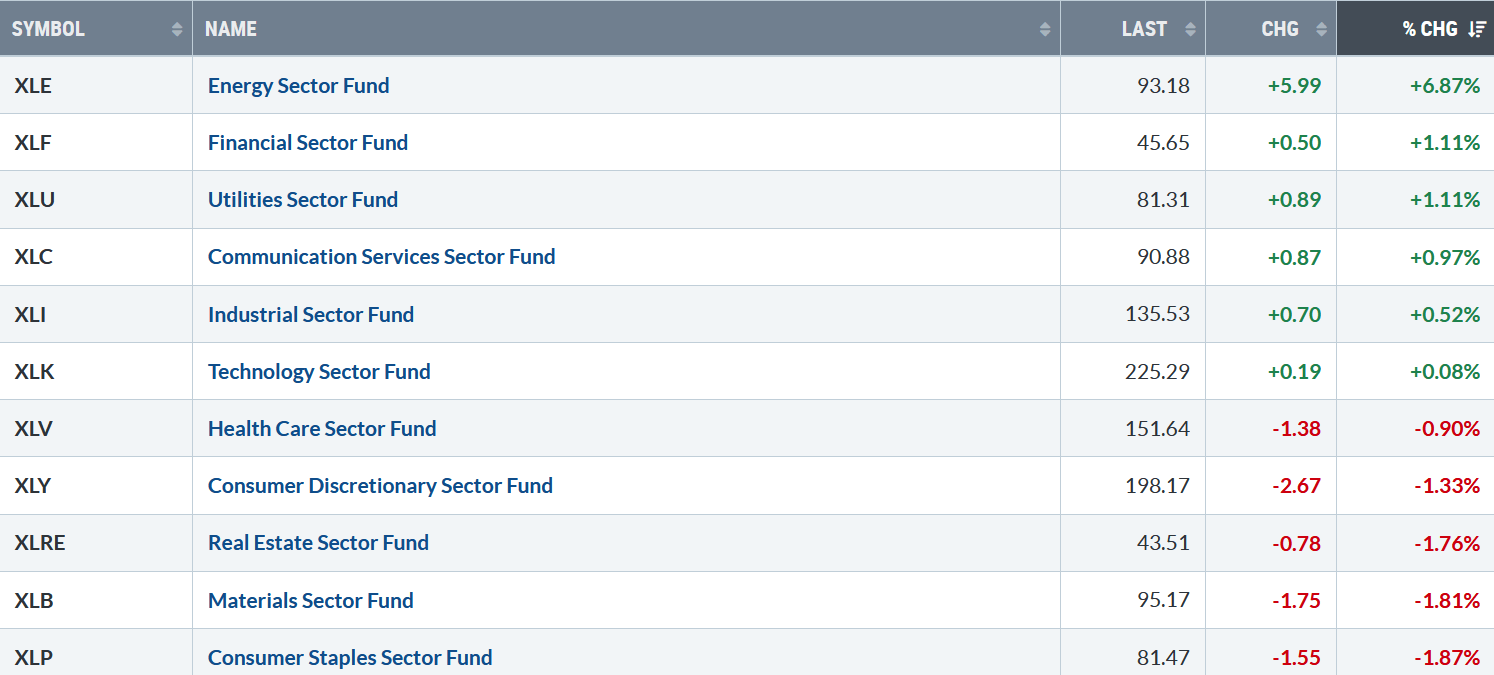

The rise slowed for the major averages. Six of the eleven S&P SPDR sectors were higher last week. Energy (XLE) and Financials (XLF) were the strongest, while Materials (XLB) and Consumer Staples were the weakest. The SPDR S&P 500 ETF Trust (SPY) gained +0.26%.

