Bonnie’s Market Update 9/27/24

Bonnie’s Market Update 9/27/24

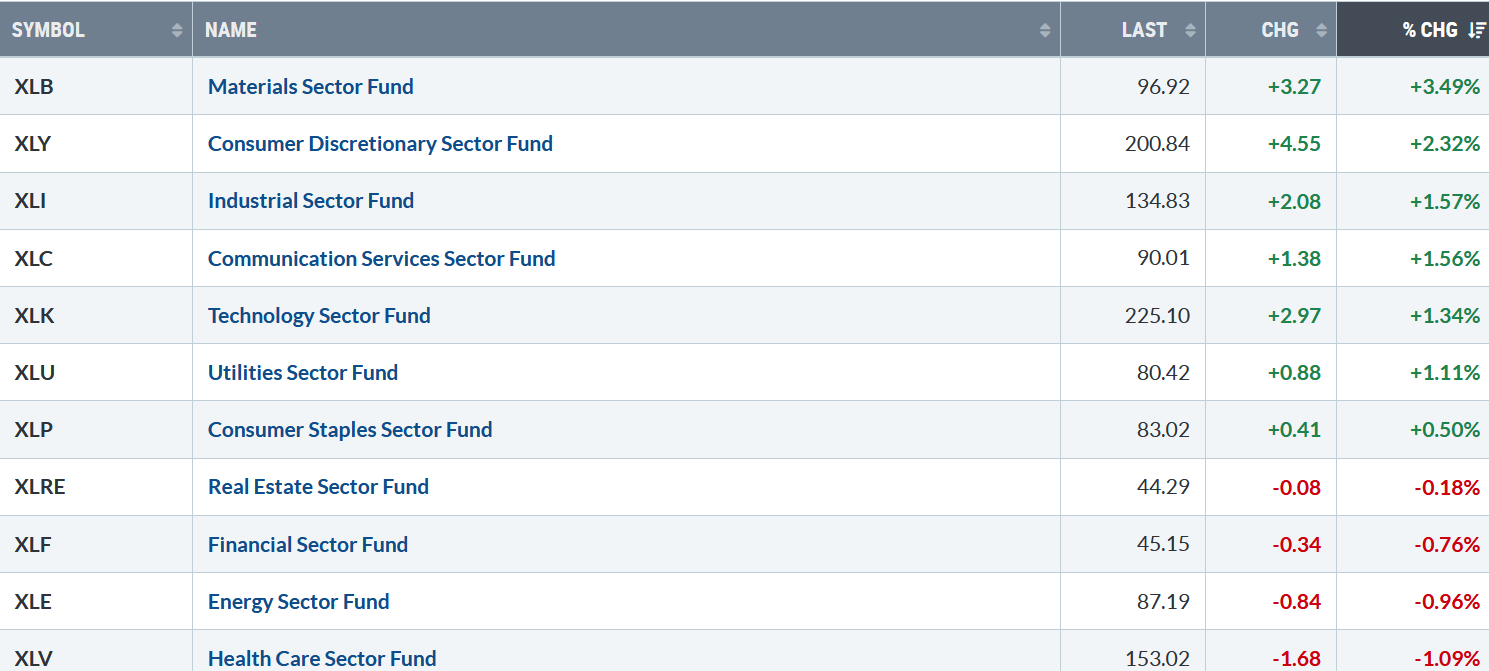

Major averages rose for the third week. Seven of the eleven S&P SPDR sectors were higher last week. Materials (XLB) and Consumer Discretionary (XLY) were the leading sectors, and Energy (XLE) and Health Care (XLV) were the weakest. The SPDR S&P 500 ETF Trust (SPY) gained +0.57%.

