Bonnie’s Market Update 1/10/25

Bonnie’s Market Update 1/10/25

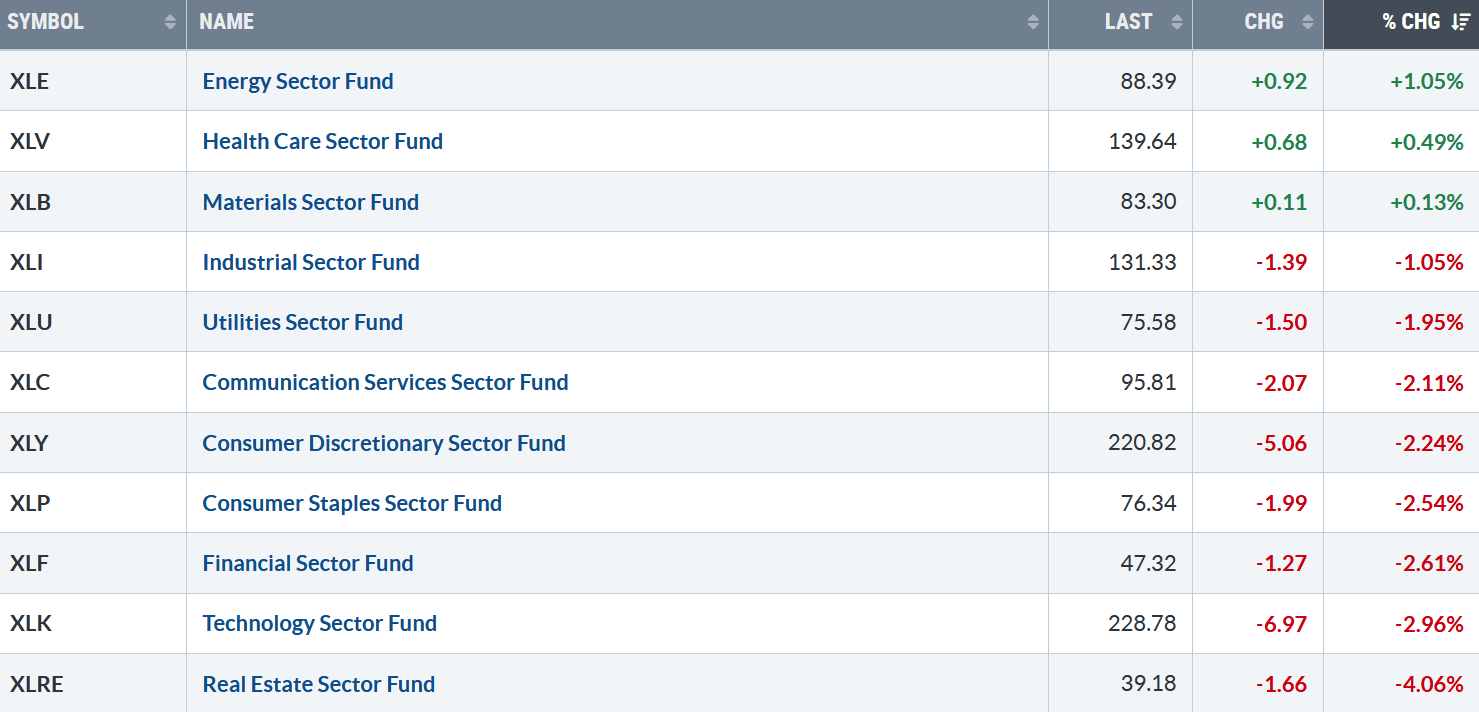

The shaky start to 2025 continued. Only three of the eleven S&P SPDR sectors were higher last week. Energy (XLE) and Health Care (XLV) were the leading sectors, while Technology (XLY) and Real Estate (XLRE) were the weakest sectors. The SPDR S&P 500 ETF Trust (SPY) fell -1.94%.

