Bonnie’s Market Update 1/24/25

Bonnie’s Market Update 1/24/25

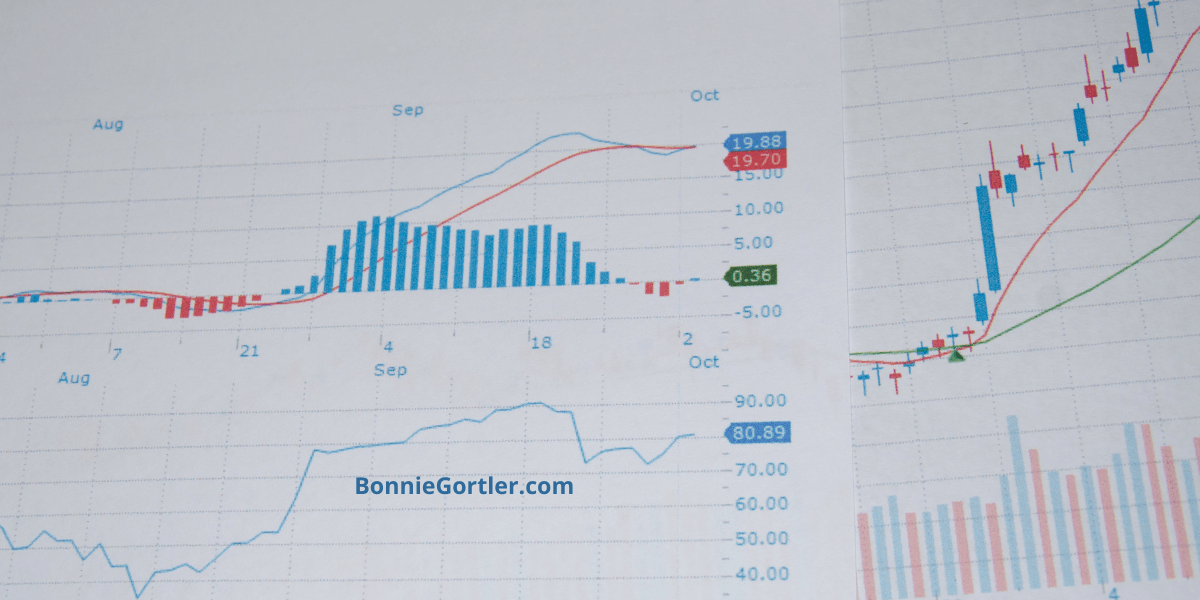

There was weakness Friday, but ten of eleven S&P SPDR sectors finished higher last week. Communication Services (XLC) and Healthcare (XLV) were the leading sectors, while Consumer Discretionary (XLY) and Energy (XLE) were the weakest sectors. The SPDR S&P 500 ETF Trust (SPY) rose +1.74%.

S&P SPDR Sector ETFs Performance Summary 1/17/25 – 1/24/25

Source: Stockcharts.com

Figure 2: Bonnie’s ETFs Watch List Performance Summary 1/17/25 – 1/24/25

Source: Stockcharts.com

Biotechnology and Internationals were strong, including Europe, China, and Emerging Markets, all outperforming the S&P 500. Semiconductors, Small-Cap Growth, and Value were higher but underperformed the S&P 500.

If you like charts, I invite you to join my Facebook Group. Learn more about it here: Wealth Through Market Charts.

Charts to Watch:

