Bonnie’s Market Update 10/25/24

Bonnie’s Market Update 10/25/24

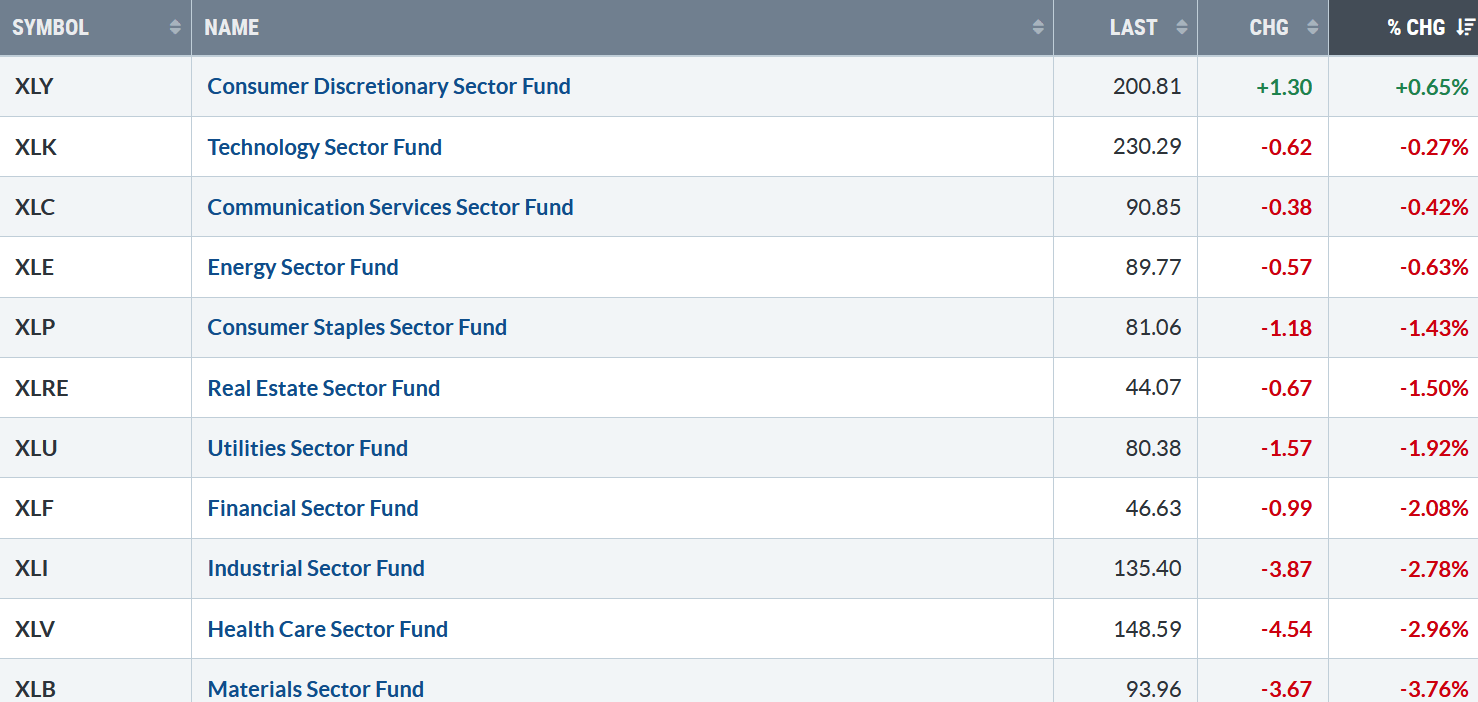

The rally lost steam last week. Only one of the eleven S&P SPDR sectors was higher last week. Consumer Discretionary (XLY) had a small gain, while Healthcare (XLV) and Materials (XLE) were the weakest sectors. The SPDR S&P 500 ETF Trust (SPY) fell -0.95%.

