Bonnie’s Market Update 1/17/25

Bonnie’s Market Update 1/17/25

A solid oversold rally last week. All eleven S&P SPDR sectors were higher last week. Energy (XLE) and Financial (XLF) were the leading sectors, while Consumer Staples (XLP) and HealthCare (XLV) were the weakest sectors. The SPDR S&P 500 ETF Trust (SPY) rose +2.94%.

S&P SPDR Sector ETFs Performance Summary 1/10/25 – 1/17/25

Source: Stockcharts.com

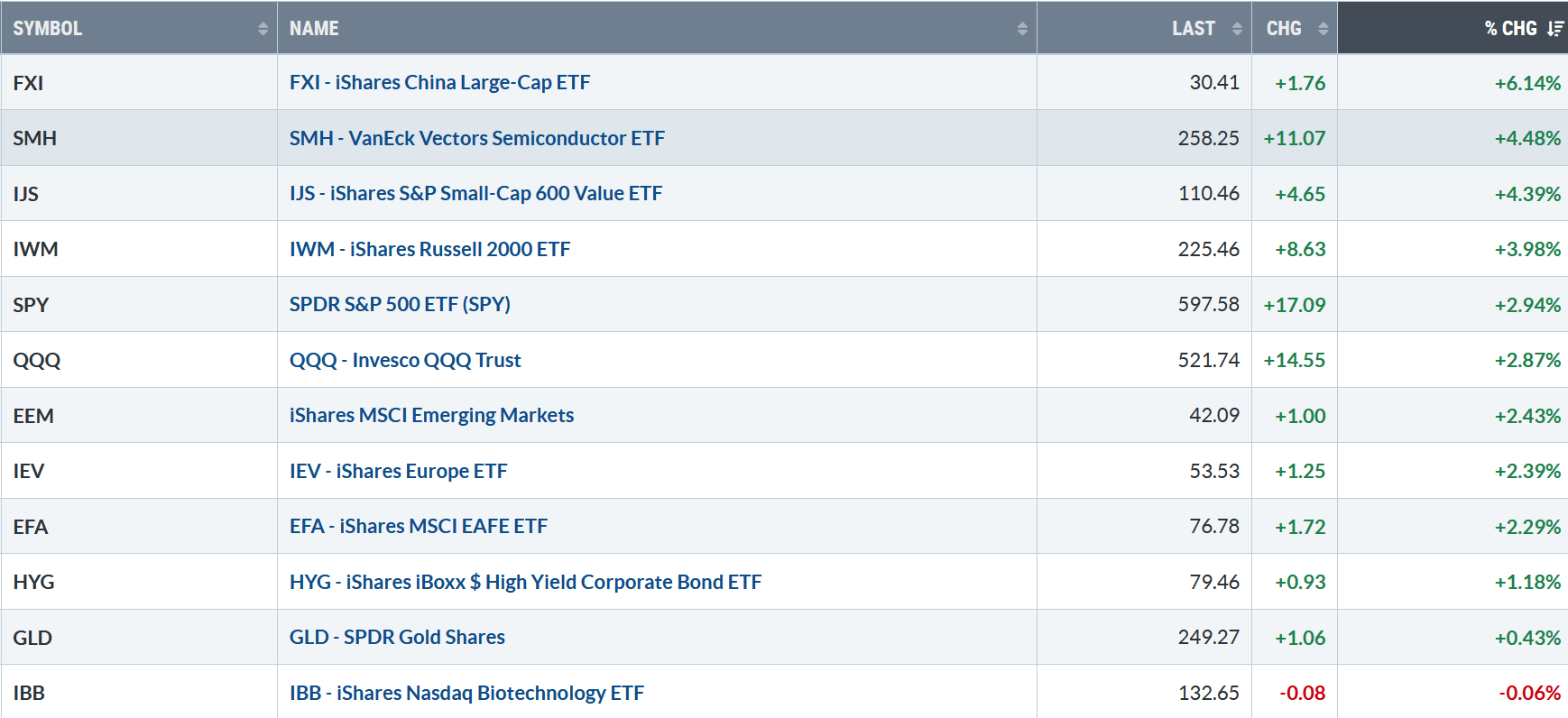

Figure 2: Bonnie’s ETFs Watch List Performance Summary 1/10/25 – 1/17/25

Source: Stockcharts.com

China and Semiconductors Small Cap Growth and Value, led the rally, while Technology, Gold, and Biotechnology lagged.