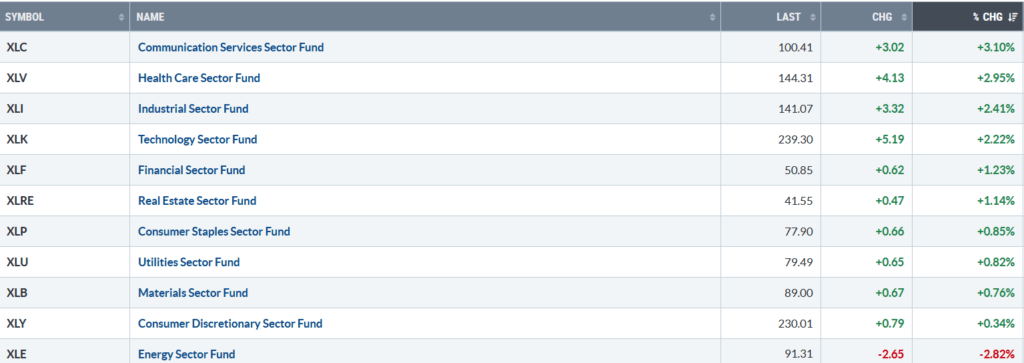

Figure 3: UST 10YR Bond Yields Daily

Source: Stockcharts.com

The 10-year U.S. Treasury rose, closing at 4.626, remaining below the 2024 high. Rising yields are likely to damper significant gains while falling yields would support further upside in U.S. equities.

Learn how to implement a powerful wealth-building mindset and charting strategies to help you grow your wealth in the comfort of your home in my eCourse Wealth Through Investing Made Simple. Learn more here.

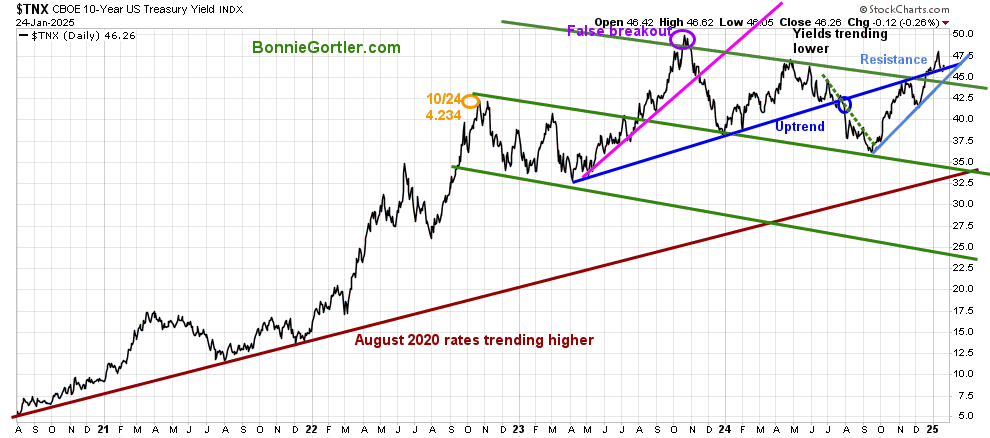

Figure 4: Fear & Greed Index

Source. CNN.com

Investor sentiment based on the Fear and Greed Index (a contrarian index) measures the market’s mood. The Fear and Greed Index rose from 37 to 49, a neutral reading with the rally last week.

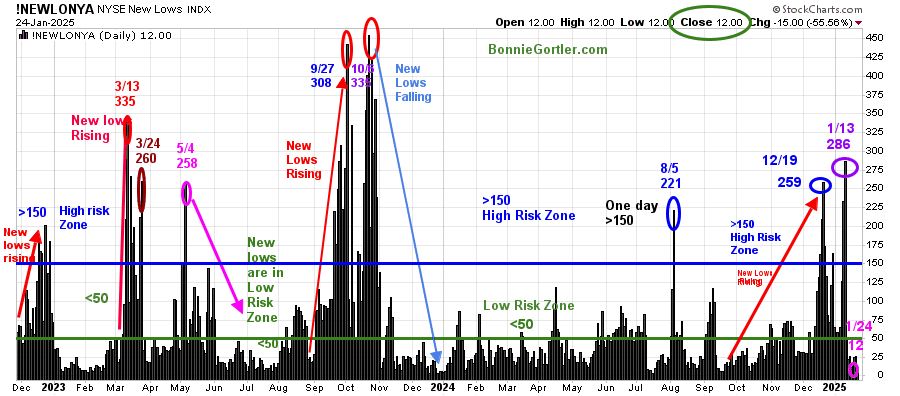

Figure 5: NYSE New Lows

Source: Stockcharts.com

New Lows on the NYSE rose in December 2024, with a high of 259, then briefly contracted before peaking at 286 (purple circle) on 1/13/25. Since then, New Lows have fallen sharply, closing at 12 (pink circle) and remaining in the lowest risk zone.