S&P SPDR Sector ETFs Performance Summary 1/3/25 – 1/10/25

Source: Stockcharts.com

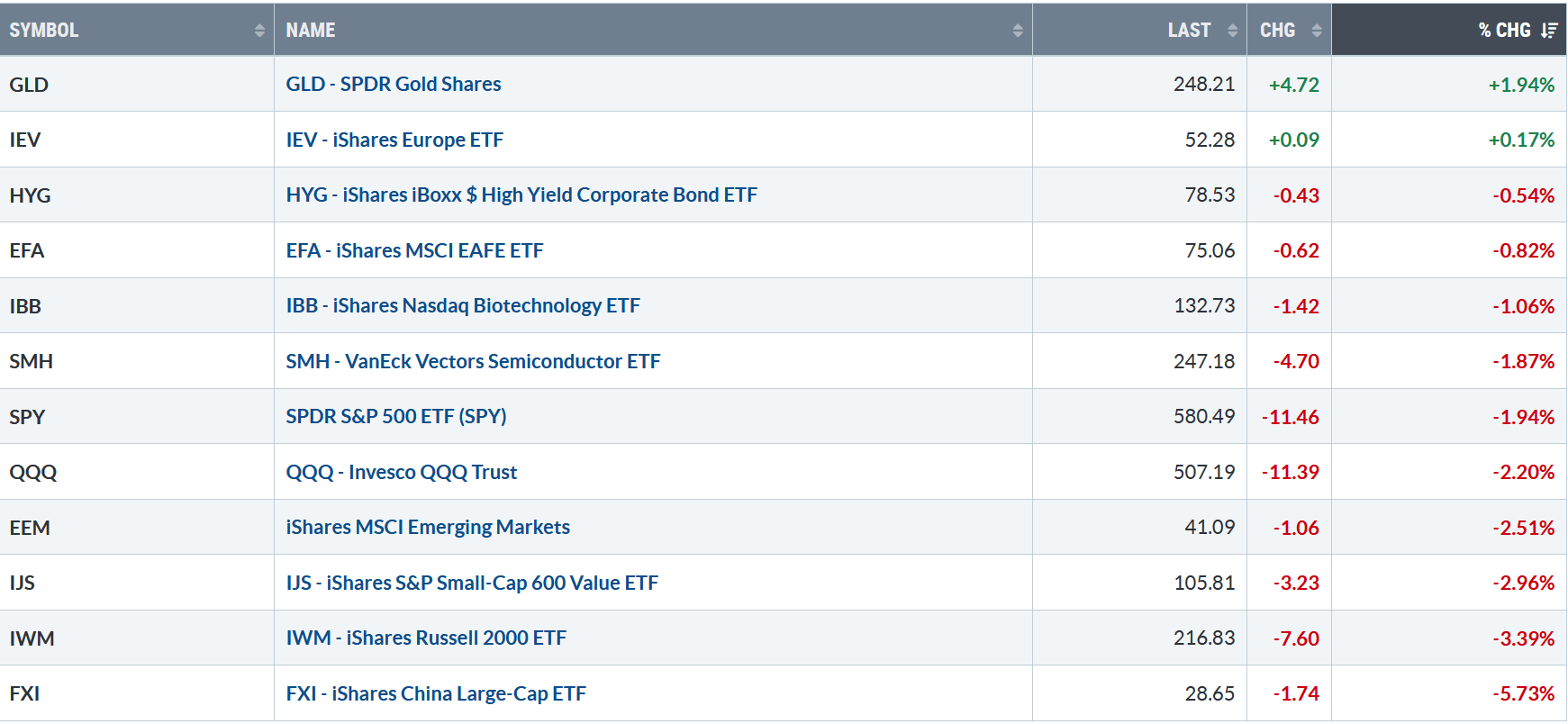

Figure 2: Bonnie’s ETFs Watch List Performance Summary 1/3/25 – 1/10/25

Source: Stockcharts.com

Gold was strong, while Small Cap Growth, Value, Technology, and China were under selling pressure last week.

I invite you to join my Facebook Group. Learn more about it here: Wealth Through Market Charts.