S&P SPDR Sector ETFs Performance Summary 10/18/24 – 10/25/24

Source: Stockcharts.com

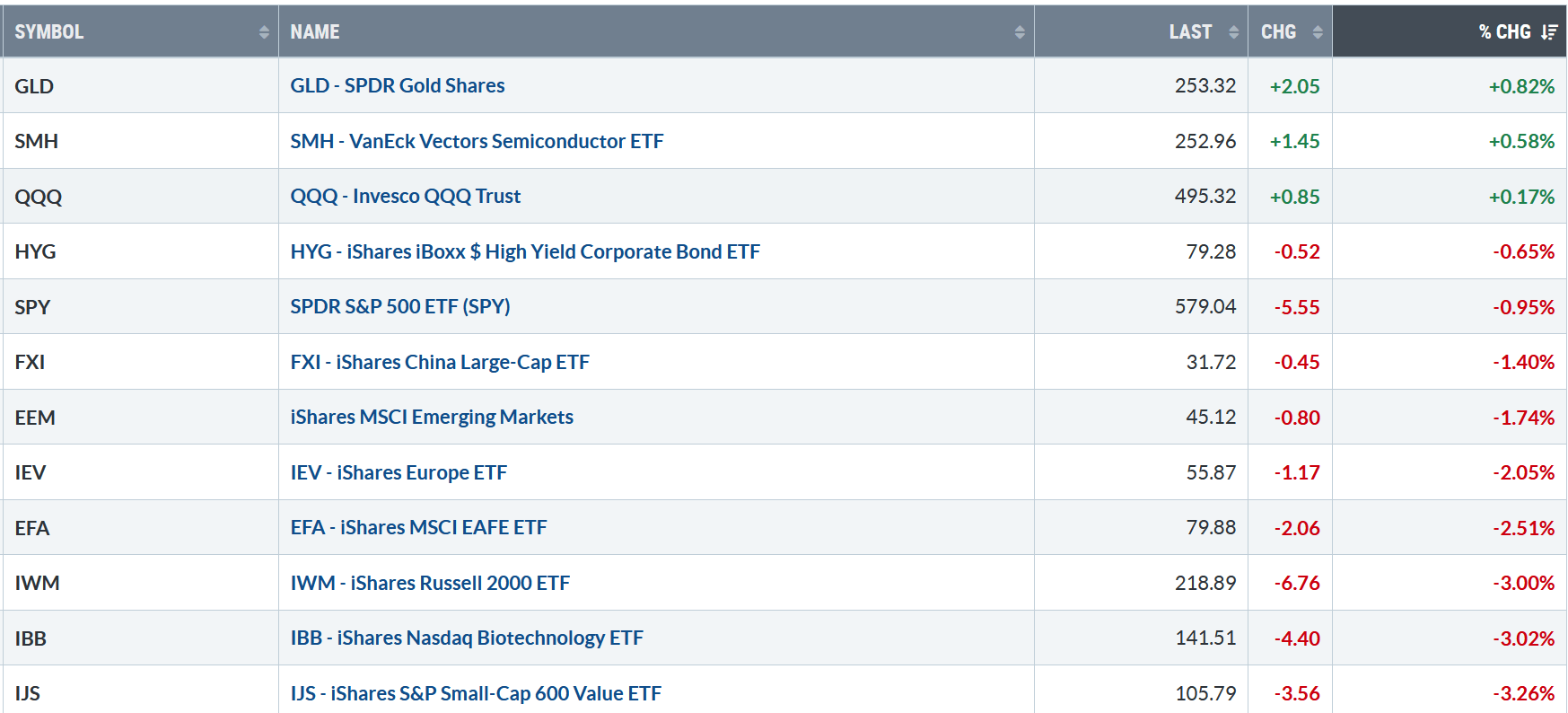

Figure 2: Bonnie’s ETFs Watch List Performance Summary 10/18/24 – 10/25/24

Source: Stockcharts.com

Gold continued higher. Semiconductors and Technology had small gains ahead of key earnings announcements for next week. China fell for the third week, along with weakness in other global markets. Biotechnology and Small-Cap Growth and Value both fell, weaker than the S&P 500.

You can explore Bonnie’s market charts from last week and more HERE.

A Few Favorites:

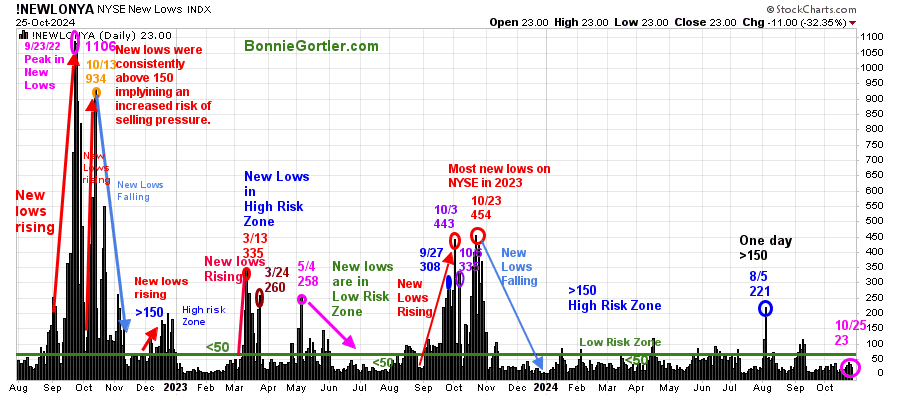

Figure 3: NYSE New Lows

Source: Stockcharts.com

New Lows on the NYSE remain in the lower risk zone, closing at 23 (pink circle) on 10/25/24. Learn more about the significance of New Lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter here.

