Bonnie’s Market Update 11/22/24

Bonnie’s Market Update 11/22/24

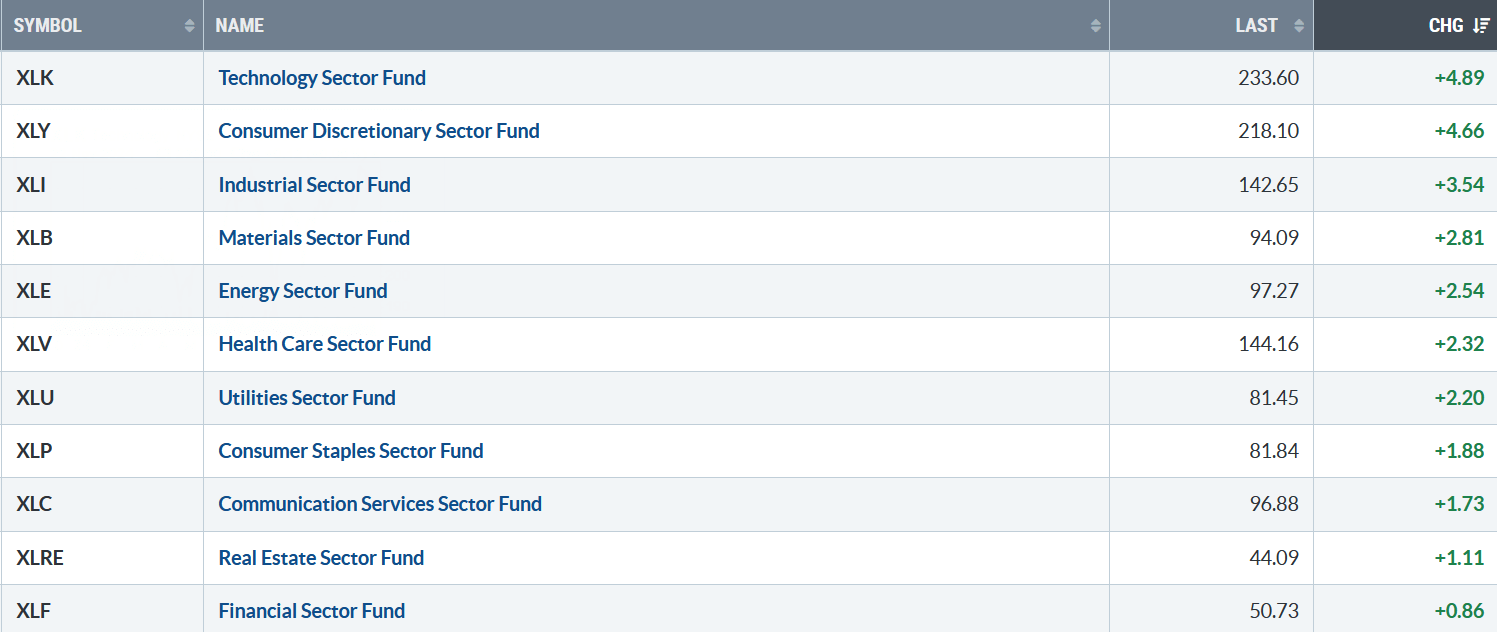

Selling turned to buying last week. All eleven S&P SPDR sectors were higher last week. Technology (XLK) and Consumer Discretionary (XLY) were the leading sectors, while Real Estate (XLRE) was the weakest sectors. The SPDR S&P 500 ETF Trust (SPY) rose +1.67%.