S&P SPDR Sector ETFs Performance Summary 9/20/24-9/27/24

Source: Stockcharts.com

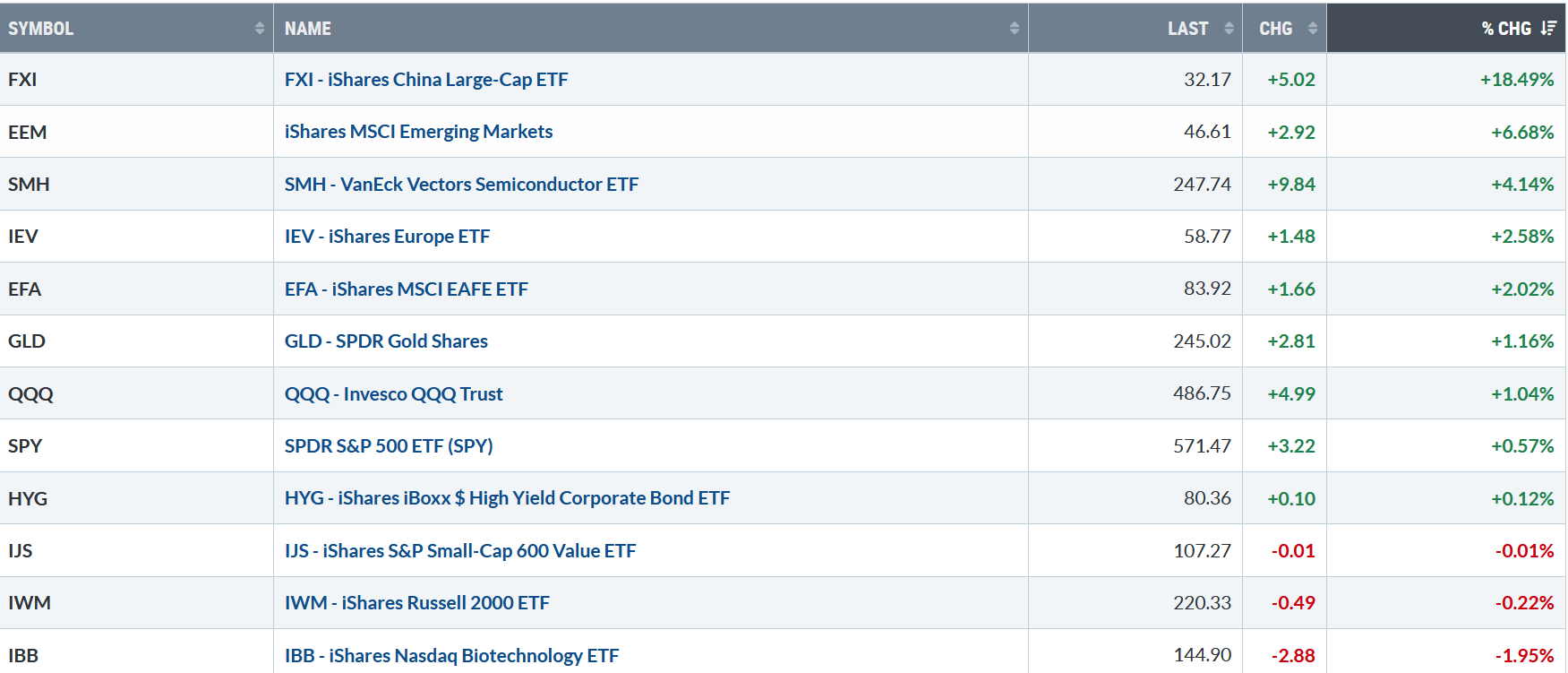

Figure 2: Bonnie’s ETFs Watch List Performance Summary 9/20/24-9/27/24

Source: Stockcharts.com

China’s stock market skyrocketed after news that the government would help the economy. Emerging Markets and Semiconductors were stronger than the S&P 500, while Small Caps, Growth, Value, and Biotechnology lagged.

You can explore Bonnie’s market charts from last week and more HERE.

Summing Up:

Tape action continues to be positive as the major averages continue higher. Its bullish market breadth has confirmed the highs in the major averages, implying any pullback is likely short-lived, and another test of the high will follow.

Let’s get to know each other better. If you have any questions or want to explore charts together, contact me at Bonnie@Bonniegortler.com. Alternatively, you can go directly to my calendar to schedule a time. Click HERE:

If you like this market update, you will love my free Charting Master Class. Sign up here.