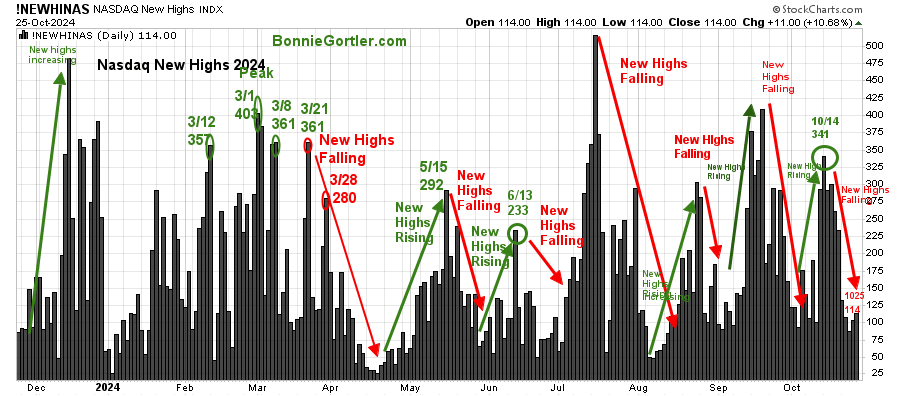

Warning: Market Breadth is Weakening

Figure 4: Nasdaq New Highs

Source: Stockcharts.com

Fewer stocks on the Nasdaq are making New Highs.

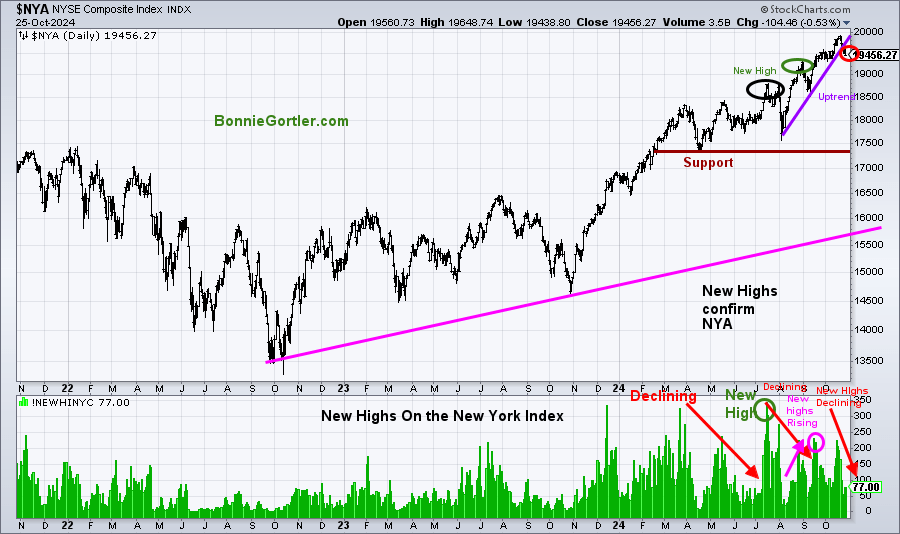

Figure 5: New York Index New Highs

Source: Stockcharts.com

Warning: Fewer stocks on the New York Stock Exchange index are making New Highs, and the uptrend from August in the New York Index broke (red circle).

