The last few weeks of trading have been disappointing, to say the least. This month U.S. stock indexes suffered their worst decline since February. Selling has intensified, increasing volatility when support levels were violated that have been intact all year. The market tape action is concerning. The decline this month could wind up to be the biggest since January 2016 in the S&P 500 and Nasdaq. Market breadth is not improving. New 52-week lows on the New York Stock Exchange were higher than during the February low. Downside momentum has not been offset by a bullish thrust to the upside. International markets have sustained large losses and remain weak. There is no clear indication an advance will begin that could support the U.S. market.

n the other hand, our stock market U.S. models moved into the most bullish condition earlier this month, suggesting risk is most likely to be contained. Favorable seasonality is upon us. The major averages are oversold for the short-term, in an area where a tradeable rally is possible. The S&P 500 (SPY) recovered from well off its low made on October 23 instead of collapsing. It would be an encouraging sign if the low on 10/23 is not violated. However, it’s too early to say the decline is over and the bottom is in. I believe more base building is needed before a significant advance could be sustained.

A few signs that the market is healthy would be if:

- Tape action improves, such as daily NYSE 52-week lows contract and go below 50.

- More upside than downside volume on the NYSE and Nasdaq when the market rises.

- Several days in a row of positive breadth on the NYSE and Nasdaq with a greater number of stocks advancing than declining.

- In the near term the 10/23 low on the S&P 500 (SPY) holds at 268.61.

(Side note: Refer to the hotline for updates).

Where do we go from here?