S&P SPDR Sector ETFs Performance Summary 11/15/24 – 11/22/24

Source: Stockcharts.com

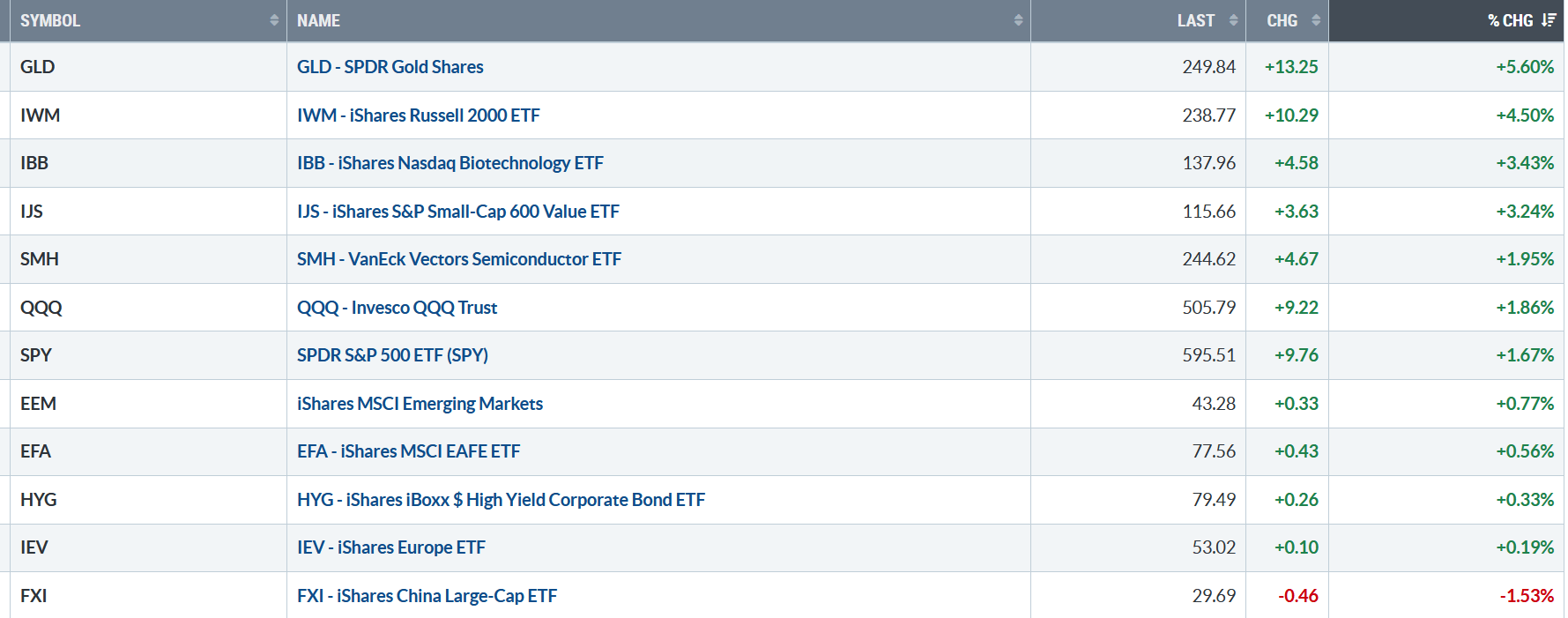

Figure 2: Bonnie’s ETFs Watch List Performance Summary 11/15/24 – 11/22/24

Source: Stockcharts.com

A broad rally last week after the previous week’s weakness. Gold and Small Caps led, outperforming the S&P 500 (SPY).

You can explore Bonnie’s market charts from last week and more HERE.

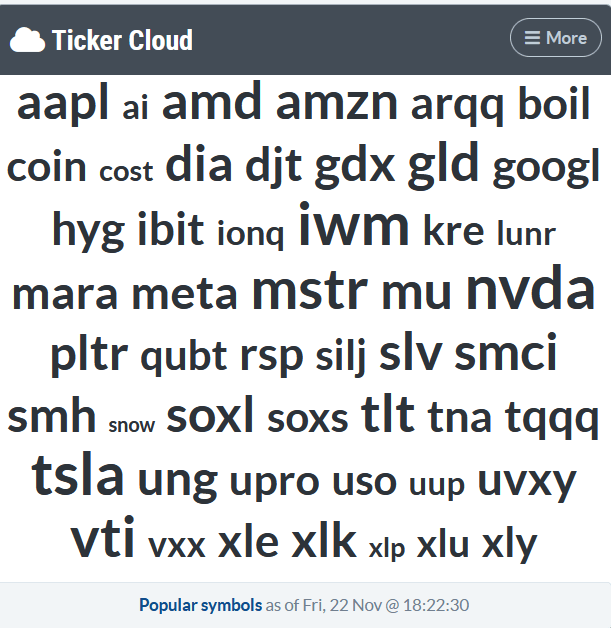

Figure 3: Popular Stocks 11/22/24

Source: Stockcharts.com

Symbols of stocks that investors show interest in.