S&P SPDR Sector ETFs Performance Summary 9/27/24-10/04/24

Source: Stockcharts.com

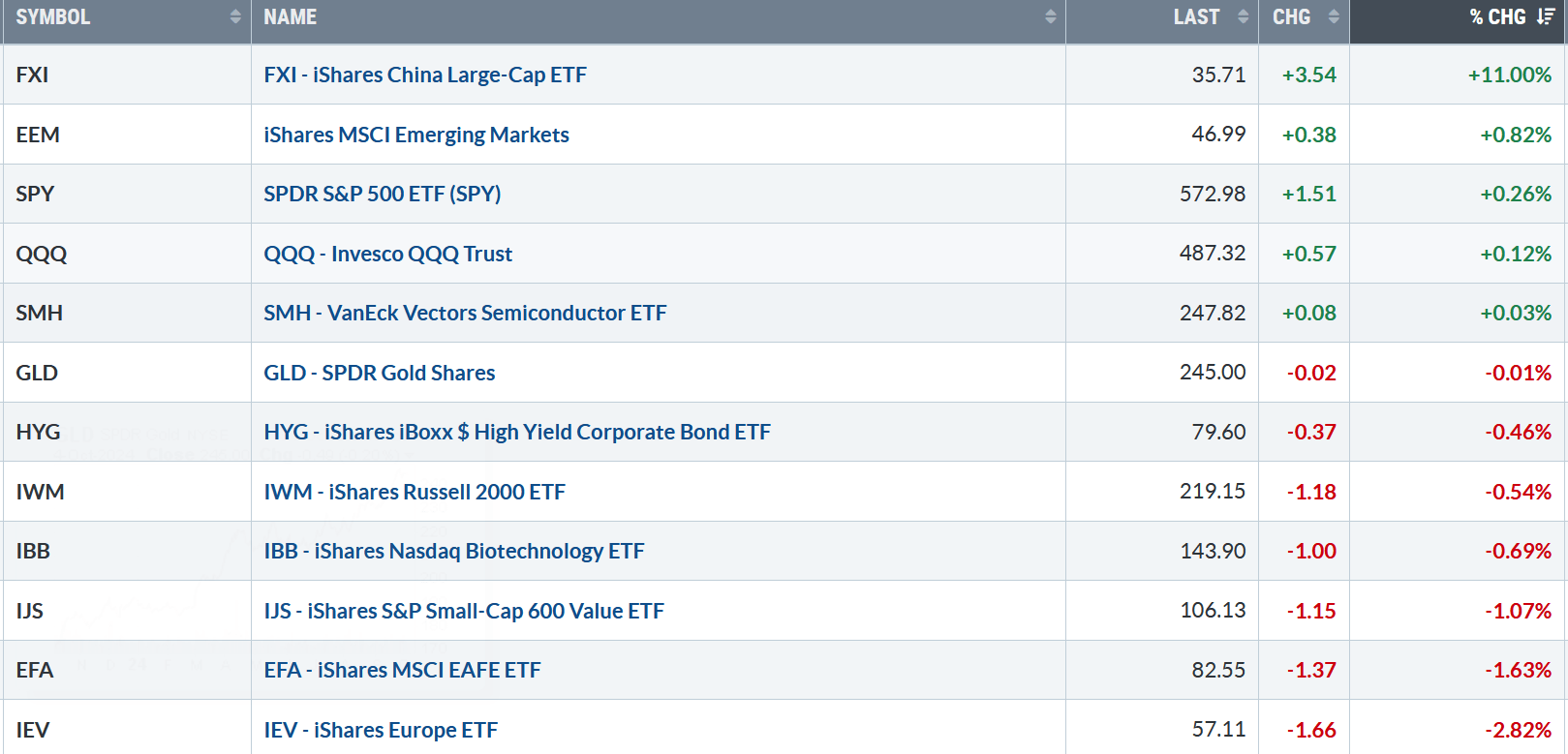

Figure 2: Bonnie’s ETFs Watch List Performance Summary 9/27/24-10/04/24

Source: Stockcharts.com

China’s stock market rose sharply for the second week as investors and institutions purchased and closed their shorts. Small Caps, Growth, Value, Biotechnology, and Europe were lower.

