Alert Has Been Given: The Stock Market’s Major Rising Trend Is In Jeopardy

“Expect the best. Prepare for the worst. Capitalize on what comes.” ~Zig Ziglar

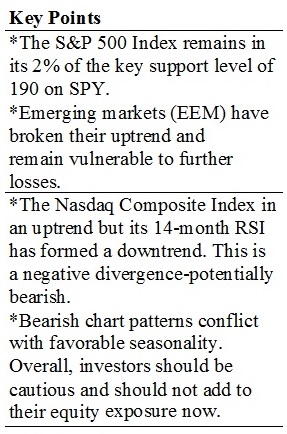

How quickly the market changes its character. The S&P 500 finished September down after making a new all-time high a few weeks ago on Sept. 18, 2014. The market tape action is getting worse. The anticipated rise in volatility during September kicked in, the Volatility Index (VIX), a . measurement of fear, increased over 40% from 11.52, its lowest reading on September 19 to a high of 16.43 at the end of the month. Momentum continues to deteriorate, warning signals are being given, and the odds are increasing that a further decline could continue in October. Small caps continue to under perform. Junk bonds have joined the decline, falling over 2% from their highs. International markets are under pressure especially the more volatile emerging market area. China, Russia and Latin America fell sharply and lost relative strength to the US market. Europe was a big disappointment; its rally very short lived. I was optimistic about the iShares S&P Europe 350 ETF (IEV) in the August 29th newsletter but price fell below 45.00, the key support, indicating a failure has taken place. This breakdown implies more negative repercussions going forward. The stock market charts are not appealing.

How quickly the market changes its character. The S&P 500 finished September down after making a new all-time high a few weeks ago on Sept. 18, 2014. The market tape action is getting worse. The anticipated rise in volatility during September kicked in, the Volatility Index (VIX), a . measurement of fear, increased over 40% from 11.52, its lowest reading on September 19 to a high of 16.43 at the end of the month. Momentum continues to deteriorate, warning signals are being given, and the odds are increasing that a further decline could continue in October. Small caps continue to under perform. Junk bonds have joined the decline, falling over 2% from their highs. International markets are under pressure especially the more volatile emerging market area. China, Russia and Latin America fell sharply and lost relative strength to the US market. Europe was a big disappointment; its rally very short lived. I was optimistic about the iShares S&P Europe 350 ETF (IEV) in the August 29th newsletter but price fell below 45.00, the key support, indicating a failure has taken place. This breakdown implies more negative repercussions going forward. The stock market charts are not appealing.