Continue to watch New Lows to see if New Lows begin to expand. It is positive in the short term if new lows stay below 50. New Lows above 150 and rising would be a warning sign of weakness ahead.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

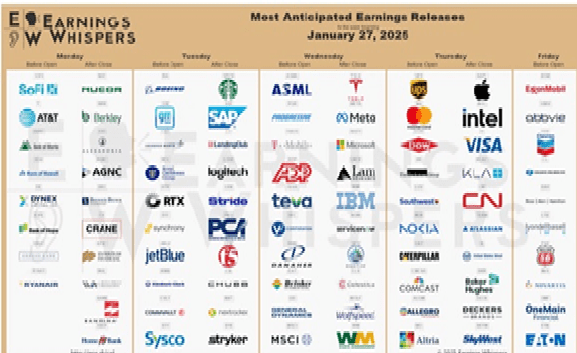

Increased daily volatility is likely this week, with key earnings released.

Figure 6: Most Anticipated Earnings Releases week of January 27, 2025

Source: Earnings Whispers

Meta and Microsoft earnings on Wednesday and Apple on Thursday are key.

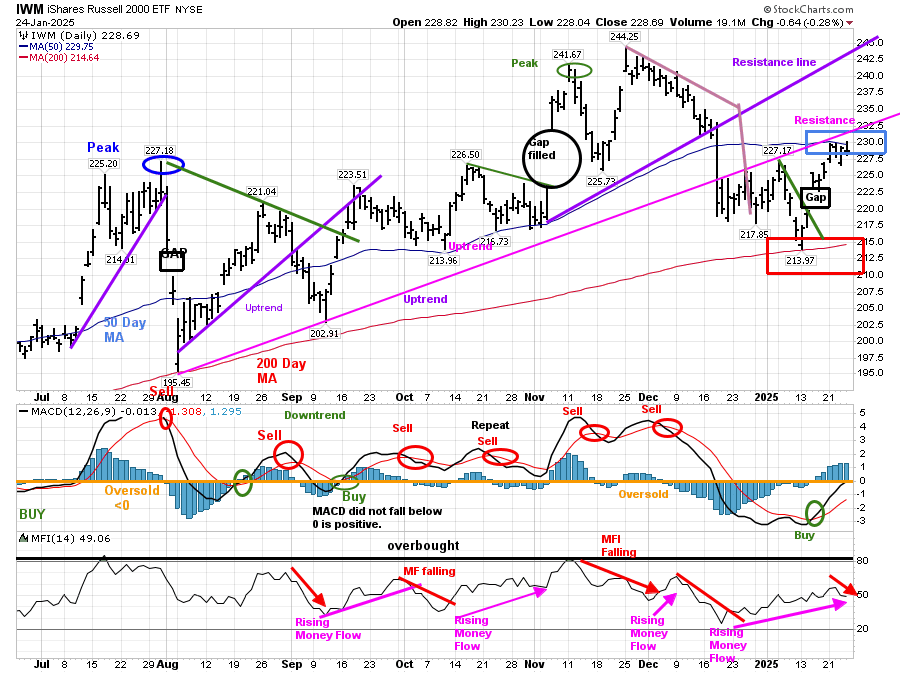

It’s a positive sign that Russell 2000 participated in the advance last week.

Figure 7: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue rectangle) and 200-Day Moving Average (MA) (red rectangle) that traders watch and use to define trends.

IWM rose +1.43%, closing slightly below resistance (pink line) and the 50-day MA (blue rectangle) and above the 200-day MA (red rectangle). Resistance is between 230.00 and 235.00, followed by 242.50.