Charts to Watch:

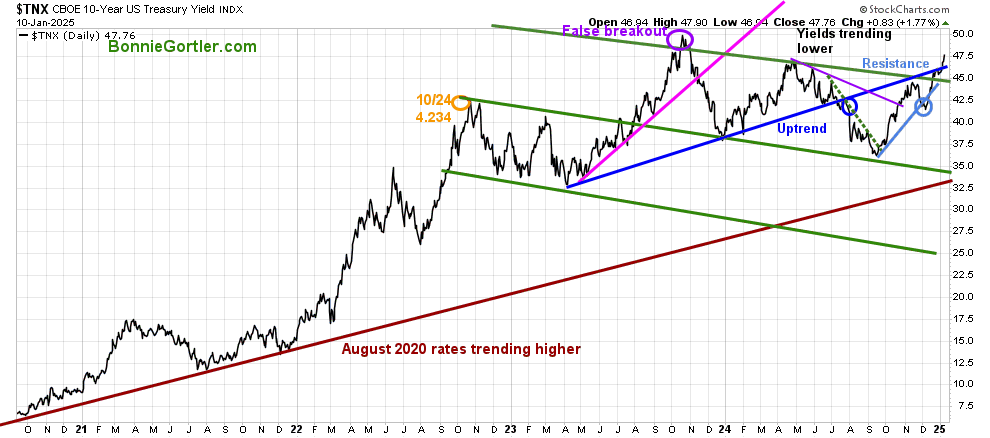

Figure 3: UST 10YR Bond Yields Daily

Source: Stockcharts.com

The 10-year U.S. Treasury rose last week, closing at 4.776, trending higher, the highest close since April 2024. Continued rising yields are not helping equities.

Learn how to implement a powerful wealth-building mindset and charting strategies to help you grow your wealth in the comfort of your home in my eCourse Wealth Through Investing Made Simple. Learn more here.

Figure 4: Fear & Greed Index

Source. CNN.com

Investor sentiment based on the Fear and Greed Index (a contrarian index) measures the market’s mood. The Fear and Greed Index fell, closing at 27, showing continued fear last week, getting closer to extreme fear where many good buying opportunities have occurred in the past.

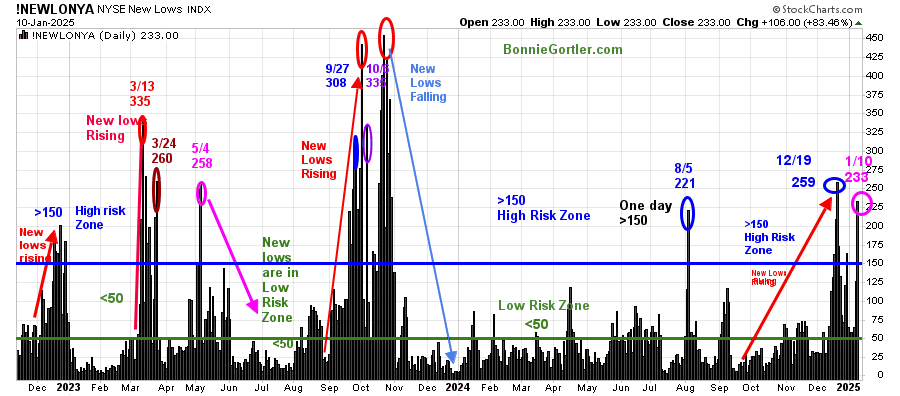

Figure 5: NYSE New Lows

Source: Stockcharts.com

New Lows on the NYSE rose in December, with a high of 259, then briefly contracted. New Lows are again rising, now in the high-risk zone above 150, closing at 233 (pink circle) on 01/10/25. It’s a good time to review your portfolio if you have not done so.

Watch New Lows closely now to see if New Lows rise or fall. If lows New Lows remain above 150 and continue to expand, it would be bearish and a warning sign of more weakness ahead. On the other hand, if New Lows fall between 25 and 50, it will be positive in the short term.

Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

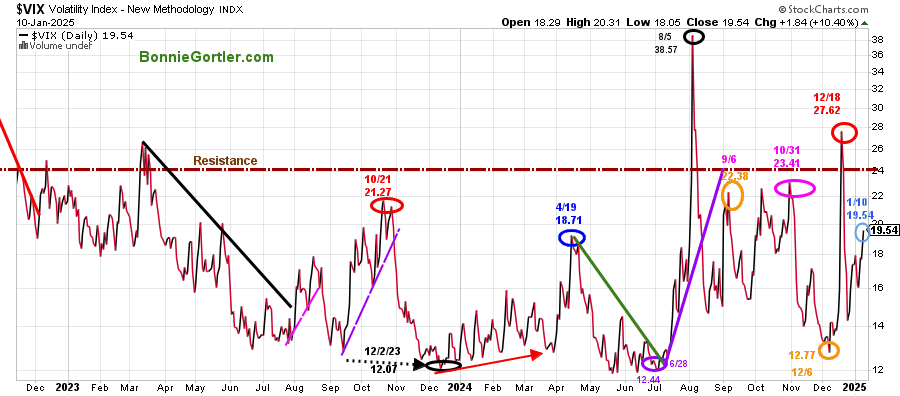

Figure 6: CBOE Volatility Index (VIX)

Source: Stockcharts.com

The CBOE Volatility Index (VIX), a measure of fear, made a low on 12/6 of 12.77, then rose to a short-term peak of 27.62 on 12/18. VIX closed at 16.13 as equity prices fell. VIX rising would imply more weakness, while a decline in VIX would be positive for equities in the near term.

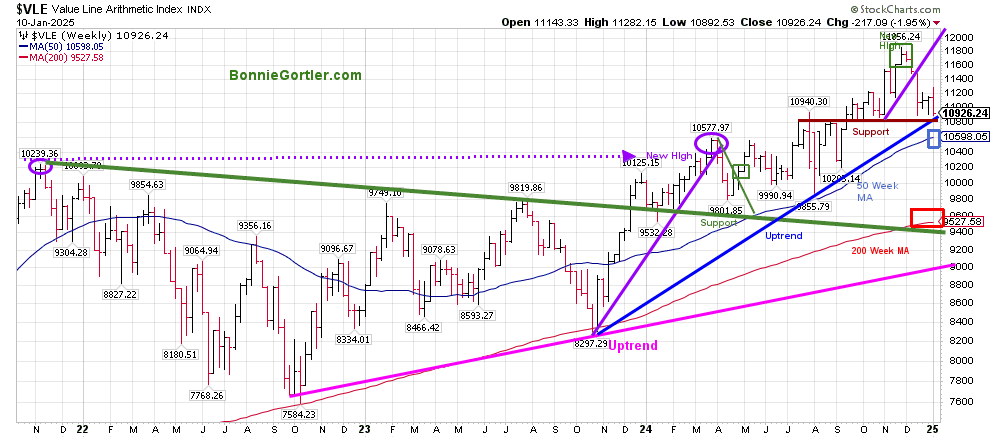

Figure 7: Value Line Arithmetic Average

Source: Stockcharts.com

The Value Line Arithmetic Index ($VLE) is a mix of approximately 1700 stocks. The VLE uptrend from October 2022 (pink line) and October 2023 (blue line) remains in effect.

The October 2024 trendline (purple line) broke four weeks ago, and VLE has since retraced. VLE has remained above support so far, which is positive. However, it’s negative that VLE closed near its low for the week.

VLE has remained in an uptrend since November 2023 but threatens to break with weakness this week. VLE closed above its 50-week MA (blue rectangle) and the 200-week MA (red rectangle).

Support remains at 10800, followed by 10500. Resistance is 11300, followed by 11600. It would be positive if VLE closes above 11300 in the short term and then has enough strength to close above the 11/25 high at 11856.24.

You can explore Bonnie’s market charts from last week and more HERE.