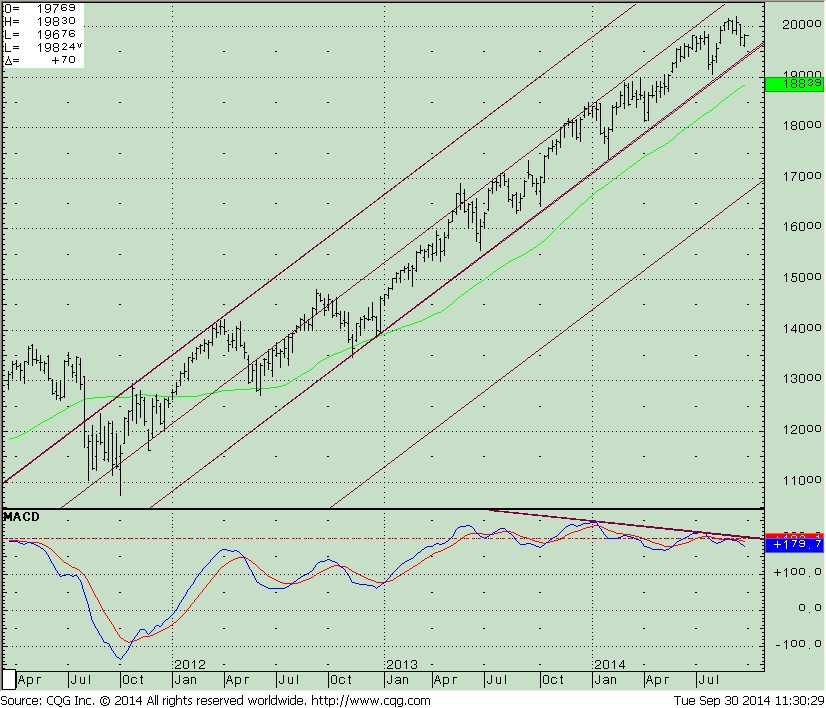

Chart 1: Weekly S&P 500 SPDR (SPY) and its MACD

The chart to the right shows the intermediate weekly uptrend of the S&P 500 weekly uptrend of the S&P 500 (SPY) barely intact from October 2013.Notice how each of the declines that we have had have held this key trend line. The S&P 500 is trading at 193.91 at the time of this writing, a few percent above the 50 week Moving Average which lies at188.39 and rising each week. With the daily trendline already broken, and price below its50 day moving average, staying above this level is important. If the weekly trendline is broken, with the increasing volatility market there is a possibility of even wider daily swings to happen more frequently. The channel line (parallel) gives an objective to 169.00 if the decline continues.

The lower part of the chart is the weekly MACD, a momentum indicator that continues to show less momentum on each rally and a negative divergence, a new high in price but not in MACD. Negative divergences have occurred periodically along the advance, but so far a significant decline of 10% has not materialized. This time might be different.Weekly MACD is not oversold enough to be considered in a favorable position where intermediate advances occur. More time is needed for a more favorable pattern to develop.

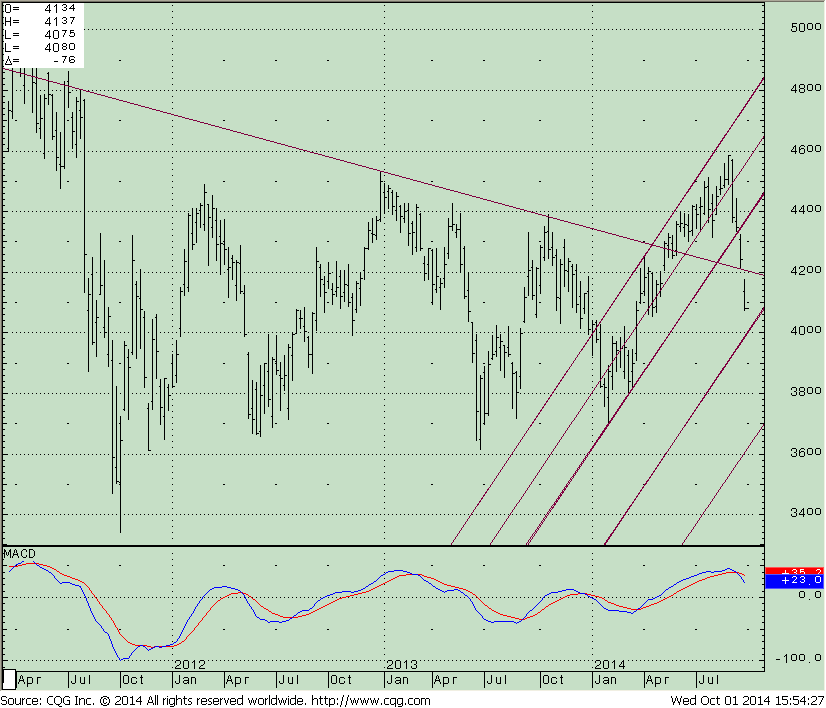

The international sector, especially the emerging market area, has been under more pressure than the US market. The iShares MSCI Emerging Markets Index ETF (EEM) rally from late March to early September has reversed, giving up much of its gains after losing 7.77% in September. October is starting off better.

The largest countries represented in EEM (as of September 30 2014) were in China

Chart 2 Weekly iShares MSCI Emerging Market Index ETF (EEM)

The largest countries represented in EEM as of September 30 2014 were in China 17.74%,

South Korea 15.29%, Taiwan 12.91%, and Brazil 9.63%. Latin America was hit the hardest losing19.09% in September, but all countries were weak with losses over 5%.

The top portion of the chart to the right shows EEM weekly. The breakout failed to hold the first channel support at 42, the retracement line of the breakout. The next lower objective is 40.00 where a pause in the decline could temporarily take place in the short term, but I don’t think this level will hold. With the lower portion MACD extended and generating a clear sell signal there is a good chance of a further pullback to 36.00. If The EEM rallies to penetrate 42.50 this would nullify the downside objective.