If you like charts, I invite you to join my Facebook Group. Learn more about it here: Wealth Through Market Charts.

Charts to Watch:

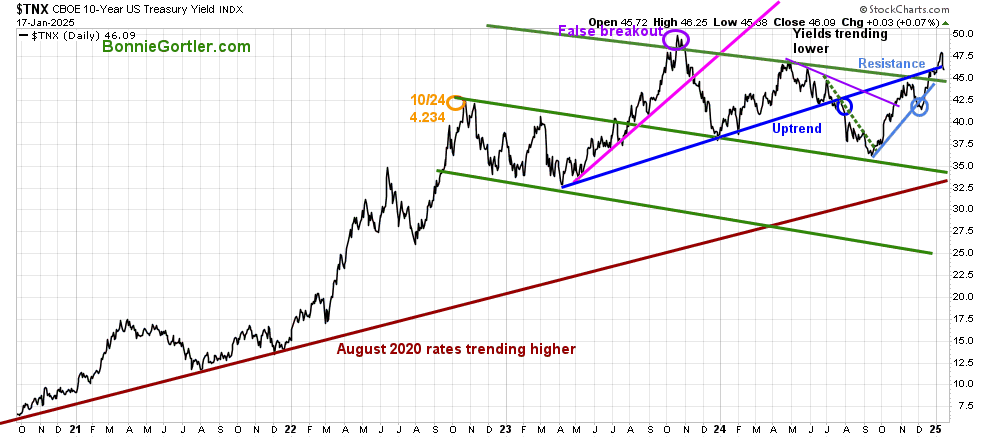

Figure 3: UST 10YR Bond Yields Daily

Source: Stockcharts.com

The 10-year U.S. Treasury fell, helping equities last week, closing at 4.609, pulling back from the highest close since April 2024. On the other hand, rising yields are likely to damper any significant gains.

Learn how to implement a powerful wealth-building mindset and charting strategies to help you grow your wealth in the comfort of your home in my eCourse Wealth Through Investing Made Simple. Learn more here.