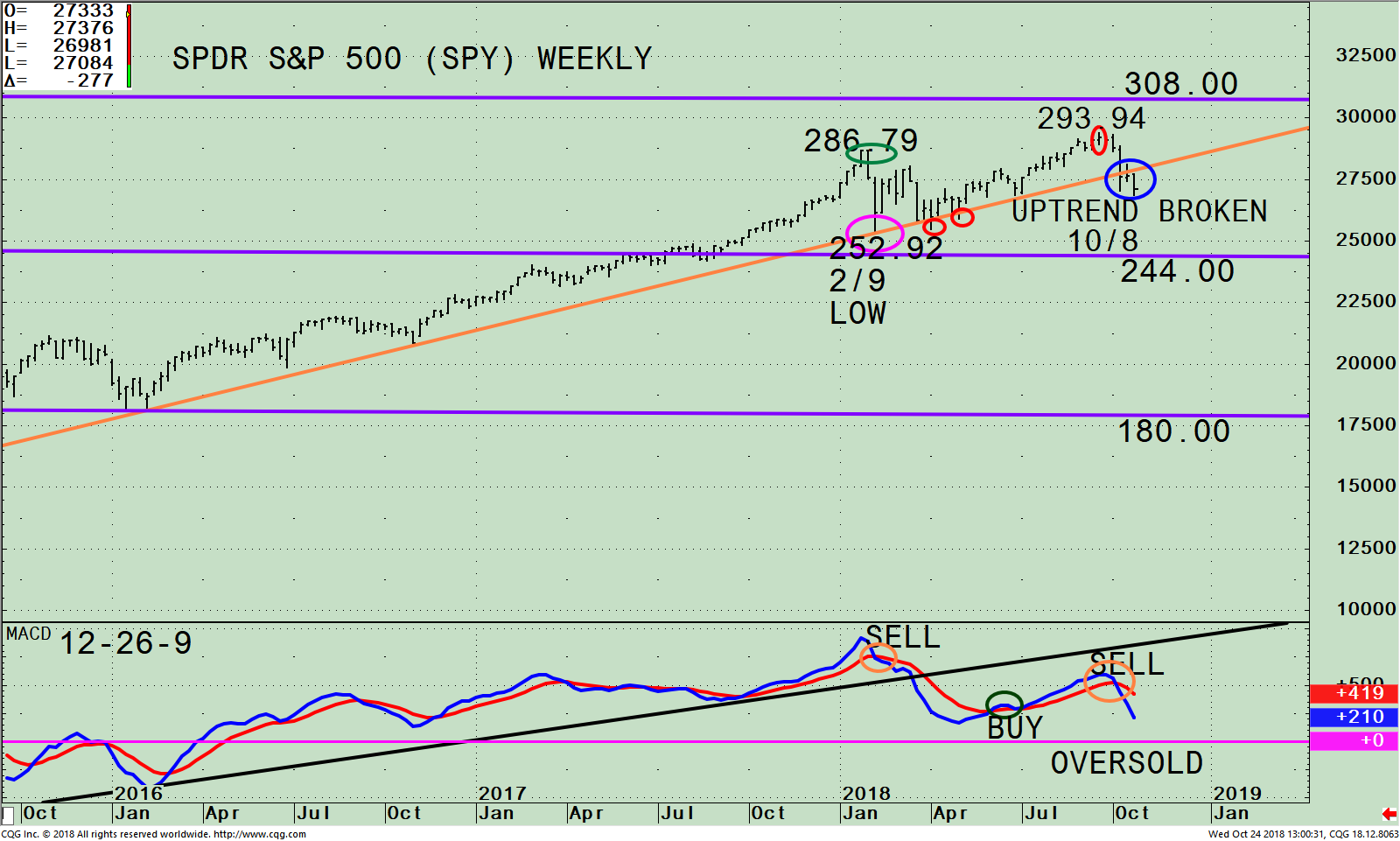

The SPDR S&P 500 (SPY) Weekly Price Channel and 12-26-9 Day MACD

The top part of the chart is the SPDR S&P 500 (SPY) ETF and its weekly (intermediate) trading channel (purple line). The SPY has been in an uptrend since February 9, 2016 (orange line) except for two minor downside penetrations of this trendline (red circles) in April. The SPY made a new all-time high on 9/20 at 293.94. However, it didn’t have enough strength to reach the upper channel and turned down breaking the uptrend on 10/8 (blue circle). The intermediate trend is now negative. This suggests the easy money is over. The SPY has given back most of its gains this year. A clue the latest decline is complete is if the SPY rises and closes above the trendline that it broke between 275.00 and 278.00. This area is now resistance.

On 10/23 there was a slight penetration of the 10/11 low, but buyers stepped in to support the SPY reversing higher 1.9%. The best case now would be if the low of 268.61 holds. However, since tape action has been poor, and the intermediate trend is no longer up, the 10/23 reversal may not be the final bottom. Its likely more time is needed, and further base building is required with more favorable patterns to develop for a real bottom to form that is a safer buying opportunity. Since the SPY is no longer in an uptrend it’s very possible the SPY will test the low made February 9 at 252.92 (pink circle) and possibly to the middle channel at 244.00. In the most bearish case, which is not likely, the downside objective is 180.00.

The lower portion of the chart is the 12-26-9 MACD, a measure of momentum. MACD generated a sell in late January (orange circle), confirming the SPY high. The first MACD sell after a rise for almost two years was only a warning of sign that momentum was slowing. MACD then broke the uptrend as the SPY fell. However, MACD didn’t get oversold and below 0 before it turned up in June. Even though MACD is near June levels now, since the SPY has broken its uptrend and is declining it’s likely this time MACD could go below 0 before a safer buying pattern develops.

To Sum Up:

The October decline continues. Tape action is not yet showing signs the decline in October is complete. The S&P 500 (SPY) has broken the intermediate uptrend and this time remains below the uptrend line for three weeks implying the easy money has been made. The intraday reversal to the upside that occurred on 10/23 is questionable as the bulls and the bears battle for control. With the intermediate trend down on the S&P 500, a bumpier time could be ahead until momentum patterns get into oversold condition forming a bottoming formation before a sustainable rally begins.

I would love to hear from you. Please call me at 516-829-6444 or email at bgortler@signalert.com to share your thoughts or ask me any questions you might have.

Sign up for a FREE 3 issue trial of

SYSTEMS AND FORECASTS

Click here

******Article published in Systems and Forecasts by Bonnie Gortler October 24, 2018

If you like this article you would love the free

excerpt chapter of my book Journey to Wealth.

Get instant access here

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments for their own particular situations and for determination of their own risk levels. Past performance does not guarantee any future results.