Biotechnology and Technology Leadership Coming To An End

“The ability to say “no” is a tremendous advantage for an investor.”–Warren Buffett

The first quarter is complete, with S&P 500 gaining 0.86% for the month and 1.86% for the recent quarter (total returns). The S&P 500 index continues to be resilient and consistent; a profitable area in which to be invested Stock market volatility has quieted down. The VIX, (a fear index) continues to be trending lower, a plus for the stock market. With the S&P 500 near its highs VIX is showing no fear, now trading at 13.17, below the level 13.72 where it closed on December 2013.

The S&P 500 is gaining relative strength compared to other more volatile areas in the market. The old leaders of the market, Nasdaq 100 (QQQ) and Biotech (XBI) which have more volatility and risk, are losing momentum, not a good sign as we move further into the year. In late February when the S&P 500 had a short term decline, the technology sector started to lose momentum and biotech fell sharply, down 16.3% from its peak on February 27th.The Nasdaq 100 (QQQ) and Biotechnology (XBI) average have been leaders of the stock market but are not acting well. They are trading below their highs, are risky, and are giving warnings that they will under perform with their leadership coming to an end. This doesn’t bode well for the market. The internal strength of the market is getting weaker, not improving; a shift of capital is taking place as the S&P 500 is making new highs.

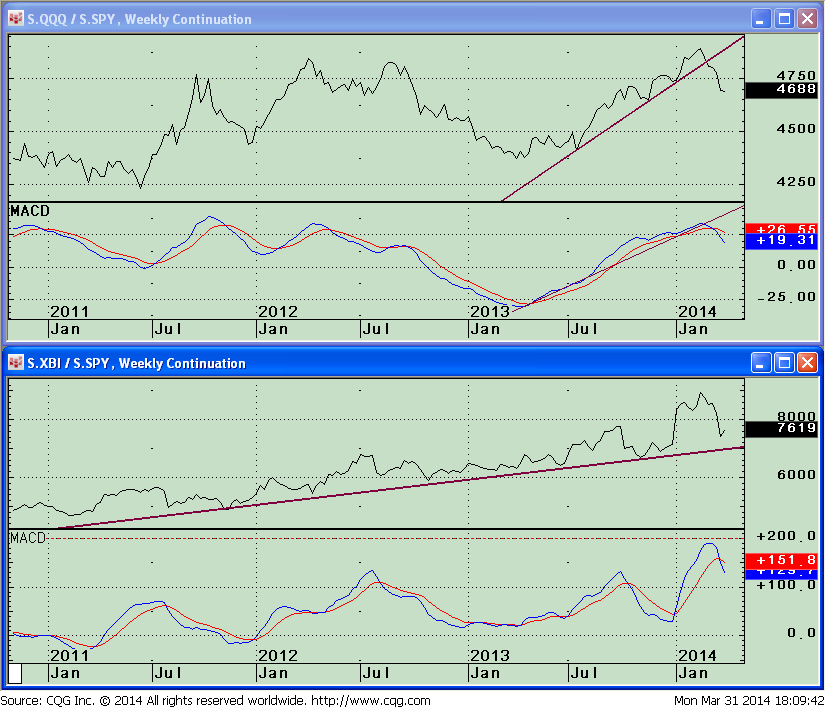

What are the Weekly Nasdaq 100 (QQQ) and Biotechnology (XBI) Strength Ratio Charts Saying Now?

See the chart below, the weekly Relative Strength ratio chart of the QQQ/SPY where I have drawn two trend lines. In late February 2014, the Nasdaq’s uptrend since July 2013 was broken, suggesting the S&P 500 will be stronger than the Nasdaq. In the lower portion of the first chart below, MACD confirms the trend line break. Momentum is decreasing in the Technology area.

The second (lower) chart is the weekly XBI/SPY relative strength ratio that made a low in November 2011. Since then, biotech (XBI) has been a very profitable area to be invested in. Each time the XBI has declined, this trend line has held. In the lower portion MACD has just generated a sell. The upside momentum is weakening and there is a good chance the up-trend will be broken soon. When this occurs a more serious decline could take place in the overall stock market and a larger correction than what we have had will occur.