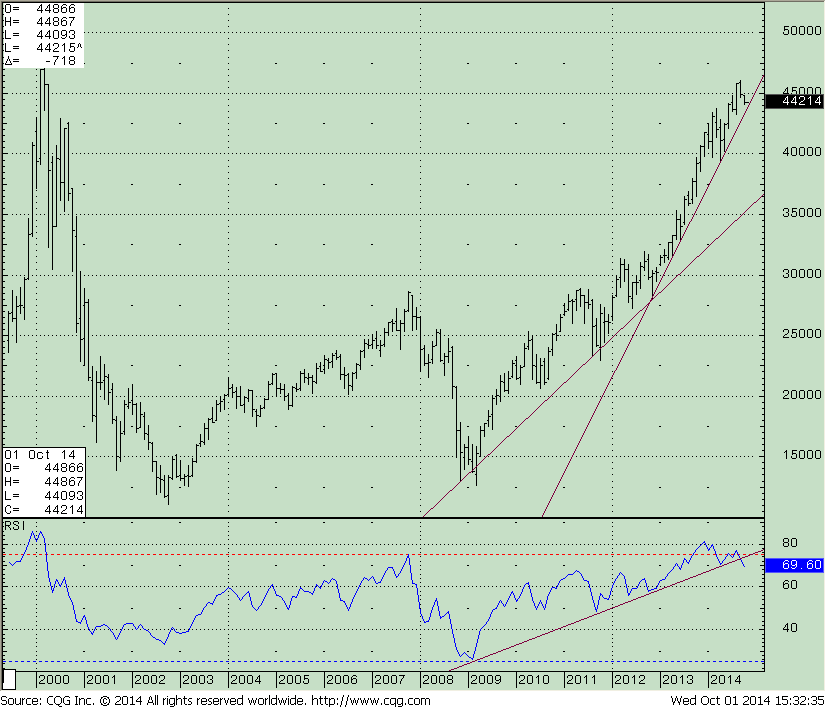

ALERT –THE MONTHLY RSI UP TRENDLINE FOR THE NASDAQ COMPOSITE HAS BEEN BROKEN

Chart 3 Monthly Nasdaq Composite

In the September 12 newsletter I wrote The S&P 500 and Nasdaq Long Term Trend Remain Up. This is no longer the case. The lower part of the chart to the right shows that the 14 month RSI of the Nasdaq Composite from 2008 has been violated to the downside. This is giving a major warning sign that price will follow and this decline could be more serious than what we have had. Time will tell.

Just To Sum Up:

For the past few months I have given in the newsletter these key support levels to monitor. We are approaching them quickly; 190.00 on The S&P 500 ETF (SPY) and 94.90 on the PowerShares QQQ Trust (QQQ). The iShares Russell 2000 Index ETF (IWM) closed at 107.91 and made an intra-day low on October 1, a hair above the key 107.50 support level.

The S&P 500 is very close to breaking its weekly uptrendline in terms of price but so far it’s intact. Longer term monthly RSI charts which were holding their RSI uptrendline have now broken below, giving a warning. New lows on the New York Index are expanding, now over 250, a danger zone. The bulls appear to no longer be in control.

Now is a good time to review your portfolio, keep a more active eye on the market, and be cautious. Even with the market being oversold on the short term it looks like it’s too early for this to be a safe buying opportunity to step in. This could be the time where the S&P will break support and more aggressive selling will take place. The most positive point I can make is we are entering a more favorable seasonal period historically, where the mid-term presidential cycle is favorable and market risk has been contained with significant price gains in the past. The bulls and bears will be in battle. I am recommending you to protect your investments: focus on preservation of your capital just in case this is the decline where the S&P falls more than 10% which it hasn’t happened in over four years.

If you need some assistance with your investments I invite you to call me at 844-829-6444 or E mail me at BGortler@Signalert.com

Source: http://www.pritchettcartoons.com/aging-bull.htm, accessed 10/3/2014

Source: http://www.pritchettcartoons.com/aging-bull.htm, accessed 10/3/2014

Sign up for a Free 3 Issue Trial of the Systems and

Forecasts newsletter where I am the Guest Editor http://bit.ly/1fM79hp