Charts to Watch:

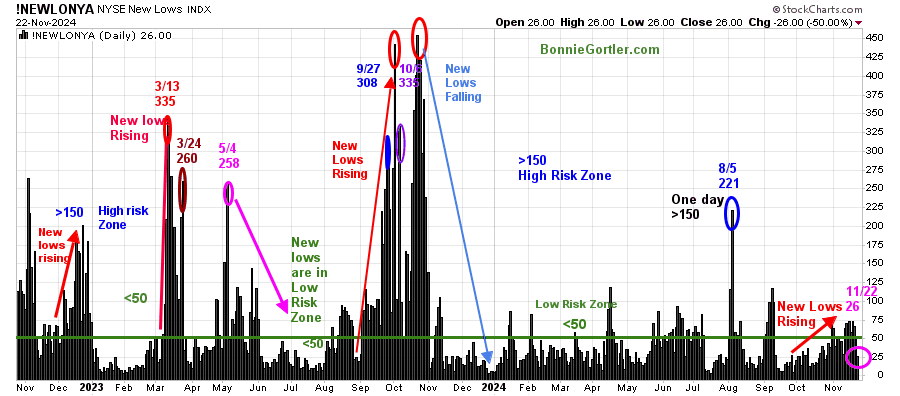

Figure 4: NYSE New Lows

Source: Stockcharts.com

New Lows on the NYSE remain in the lower risk zone, closing at 26 (pink circle) on 11/22/24. Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

Figure 5: CBOE Volatility Index (VIX)

Source: Stockcharts.com

The CBOE Volatility Index (VIX), a measure of fear, closed at 15.24 (blue circle), a low and low reading, now falling, which is positive.

Are you interested in learning more about the stock market? Learn how to implement a powerful wealth-building mindset and simple, reliable strategies to help you grow your wealth in my eCourse Wealth Through Investing Made Simple. Learn more here.

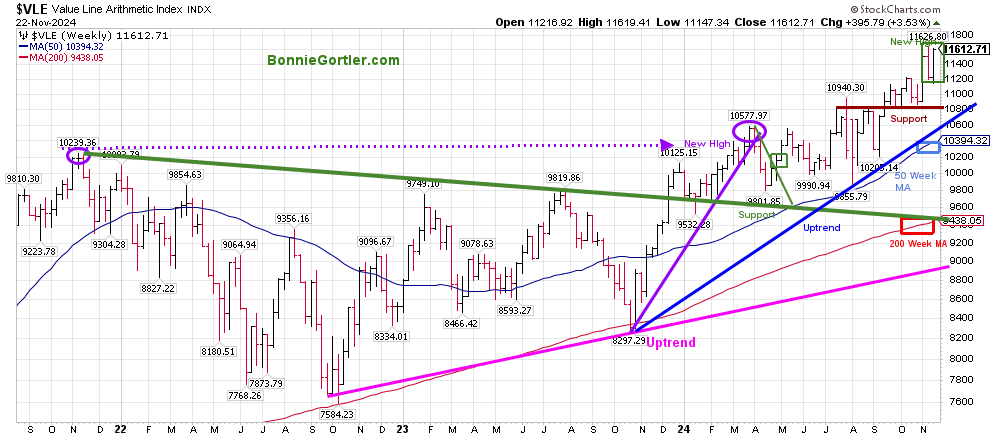

Figure 6: Value Line Arithmetic Average

Source: Stockcharts.com

The Value Line Arithmetic Index ($VLE) is a mix of approximately 1700 stocks.

VLE uptrend from October 2022 and October 2023 remains in effect. It’s bullish that VLE rebounded +3.53%, closing near its high for the week, slightly under the previous high.

VLE remains above the 50-week MA, which is rising (blue rectangle), and the 200-week MA (red rectangle), a sign of underlying strength.

Support is at 10800, followed by 10400.

It would continue to be positive if VLE holds support and closes above the previous week’s high at 11626.80.