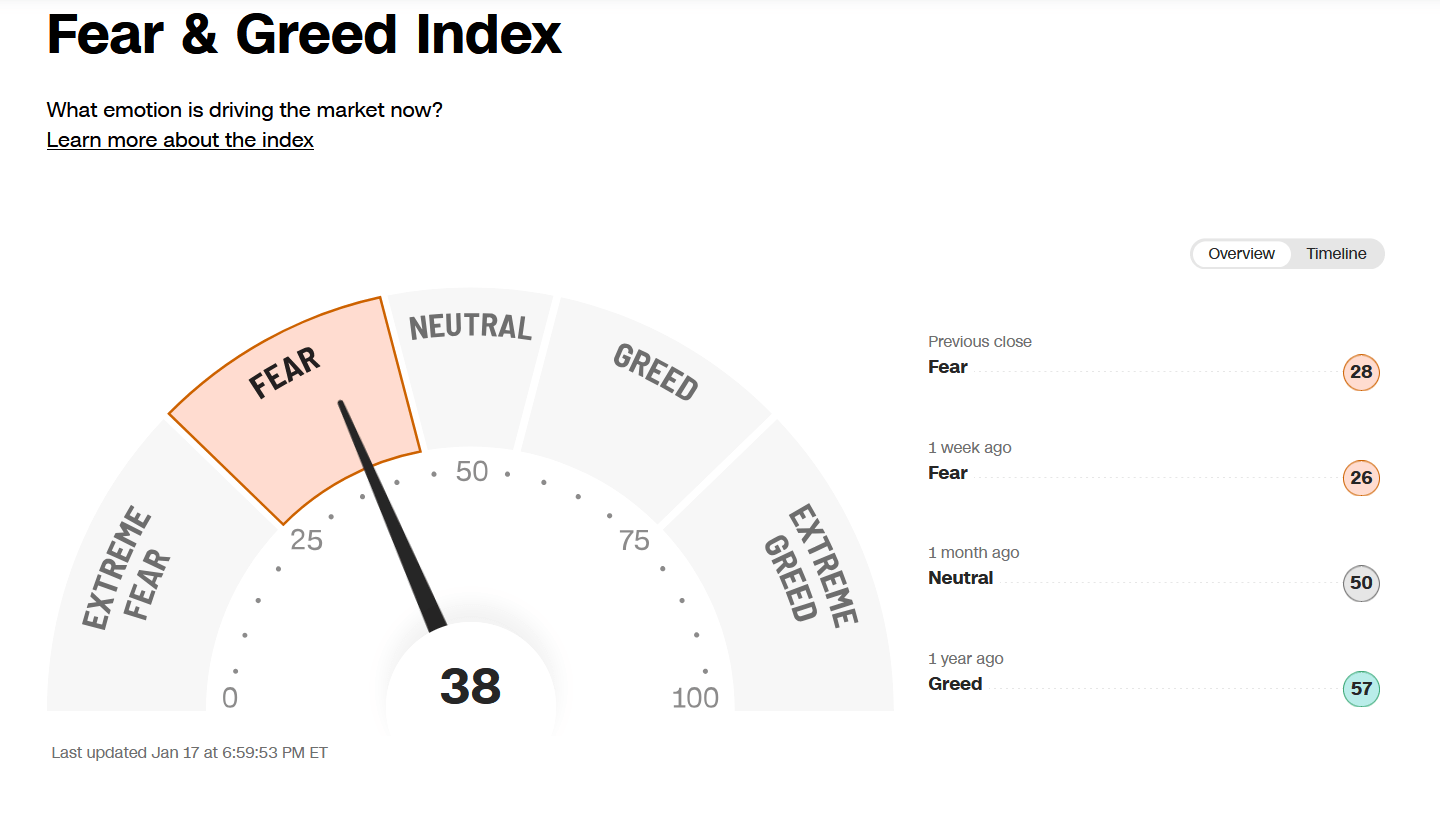

Figure 4: Fear & Greed Index

Source. CNN.com

Investor sentiment based on the Fear and Greed Index (a contrarian index) measures the market’s mood. The Fear and Greed Index rose from 27 to 37, continuing to show fear despite the broad rally last week.

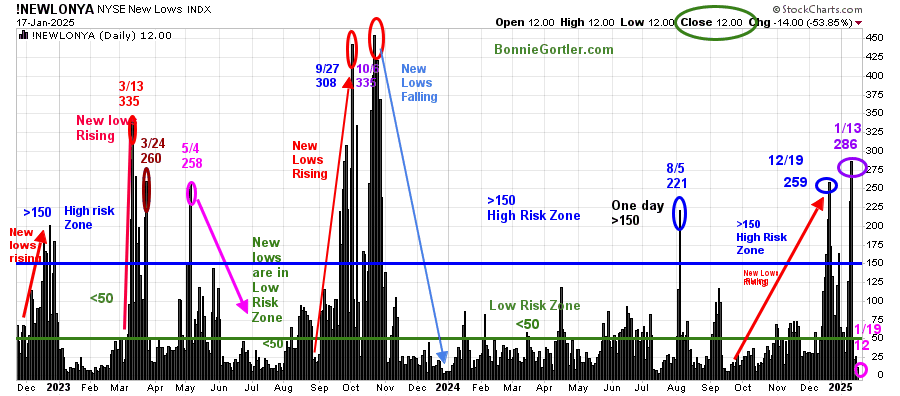

Figure 5: NYSE New Lows

Source: Stockcharts.com

New Lows on the NYSE rose in December, with a high of 259, then briefly contracted before peaking at 286 (purple circle) on 1/13/25. New Lows have fallen sharply, closing at 12 (pink circle) after briefly being in the high-risk zone above 150.