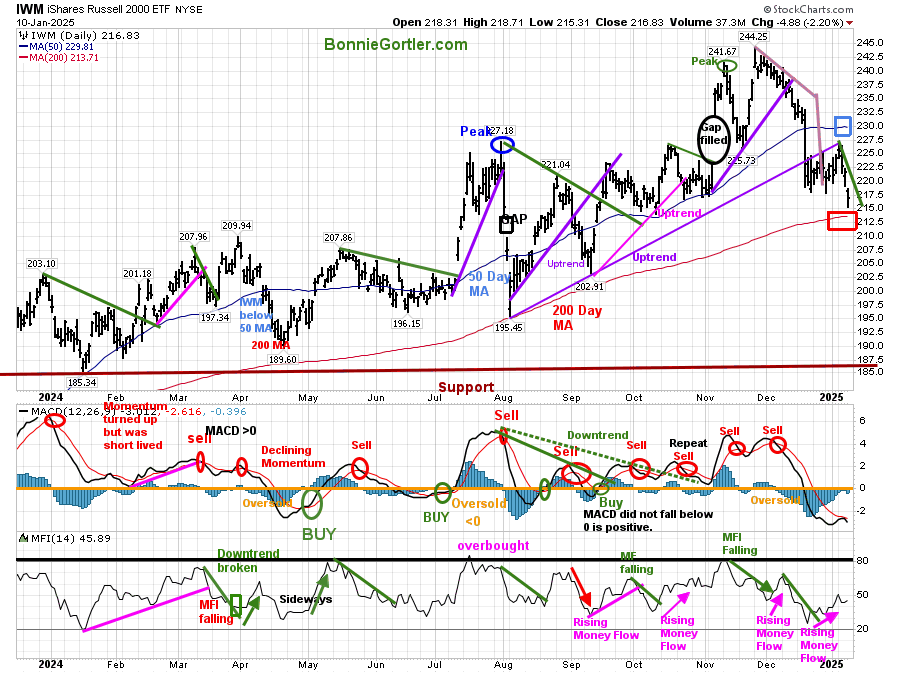

Continued Weakness in Russell 2000 is Troublesome

Figure 8: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue rectangle) and 200-Day Moving Average (MA) (red rectangle) that traders watch and use to define trends.

IWM fell -3.39% last week, weaker than the S&P 500. It remains unfavorable that IWM broke its short-term November uptrend and continues trading below the August uptrend (purple line) and the 50-day Moving Average.

MACD is short-term oversold, is below 0, and is positioned for a fresh MACD buy on a turn-up.

Money Flow broke the downtrend from December 24 and is rising, but it is not very convincing as IWM continues to fall.

Support is at 213.00. Two closes below 213.00 wouldimply further weakness. On the other hand, two closes above 222.50 would be positive.

You can explore Bonnie’s market charts from last week and more HERE.

Figure 9: QQQ Weekly

Source: Stockcharts.com

Invesco Trust (QQQ) fell -2.20% last week, with no follow-through to the previous weeks gains. The QQQ intermediate uptrend from October 2023 remains positive (purple line).

The QQQ intermediate momentum has weakened, generating another repeat sell by MACD.

Money Flow is trending lower.

Support is 500.00, followed by 480.00 and 460.00. Resistance is at 530.00 and 540.00.

The daily chart remains oversold, implying a possible bounce. However, now, there is an increased risk of selling intensifying in the short term if technology stocks continue to weaken and support levels break.