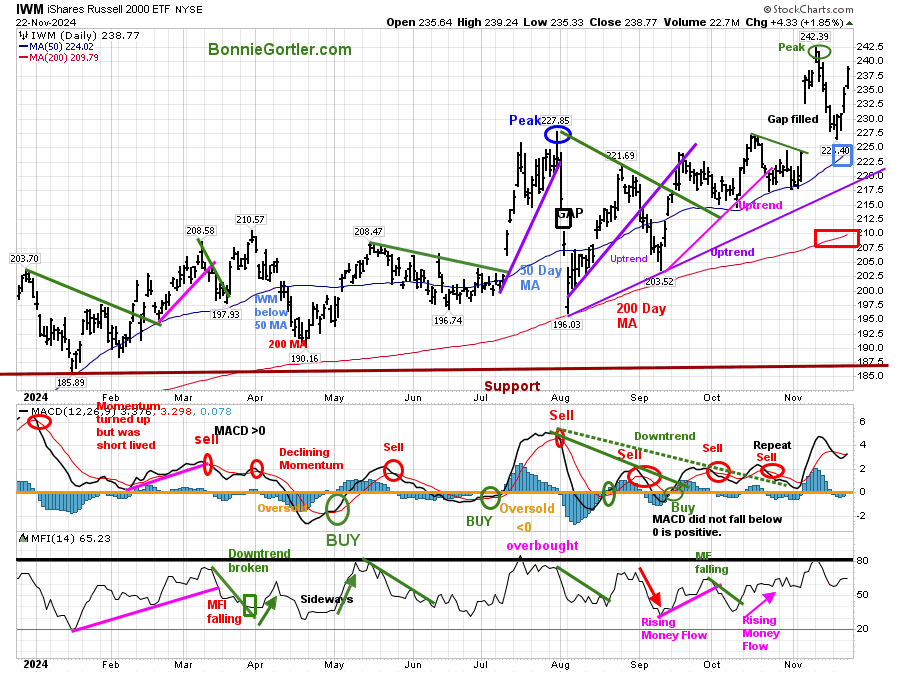

Small Caps Leadership Last Week is Bullish

Figure 7: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (M.A.) (blue rectangle) and 200-Day Moving Average (M.A.) (red rectangle) that traders watch and use to define trends.

IWM made a new high in early November and reversed the lower to fill the gap but held support at the 50-day MA and gained +4.50% last week. Further strength shown by closing above the high made on 11/11/24 of 242.39 would be positive.

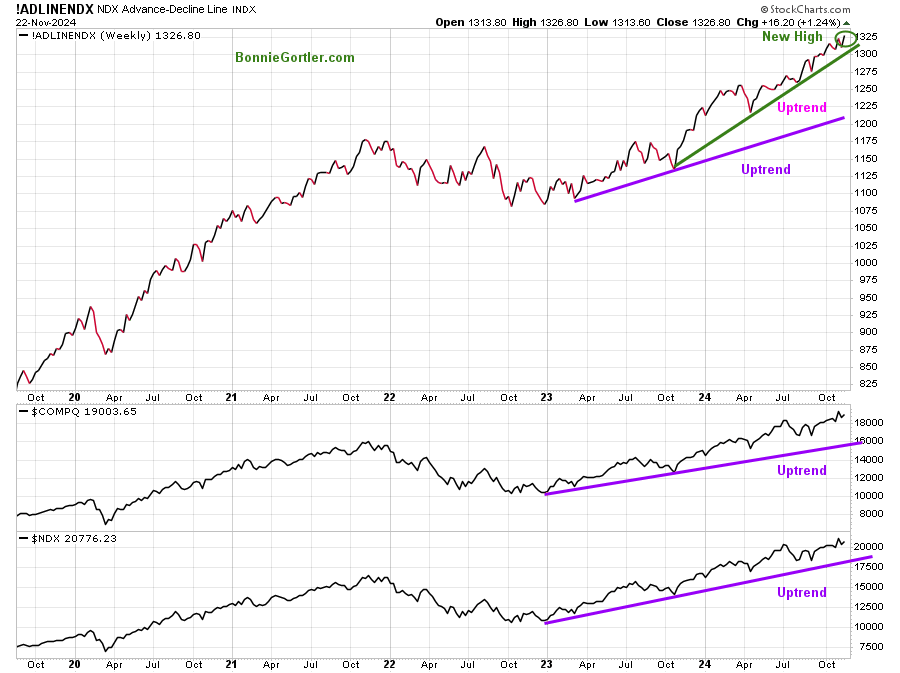

Figure 8: Nasdaq Advance Decline line (Top) Nasdaq Composite (Middle) Nasdaq 100 (Bottom)

Source: Stockcharts.com

The uptrend remains for the intermediate term for the NDX Advance Decline Line, Nasdaq Composite. and NDX Index.

The bulls continue to get the benefit of the doubt as long as the uptrends remain intact. However, be alert for a correction if the uptrends break.