Watch New Lows closely to see if New Lows rise or fall. If lows New Lows remain less than 50, it is positive in the short term. On the other hand, if they close above 150 and continue to expand, it would be a warning sign of weakness ahead.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

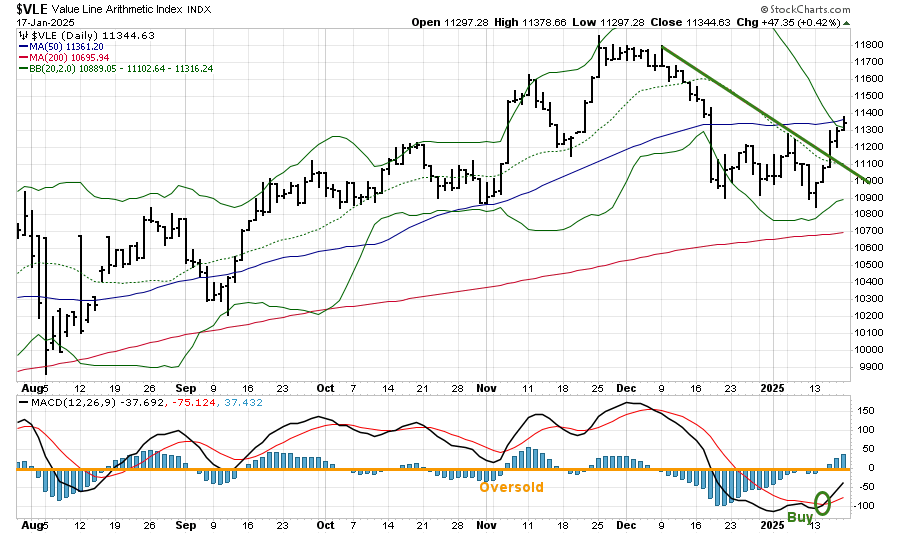

Figure 6: Value Line Arithmetic Average Daily (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

VLE rose sharply, +3.83% last week, breaking the short-term downtrend (green line) and generating a daily MACD buy (bottom chart). However, VLE is not out of the woods on an intermediate basis, as downside momentum is not oversold to imply a significant bottom has formed for the intermediate term. (See Figure 7).

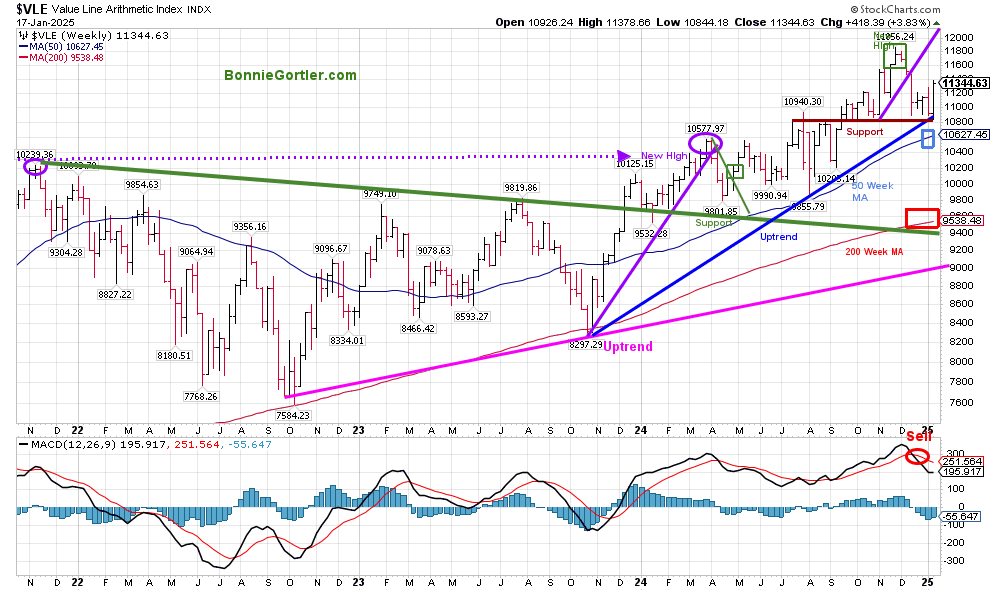

Figure 7: Value Line Arithmetic Average Weekly (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The Value Line Arithmetic Index ($VLE) is a mix of approximately 1700 stocks. The uptrend from October 2022 (pink line) and October 2023 (blue line) remains in effect. The October 2024 trendline (purple line) broke five weeks ago and then retraced towards support, which appears to have held.

VLE closed above its 50-week MA (blue rectangle) and the 200-week MA (red rectangle), which is positive.