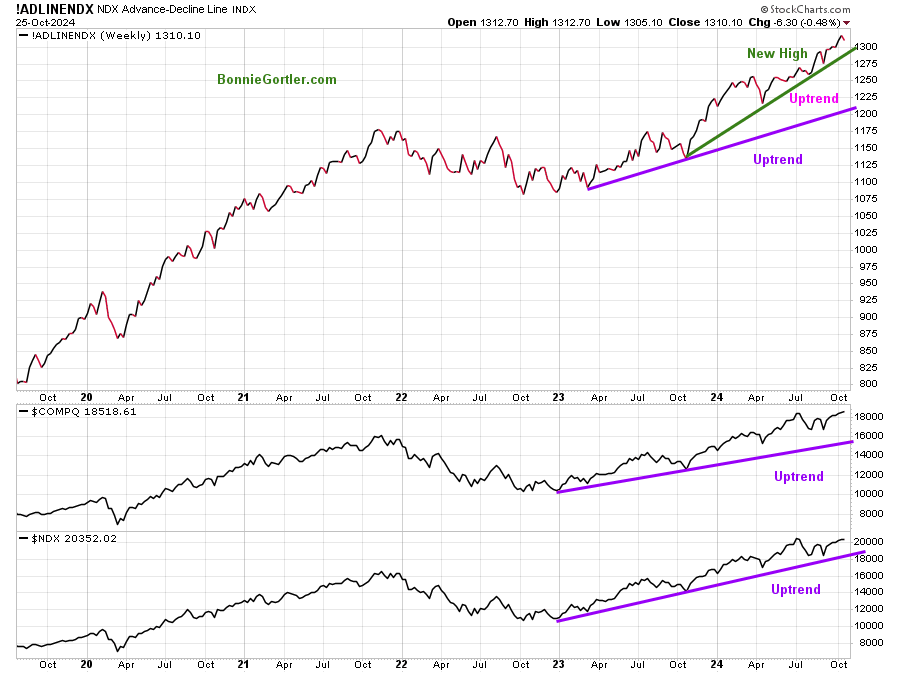

Figure 6: Nasdaq Advance Decline line (Top) Nasdaq Composite (Middle) Nasdaq 100 (Bottom)

Source: Stockcharts.com

The uptrend remains for the intermediate term for the NDX Advance Decline Line. Nasdaq Composite and NDX Index. At the moment, the bulls get the benefit of the doubt. However, a significant correction may occur if the uptrends break. As long as the uptrend in the NDX Advance-Decline line, Nasdaq Composite, and Nasdaq 100 remain in effect, the bulls remain in control, and risk is likely to be limited.

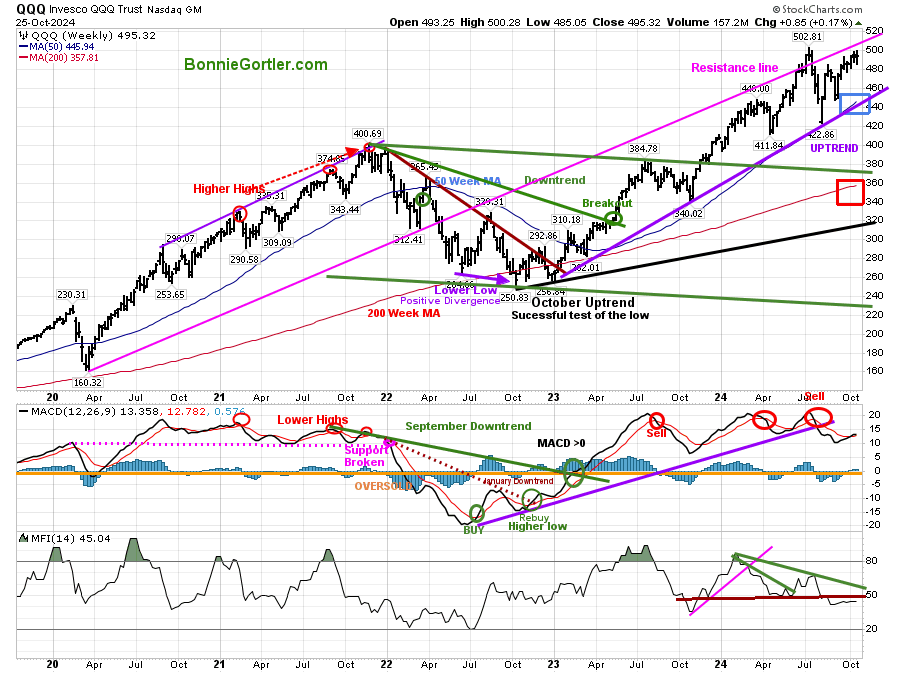

Figure 7: QQQ Weekly

Source: Stockcharts.com

The QQQ intermediate uptrend from October 2023 remains intact. However, this week’s key earnings of Microsoft (MSFT), Meta Platforms (META), Amazon (AMZN), and Apple (APPL) are likely to give a clue to the short-term direction.

For more of Bonnie’s market charts from last week and more, Click HERE.

Summing Up:

The Dow, New York Index, S&P Small and Mid Cap Index, Russell 2000, and Valueline Index fell more than 2% as the advance slowed. A pattern of higher lows and higher highs continues on many charts, which is positive. Support on the S&P 500 Index at 5640 and 5400 and QQQ support at 482.00 and 465.00 remain intact. Volatility will likely increase this week, with many key earning releases that could spark a resurgence in the advance if investors are satisfied with the results. However, the decline will accelerate if earnings fall short of expectations and support levels break. Manage your risk, and your wealth will grow.

Let’s get to know each other better. If you have any questions or want to explore charts together, contact me at Bonnie@Bonniegortler.com. Alternatively, you can go directly to my calendar to schedule a time. Click HERE:

If you like this market update, you will love my free Charting Charting Master Class. Sign up HERE.