MACD remains on a buy (green circle), rising from below 0.

Money Flow has risen since December 24 but has turned down.

Support is at 225.00, 222.50, and 213.00. Two closes below 213.00 would be negative. On the other hand, two closes above 230.23 would be positive and imply a test of the November high at 244.25.

You can explore Bonnie’s market charts from last week and more HERE.

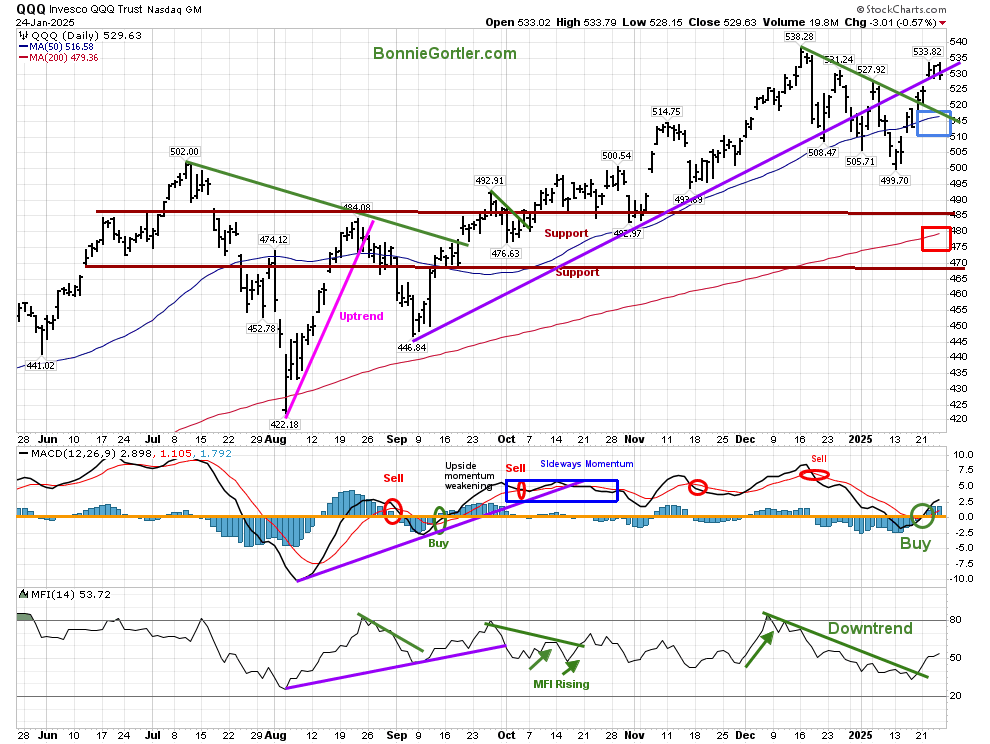

Figure 8: QQQ Daily Invesco QQQ Trust (QQQ) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The Chart shows the daily Invesco QQQ, an exchange-traded fund based on the Nasdaq 100 Index.

QQQ rose +1.51%, closing above the rising 50-day MA.

Support remains at 525, 518.00, 505.00 and 495.00. Resistance is at 538.00.

MACD generated a buy with an improvement in momentum. Unlike the intermediate chart, momentum has weakened and generated repeat sell signals.

Learn how to implement a powerful wealth-building mindset and charting strategies to help you grow your wealth in the comfort of your home in my eCourse Wealth Through Investing Made Simple. Learn more here.