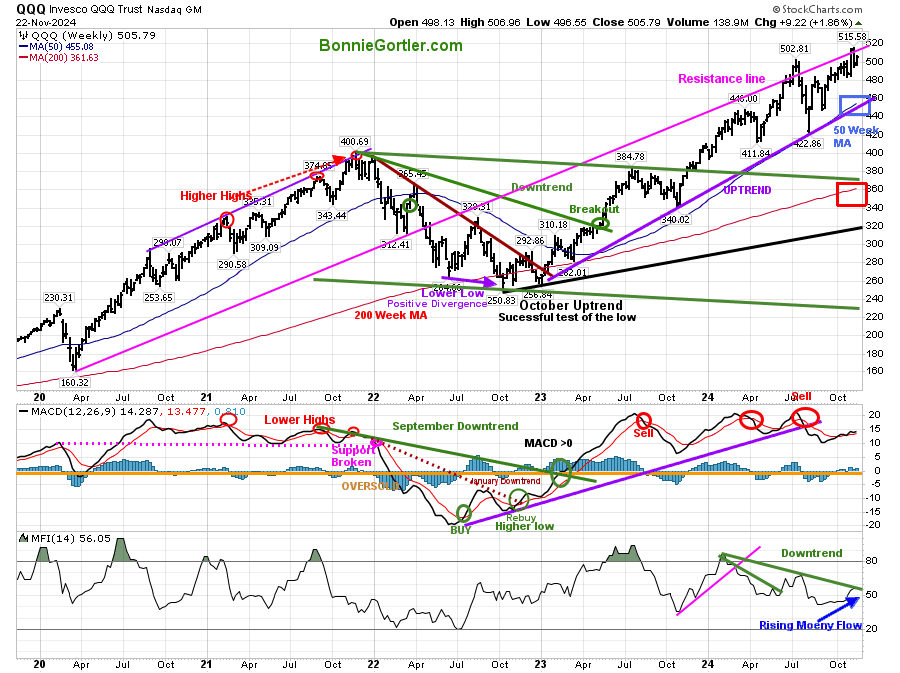

Figure 9: QQQ Weekly

Source: Stockcharts.com

It’s positive the QQQ intermediate uptrend from October 2023 remains intact.

A weekly close above 515.58 would be positive, while a weekly close below 480.00 will likely lead to some selling pressure. It’s a positive sign Money Flow has turned up and is close to breaking the downtrend. Further buying could accelerate the Nasdaq 100 higher.

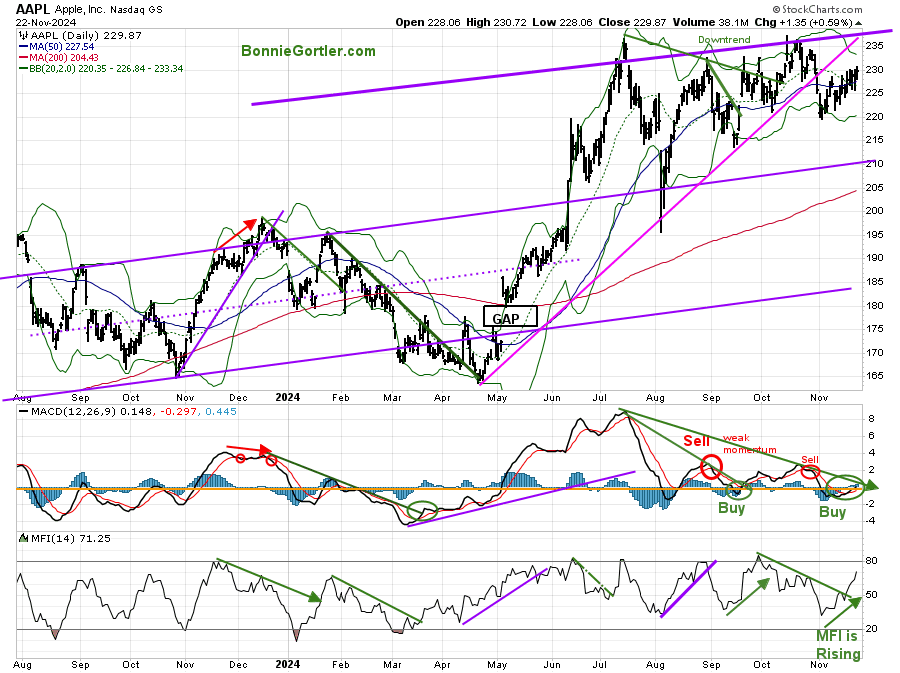

Figure 10 APPLE (AAPL) Daily

Source: Stockcharts.com

Apple gained +2.16% last week, closing near its weekly high. MACD (middle chart) is now on a buy, no longer showing downside momentum with rising Money Flow. Next week, look for Apple (AAPL) to lead the QQQ higher.

For more of Bonnie’s market charts, Click HERE.

Summing Up:

The major averages were all higher last week on improved market breadth. Favorable seasonality is here. Historically, it is not typically a time to get bearish. Portfolio managers will likely buy stocks for the upcoming end-of-month buying. As long as support levels hold and there is no major unexpected news, the major averages will continue higher. I wish you and your family a Happy Thanksgiving. Manage your risk, and your wealth will grow.

Let us get to know each other better. If you have any questions or want to explore charts together, contact me at Bonnie@Bonniegortler.com.

If you like this market update, you will love my free Charting Charting Master Class. Sign up HERE.