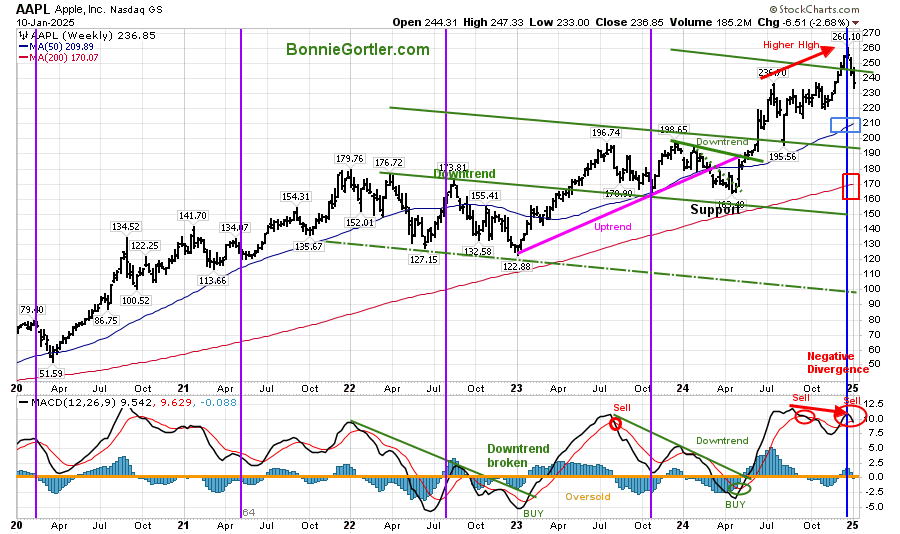

Warning: Intermediate Term Negative Divergence in Apple (AAPL)

Figure 10: AAPL Weekly

Source: Stockcharts.com

Updating the Apple (AAPL) chart mentioned in the 11/29/24 market update.

It appears that AAPL peaked on schedule after touching slightly above the top of its weekly channel and turned down, suggesting the intermediate cycle has topped.

Support is at 210.00, and Resistance is at 260.00.

MACD momentum is weakening, falling from above 0, and giving a repeat sell. Be alert that this sell is a Negative Divergence (higher price high and lower high in MACD), a bearish pattern.

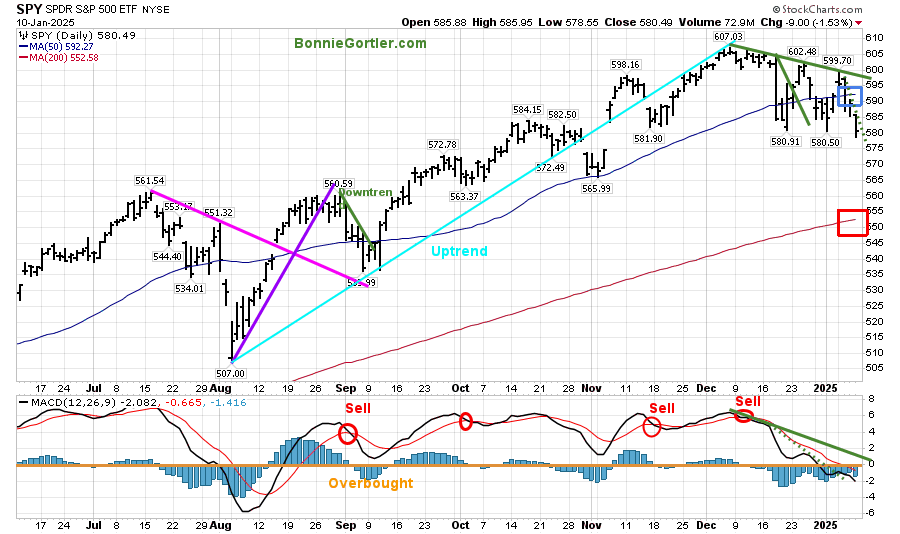

Figure 11: SPY Daily

Source: Stockcharts.com

The S&P 500 (SPY) remains in a downtrend from its peak in December.

SPY closed at 580.49, down -1.94%, giving back the previous week’s gains closing on Friday, near its weekly low and below daily support at 586.00, not a good sign, but closing slightly above intermediate support at 580.00.

Support remains at 580.00, followed by 565.00 and 550.00. Resistance is at 586.00, 593.00, and 603.00.

For more of Bonnie’s market charts, Click HERE.

Summing Up:

Friday’s tape action was poor after the December jobs report was hotter than expected as yields rose. Market breadth has weakened, momentum patterns are weakening, volatility is increasing, and Small Caps, Finance, and Technology are weak. Some support levels have broken. This week, bank earnings and key inflation reports are released. A short-term oversold relief rally is possible, but the risk of a market correction increases as the intermediate-term market momentum patterns weaken. Manage your risk, and your wealth will grow.

Let us get to know each other better. If you have any questions or want to explore charts together, contact me at Bonnie@Bonniegortler.com.

If you like this market update, you will love my free Charting Charting Master Class. Sign up HERE.