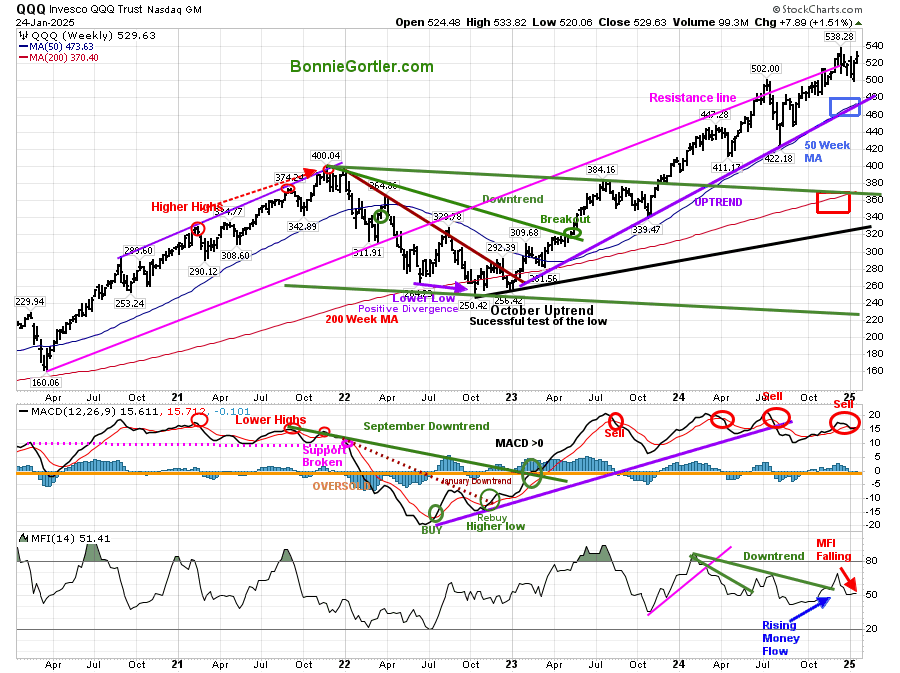

Figure 9: Weekly Invesco QQQ Trust (QQQ) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The Invesco Trust (QQQ) intermediate uptrend from October 2023 remains intact (purple line).

Intermediate momentum is weakening as QQQ rises. MACD (middle chart) has generated repeat sells, which bears watching.

Money Flow (bottom chart) has turned down.

Support is 520.00, 500.00, 480.00 and 460.00. Resistance is at 538.00.

The risk of a pullback is increasing as the short-term charts are no longer oversold after the recent relief rally, and intermediate momentum patterns are weakening. A close on Friday below 518.00 and deteriorating market breadth would imply the recent rally has ended.

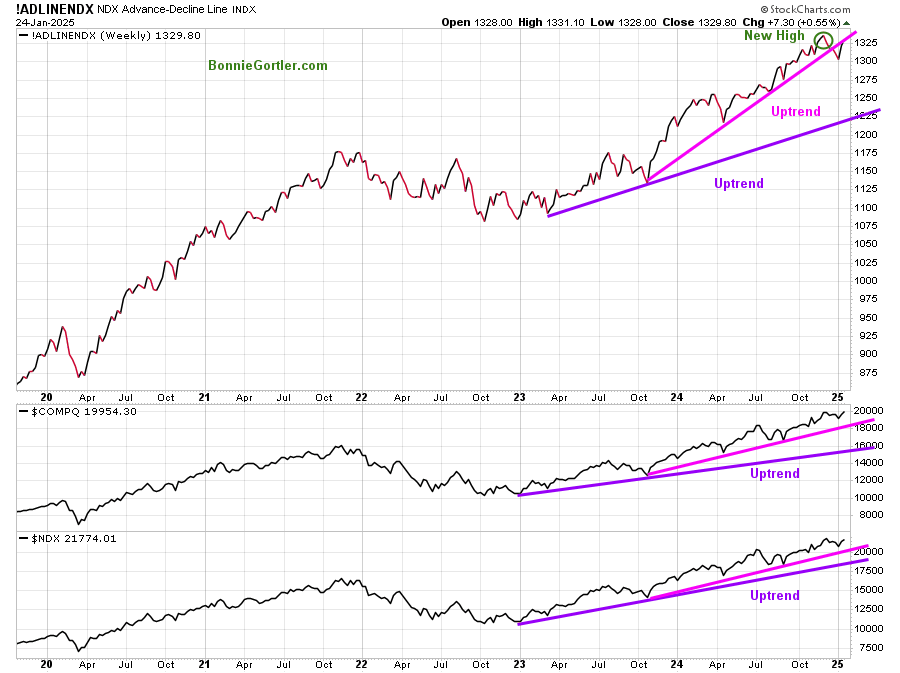

Figure 10: Nasdaq Advance Decline line (Top) Nasdaq Composite (Middle) Nasdaq 100 (Bottom)