Support is at 11300, 10800, followed by 10500. Resistance is 1600, followed by the 11/25 high at 11856.24.

Continued strength next week would be positive, but a close below last week’s low of 11378.56 would be negative.

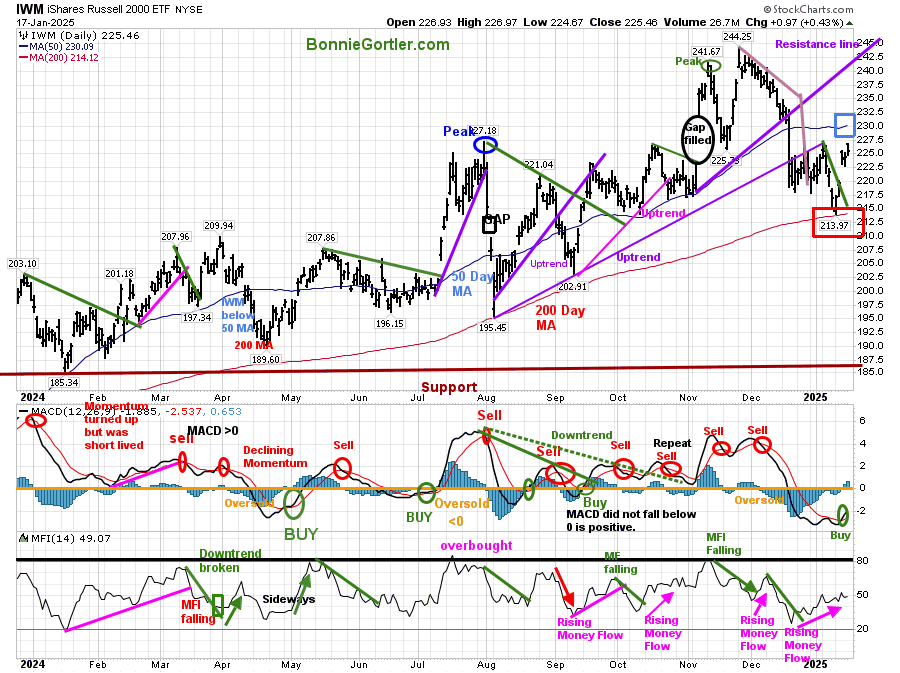

Russell 2000 momentum turns up.

Figure 8: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue rectangle) and 200-Day Moving Average (MA) (red rectangle) that traders watch and use to define trends.

IWM rose sharply, up +3.98% after falling -3.39% the previous week. IWM was stronger than the S&P 500 and broke the 2025 downtrend (green line), which is positive. IWM rebounded after touching the 200-day MA (red rectangle) to close above the 50-day MA, which closed at 230.09, a positive sign.

MACD generated a fresh buy signal (green circle), rising from oversold below 0.

Money Flow broke the downtrend from December 24 and continues to rise,

The jury remains out if last week’s rally is another false alarm or the start of a meaningful rally.

Support is at 213.00. Two closes below 213.00 would imply weakness. On the other hand, two closes above 230.09 would be positive.

You can explore Bonnie’s market charts from last week and more HERE.