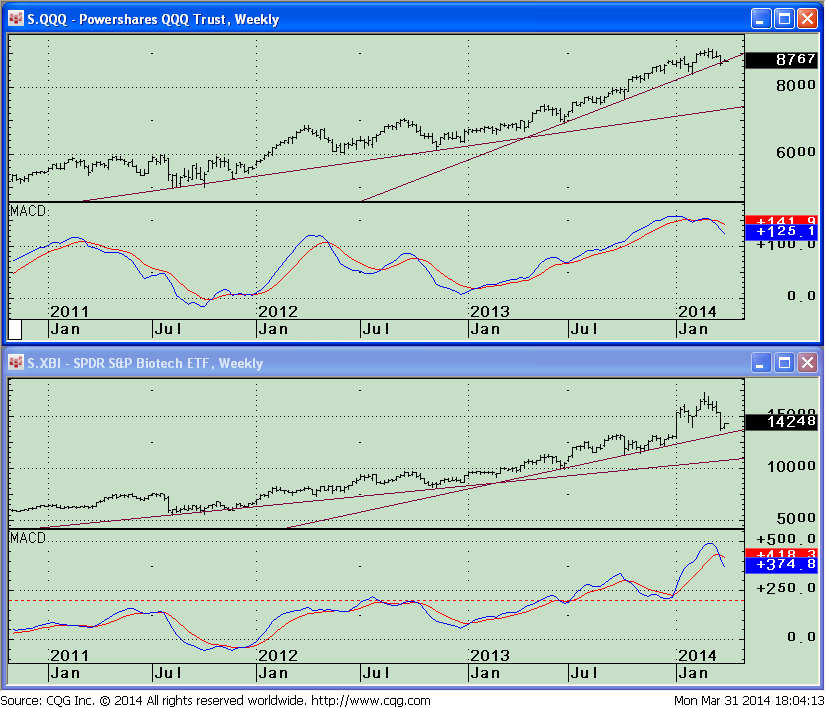

The top half of the chart below is the weekly Nasdaq 100 (QQQ). Notice the two major uptrends have not been violated as of yet. With momentum weakening (MACD of QQQ has formed a falling double bottom,which is bearish), I believe that both trend lines will be broken as investors move out of the technology area into more safe areas later this month.

The lower portion of the below chart is Biotechnology (XBI).The uptrend remains intact from 2011. Both of these uptrend trendlines remain in effect even with Biotech (XBI) peaking at 172.52 and falling to 136.47, a drop of 20.90% from high to low.We are short term oversold;a bounce is in progress as of this writing. (XBI trading at 144.82). I am expecting a reflex rally that could go as high as 155 and then more selling pressure which would break the up-trend. A break below 136 would suggest prices falling to 125 and potentially 110.

The price uptrends in technology and biotechnology (QQQ and the XBI) remain in effect for now, but warning signals are being generated as momentum is clearly weakening for the intermediate term. Sector rotation seems to be taking place in certain areas of the market. Investors are moving away from sectors that were leading the bull market higher such as biotechnology and technology, but which are now losing relative strength compared to the S&P 500.

The stock market continues to climb the wall of worry. When the market declines key support zones have been holding. Money is moving into the emerging market sector, high yield bonds are stable, and new lows are small which are all bullish. If the weekly trend lines of QQQ and XBI are violated to the downside, is a good chance the selling pressure will spread to the overall market. I continue to give the market the benefit of the doubt for the moment, but my suggestion is to avoid taking new positions in the technology and biotechnology areas of the market. If you are invested in these areas protect the gains that you have made.

What are your thoughts about the technology and biotechnology sectors? Are you expecting higher or lower prices?

Please contact me with any comments or insights, and to share your own favorite charts and indicators with me. Email: bgortler@signalert.com; phone: 1-800-829-6229.

FULL YEAR OF SYSTEMS & FORECASTS NEWSLETTER

at a SPECIAL DISCOUNT – $99

This is a hypothetical result and is not meant to represent the actual performance of any particular investment. Future results cannot be guaranteed.

Although the information is made with a sincere effort for accuracy, it is not guaranteed either in any form that the above information is a statement of fact, of opinion, or the result of following any of the recommendations made herein. Readers are encouraged to meet with their own advisors to consider the suitability of investments discussed above for their own particular situations and for determination of their own risk levels.