Source: Stockcharts.com

A new high on the NDX Advance Decline Line (top chart) was achieved in November 2024. In December, a turn-down followed, which broke the October uptrend (pink line). Notice how the NDX Ad-Line rallied back on this latest rally to where it broke down from. Time will tell if market breadth can take out the December high.

It’s positive the uptrend from January 2023 (purple line) and October 2023 (pink) remain in effect for the Nasdaq Composite (middle chart) and Nasdaq NDX Index (bottom chart).

Over the next several weeks, weak market breadth would be a warning sign of an increased risk of a potential correction in the Nasdaq Composite and NDX (Nasdaq 100) and an increase in daily volatility.

For more of Bonnie’s market charts, Click HERE.

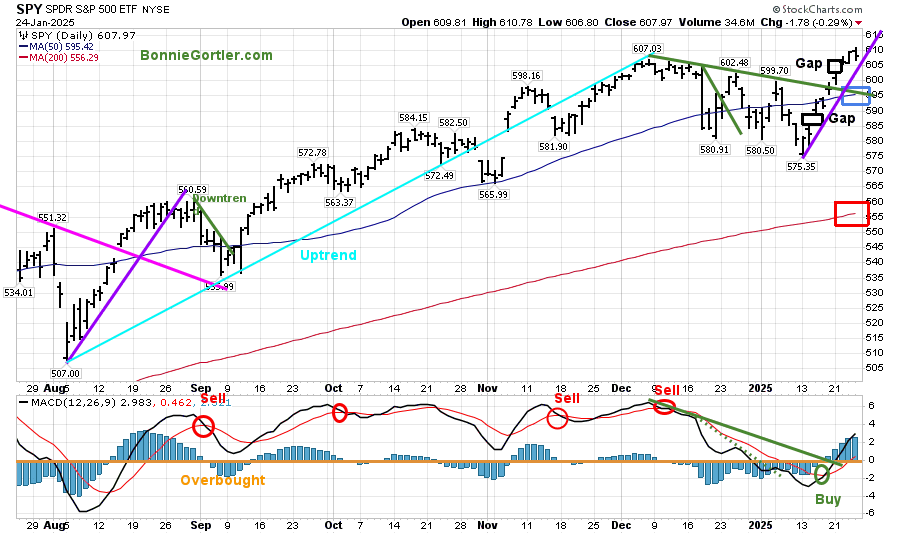

Figure 11: SPY Daily and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The S&P 500 (SPY) broke its December downtrend (green) and rose to a new high last week, finishing up +1.74%. SPY closed at 607.97, below Friday’s high of 610.78. Two gaps have not been filled yet (black rectangle). A close below 607.00, the first support will likely break the uptrend, filling both gaps.

Support is at 603.00, 595.00, 587.00, 575.00, and 565.00. Resistance is at 610.00.

Summing Up:

Market breadth was positive on both the NYSE and Nasdaq Index. The market continues to be resilient in 2025. Any decline in the major averages so far in 2025 has been contained. Technical indicators are mixed. Daily momentum patterns have turned up from oversold conditions, implying a continuation of the rally, but intermediate patterns momentum is weakening. The Fed meeting is this week, and key earnings will be announced. Therefore, expect an increase in volatility with larger daily trading ranges that could break above resistance, which would be bullish, or break below support levels, which would be bearish. Manage your risk, and your wealth will grow.

Let us get to know each other better. If you have any questions or want to explore charts together, contact me at Bonnie@Bonniegortler.com.

If you like this market update, you will love my free Charting Charting Master Class. Sign up HERE.