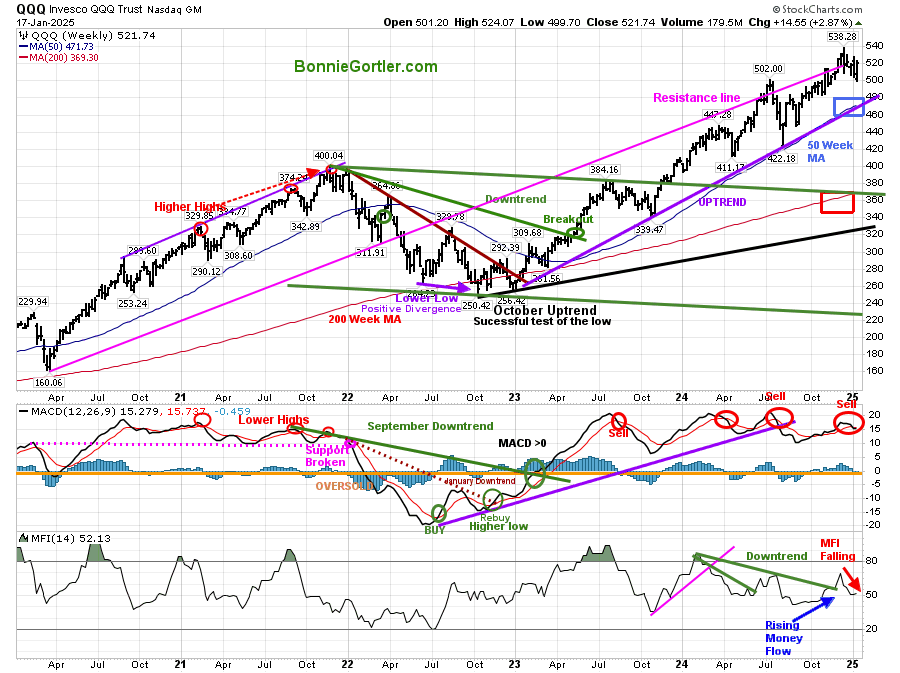

Figure 9: QQQ Weekly (top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The Invesco Trust (QQQ) intermediate uptrend from October 2023 remains positive (purple line).

Last week, QQQ tested support at 500.00, and selling pressure on Apple (AAPL) rose +2.87%.

Intermediate momentum continues to weaken, generating repeat sells, which remains concerning. However, the daily QQQ (chart not shown) momentum is improving and has turned up, and we are now close to developing a MACD buy.

Money Flow has been falling, and there was a slight uptick last week.

Support remains at 500.00, followed by 480.00 and 460.00. Resistance is at 530.00 and 540.00.

Continued strength would be favorable, but a close on Friday below 499.70 would imply the likelihood last week’s rise was only a relief rally.

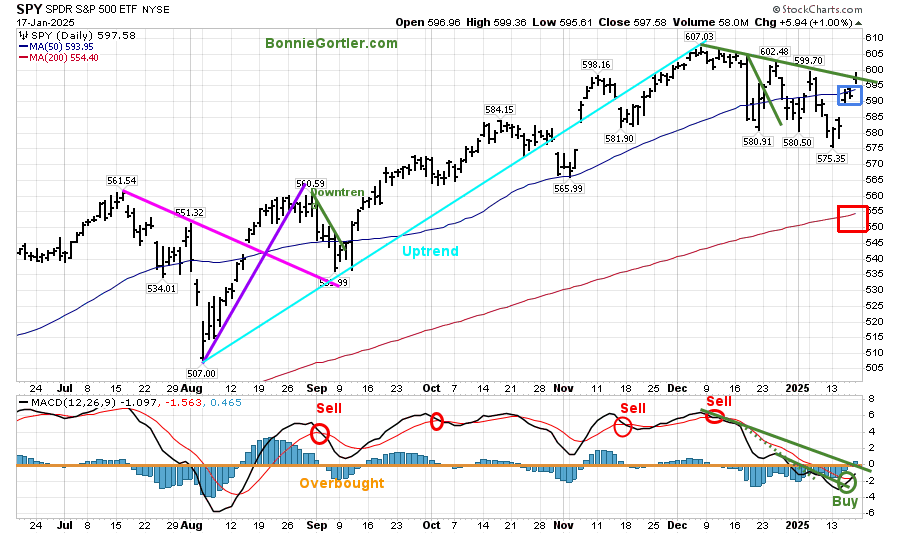

Figure 10: SPY Daily and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The S&P 500 (SPY) closed at the downtrend line (green)from its peak in December.

SPY closed at 597.58, up +2.94%, closing near its weekly high on Friday.

Support is at 590.00, 575.00, 565.00 and 550.00. Resistance is 603.00 and 607.00.

For more of Bonnie’s market charts, Click HERE.

Summing Up:

Market breadth improved, and short-term momentum patterns have turned up, implying a potential continuation of last week’s rally and further gains in the short term. However, intermediate patterns show weak momentum and do not suggest a significant bottom. Manage your risk, and your wealth will grow.

Let us get to know each other better. If you have any questions or want to explore charts together, contact me at Bonnie@Bonniegortler.com.

If you like this market update, you will love my free Charting Charting Master Class. Sign up HERE.