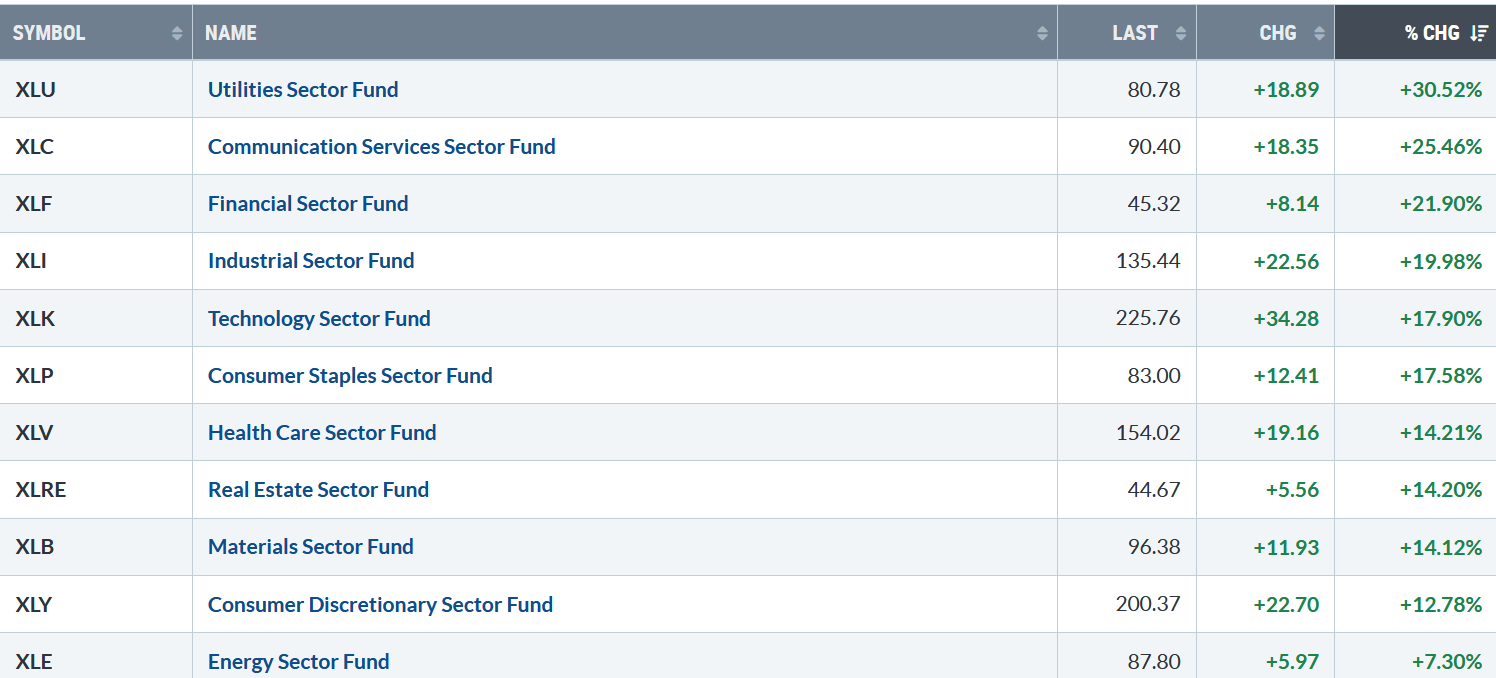

Figure 3: Bonnie’s SPDR Sector ETFs Performance Summary 12/29/23-09/30/24

Summing Up:

The major averages closed near their highs on Friday. The short-term trend remains up. Tape action continues to be positive, yet daily momentum patterns have weakened, implying an increased risk of a potential correction. Look for volatility to rise next week when Tuesday’s earnings season begins. Support on the S&P 500 Index is 5650,5500, and 5400. QQQ support is 482.00, 477.00, and 465.00. As long as support holds, the odds favor the bulls.

You can explore Bonnie’s market charts from last week and more HERE.

Let’s get to know each other better. If you have any questions or want to explore charts together, contact me at Bonnie@Bonniegortler.com. Alternatively, you can go directly to my calendar to schedule a time. Click HERE:

If you like this market update, you will love my free Charting Charting Master Class. Sign up here.